As businesses grow, so do their financial needs—and the demand for precision in accounting rises with it. To counter that, custom accounting software is here: a tailored solution that aligns perfectly with an organization’s specific goals and complexities, spanning everything from basic bookkeeping to advanced financial analytics.

Traditional, off-the-shelf accounting software serves its purpose. Still, more and more companies are looking for custom solutions to tackle specific challenges, automate repetitive processes, and integrate with other business-critical systems.

This article will cover the advantages of custom accounting software, the factors influencing its uptake in the market, and how companies use these solutions to satisfy their changing financial requirements.

Accounting Software Market Insights and Current Statistