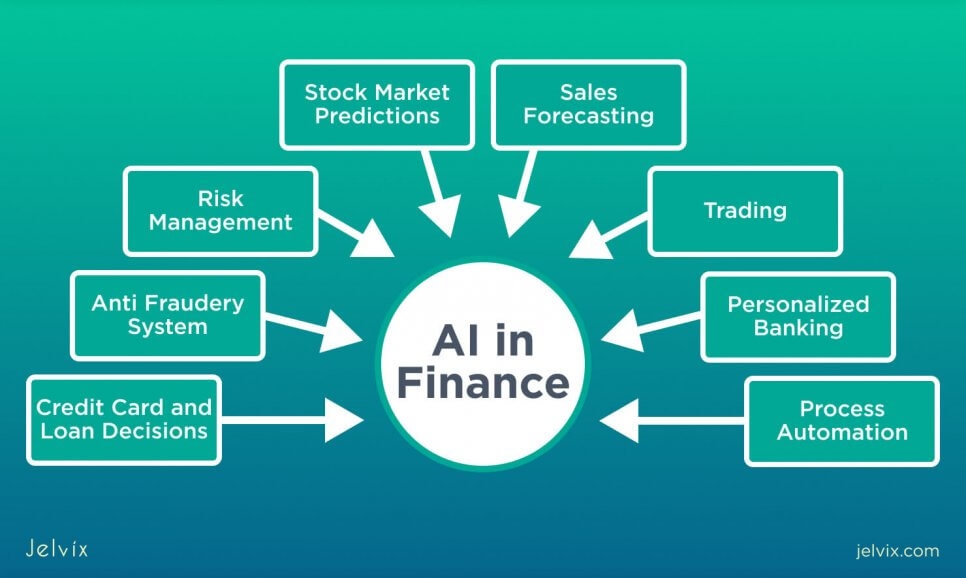

Artificial intelligence is a unique technology that can be used in different industries, and finance is no exception. Given that AI’s main advantage is its ability to work with massive amounts of data, finance can benefit from using AI even more than other areas. AI is already being used by many companies that work in such areas as insurance, banking, and asset management.

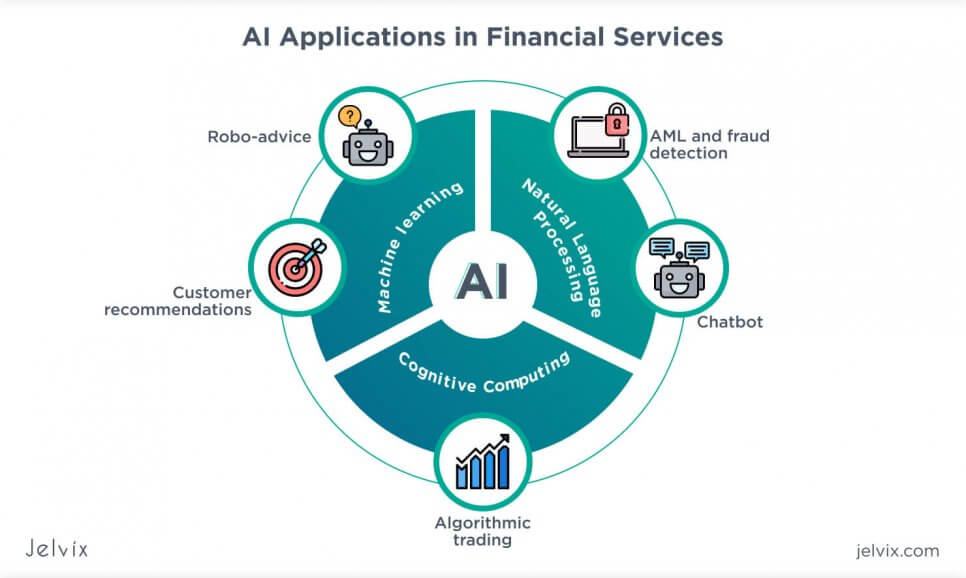

A great thing about AI is that it can be used in different ways. For instance, AI-driven chatbots can help financial organizations communicate with their customers. AI also serves as the basis for virtual assistants. Machine learning algorithms also enable algorithmic trading and can be used for risk management, fraud detection, and relationship management.

AI in finance offers numerous benefits. Perhaps, the main advantage of AI is that it gives countless automation opportunities. In turn, automation can help financial organizations increase the productivity and efficiency of many processes. Besides, given that AI can replace humans in certain situations, it helps eliminate human biases and various errors caused by emotional or psychological factors.

Obviously, AI is also better at analyzing data. Machine learning enables computers to identify patterns in data, providing decision-makers with valuable insights, and helping organizations get more precise reports.

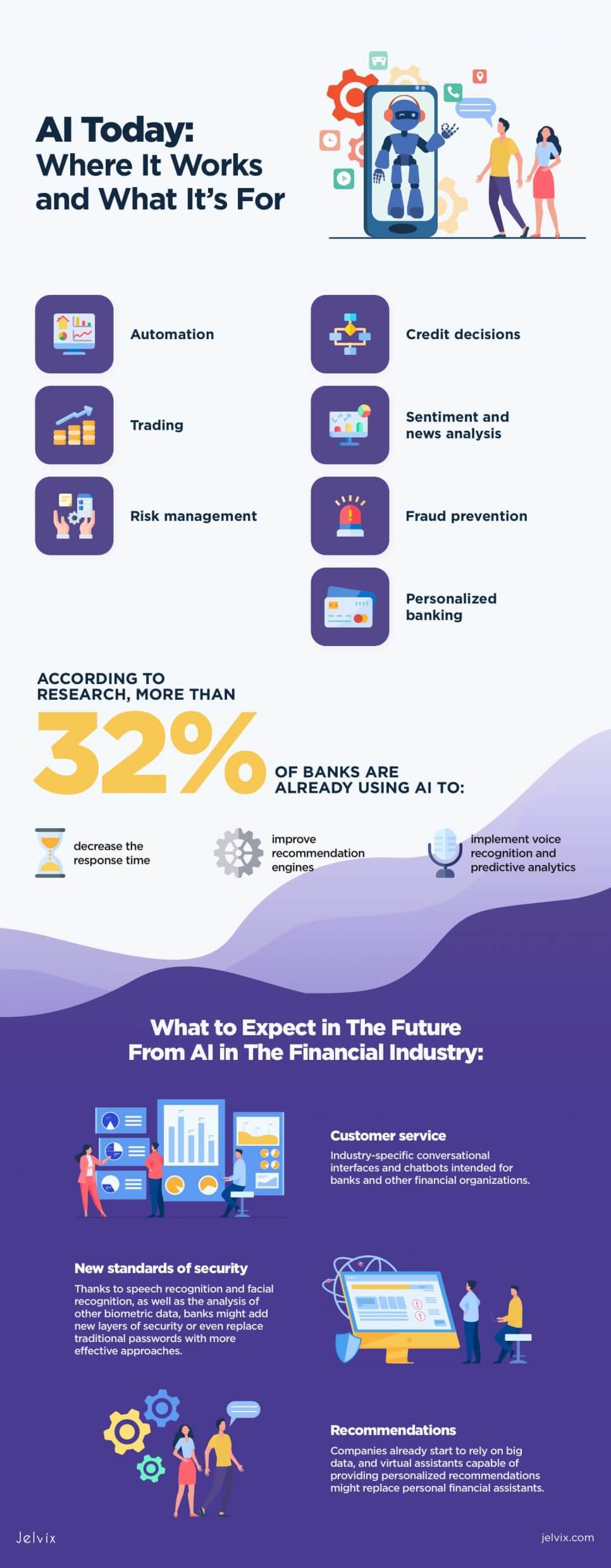

So, how is artificial intelligence used in finance?

AI Today: Where It Works and What It’s For

Automation

Automation is more than just a cross-industry trend. It’s so popular because it enables organizations to boost productivity and cut operational costs. Tasks that used to take a lot of time and required organizations to hire teams of low-skilled employees now can be completed much quicker and easier. For instance, AI can use character recognition to verify data automatically and generate reports according to certain parameters.

Automation helps companies eliminate human errors and enables employees to focus their efforts on more important tasks that a machine cannot complete. According to statistics, AI helps companies save up to 70% of the costs associated with data entry and other repetitive tasks.

Many big companies realize the advantages of AI, so they develop their own AI-driven solutions or use existing automation solutions that enable you to adapt and use them for your specific objectives. For instance, JP Morgan Chase uses Robotic Process Automation (RPA) to comply with the necessary regulations, extract data, and capture documents.

Credit Decisions

AI also helps banks assess potential borrowers much faster and more accurately, while also saving costs. AI-based solutions can immediately analyze countless factors that can have an impact on a bank’s decision. AI uses more complex credit scoring approaches than traditional systems so banks can understand whether somebody is a high-risk applicant or simply doesn’t have enough credit history.

AI-powered software offers a higher degree of objectivity. Machines are not biased, which is a critical factor, especially in financial app development. Loan-issuing applications and digital banks allow banks to provide various personalized options and integrate alternative data, including smartphone data, into the decision-making process.

AI is beneficial not only for banks but also for many other companies. For instance, automobile lending companies report that the use of AI enabled them to cut their losses by up to 23% annually.

Trading

The trend of data-driven investments has been demonstrating steady growth during the last decade. Two years ago, data-driven investments closed on a trillion dollars. AI and machine learning are used in so-called high-frequency trading, also called quantitative or algorithmic trading. This type of trading becomes more and more popular because it offers numerous benefits.

AI-driven trading systems can analyze massive amounts of data much quicker than people would do it. They can work with both unstructured and structured data. The fast speed of data processing leads to fast decisions and transactions, enabling traders to get more profit within the same period of time.

Besides, predictions made by AI algorithms are more accurate because they can analyze a lot of historical data. AI algorithms can test different trading systems, offering a new level of validation effectiveness so that traders can evaluate all the pros and cons before using a certain system.

AI can analyze a specific investor’s long-term and short-term goals to provide recommendations on the strongest portfolios. Financial institutions often use AI to manage their entire portfolios. The forecasting capabilities of AI have also been appreciated by numerous companies.

For instance, Bloomberg launched its AlpacaForecast prediction matrix that helps investors by combining real-time market data from Bloomberg with a sophisticated learning algorithm that identifies patterns in price dynamics for the most accurate predictions.

Sentiment and News Analysis

Hedge funds don’t like to share information about the way they operate, so it can be difficult to understand how exactly they may use sentiment analysis. However, AI has already demonstrated its capabilities in digital marketing, and its ability to work with data from social media can be used in the financial industry, as well.

It makes sense to expect machine learning to be used not only for various automation and customization tasks but also to news trends, social media, and other sources of data that have nothing to do with trades and stock prices.

The stock market reacts to hundreds of different factors, not only to the ticker symbols. Artificial intelligence can be used to mimic and enhance our intuition when it comes to searching for new trends and getting signals. However, to perform such tasks, AI needs not only to process data but also to understand its context better, which is still a challenge.

For instance, AI-based chatbots can provide concise answers to questions; however, AI is still far from writing comprehensive articles or ad copy because it cannot understand the context of the information it works with.

Risk Management

Risk management is another area of application of machine learning in finance. Given that AI offers incredible processing power and can handle massive amounts of both structured and unstructured data, it can handle risk management tasks much more efficiently than humans. Machine learning algorithms can also analyze the history of risks and detect any signs of potential problems before they occur.

One of the main advantages of AI in finance is that it enables organizations to analyze various financial activities in real-time, regardless of the market environment. Organizations can choose any important variables for their business planning and use them to get detailed forecasts and accurate predictions.

Crest Financial is one of the leasing companies that started to use artificial intelligence. This company employed Amazon Web Services AI for risk analysis and reported significant improvements. For instance, it managed to eliminate deployment delays that occur when using traditional data science approaches.

Fraud Prevention

AI has also proven to be very effective in preventing and fighting fraud. Cybercriminals constantly develop new, more effective tactics, but AI-based solutions can use machine learning and quickly adapt to the hackers’ strategies.

Such solutions are especially effective when it comes to fighting credit card fraud. This type of fraud has become more and more common during the last few years because of the growing popularity of online transactions and eCommerce.

AI-driven fraud detection tools can analyze clients’ behavior, track their locations, and determine their purchasing habits. Therefore, they can quickly detect any unusual activities that diverge from the regular spending pattern of a certain client.

Banks can also use artificial intelligence to deal with other types of financial crime. For instance, AI can be used to fight money laundering. Machine learning algorithms can quickly detect suspicious activity and minimize the costs of investigating money-laundering schemes. According to research, AI can decrease the cost of investigations by 20%.

Personalized Banking

The advantages of AI become obvious when it comes to personalization and providing additional benefits for users. For instance, banks use AI-powered chatbots to offer timely help while also minimizing the workload of their call centers. Financial organizations can also use various voice-controlled virtual assistants.

Such solutions are self-learning so they become more and more effective as you use them. Both virtual assistants and chatbots can also be integrated with other software. For instance, they can schedule payments, monitor account activity, and check balances.

There are also many apps that offer personalized financial advice so that users can achieve their financial goals. These smart systems can track regular expenses, income, and purchasing habits to provide the necessary financial suggestions and optimized plans.

Many well-known banks, including Bank of America, Wells Fargo, and Chase, already offer convenient mobile apps that remind users about bills, ensure timely and effective communication between banks and their customers, and help users plan expenses. Both transactions and interactions are much more convenient and streamlined.

Ways How AI Transformed the Finance Industry

The financial industry has changed dramatically since the mid-1990s. This area has been strongly influenced by digital technologies, and now it’s more digitized than ever because of digital banks and mobile banking. We live in an era when speed and convenience are the main competitive advantages in any industry.

Millennials and Generation Z are actually the biggest part of the workforce, and they’re used to getting all the necessary information and purchasing products by simply tapping on the screens of their mobile devices.

The digital transformation of the financial industry increased the competition and created so-called neobanks, such as Chime or Varo, which only operate online. Even some tech companies, including Google, are starting to explore the consumer banking segment.

Therefore, this market is becoming even more volatile and competitive. To withstand strong competition, companies need to keep up with the latest technological trends. AI is a technology that gives companies a significant advantage by facilitating numerous processes.

Experts predict that AI will have saved financial companies about $1 trillion by 2030. According to research, more than 32% of banks are already using AI to decrease the response time, improve recommendation engines, and implement voice recognition and predictive analytics. New areas of application appear all the time, and companies learn to use AI for their specific purposes.

One of the strongest trends in innovation is the use of AI to improve customer experience. Some customer-oriented solutions, like chatbots, have become mainstream. At the same time, algorithmic analytics, task automation, and process automation are also becoming more and more popular in finance because companies realize what advantages these technologies have to offer.

Robots also enable companies to hire fewer employees. According to Gartner, robotic process automation costs five times less than onshore employees and three times less than offshore ones.

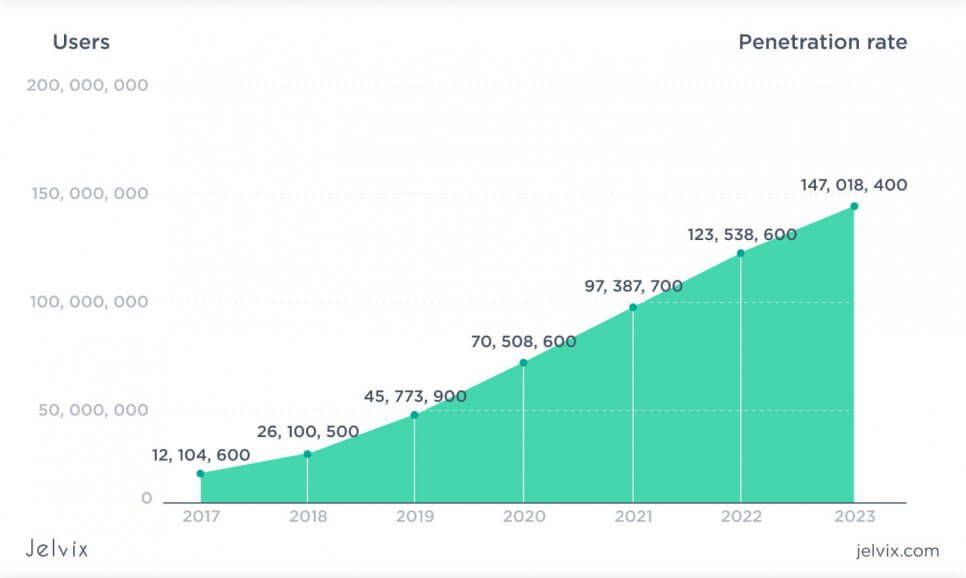

Number of robo-advisor users worldwide

Although robotic automation process involves rule-based systems that are technically not intelligent, this technology is often used along with various AI solutions. Machine learning is probably the most common type of technology associated with artificial intelligence, and it also plays an important role in the transformation of banks and the financial industry, in general.

Machine learning has already demonstrated its tremendous potential in various industries, and the financial sector is no exception. The main benefits of machine learning in the finance industry are associated with gathering, processing, and organizing huge amounts of data.

Solutions that are based on machine learning require little to no assistance from humans. They are able to learn from historical data, detecting patterns in it, and using these insights to operate with data in the future. Some solutions also use these patterns to make predictions.

When talking about AI, machine learning and automation are mentioned most often. These subsets of AI are indeed very useful and they can provide amazing results fast so companies can quickly evaluate the benefits of the new technology and its ROI. However, there are also less obvious areas of artificial intelligence that are nevertheless very interesting.

For instance, voice recognition enables people to perform their banking activities by simply talking to their devices. This technology is also extremely useful if a company uses chatbots.

Let’s take a look at the Best Machine Learning Applications with Examples to understand the benefits of this technology.

What to Expect in the Future from AI in the Financial Industry

Customer service

Conversational interfaces and chatbots are becoming more and more common. There are many universal chatbot solutions that can be used by companies from different niches, but companies like Kasisto are already developing industry-specific software intended for banks and other financial organizations. Such software will help customers make the necessary calculations and evaluate their budgets quickly.

Besides, voice recognition enables banks to provide assistance in the most convenient way possible. Such solutions will inevitably become a huge competitive advantage because banks that offer quick interaction and querying will be able to attract customers of traditional banks that require their users to log onto banking portals, look for the necessary functions, and search for the necessary information themselves.

New Standards of Security

Passwords, usernames, and security questions may disappear from the financial industry in the next few years. Security is especially important in the financial industry because most people would rather have their social media accounts hacked than become victims of hackers who want to steal their credit card information.

Therefore, the financial industry is most likely to use AI-backed security solutions to make sure that no one can access their customers’ data.

We’ve already mentioned that AI can detect unusual and suspicious behavior. Thanks to speech recognition and facial recognition, as well as the analysis of other biometric data, banks might add new layers of security or even replace traditional passwords with more effective approaches.

Recommendations

Automated solutions for financial sales already exist, but not all of them involve machine learning. Most often, these are rule-based systems. However, virtual assistants can also provide recommendations in a smarter way. For instance, they are already capable of making suggestions on possible changes to the portfolio, but they can also analyze various websites with recommendations on insurance services and help you choose a plan that meets your objectives.

AI-driven apps are becoming more and more personalized, and personalized recommendations are no longer used exclusively by companies like Netflix and Spotify. For instance, insurance companies already start to rely on big data, and virtual assistants capable of providing personalized recommendations might replace personal financial assistants.

Conclusion

Chatbots and automation software are not the only advances in financial machine learning associated with AI. Machine learning enables financial organizations to simplify numerous time-consuming tasks and to cut costs significantly, so there’s no surprise that the financial industry is already using AI in various areas.

For instance, AI can help minimize risks, fight fraud, and assist banks in making credit decisions.

Another great advantage of AI is that it provides countless personalization opportunities. Mobile banking will continue to evolve, and financial companies that fail to adopt the latest tech trends will likely lose their customers. Given that AI can work with massive amounts of data and make predictions based on the necessary set of factors, the role of machine learning in trading will also grow.

Artificial intelligence has already changed many industries forever, and its tremendous potential is unquestionable. Therefore, it makes sense to expect wider adoption of AI in finance and to prepare for the new opportunities that it offers.

Jamie Fry – Purposeful and promising author. At this moment he is working in such company, as Writing Judge essay writing service reviews and enhances his blogging skills. Confidently goes to his goal. He has a talent for writing original content. The main conviction in his life: «To be the best in the field in which you are developing». Always in search of fresh ideas.

Need a qualified team?

Reach new business objectives with the dedicated team of professionals.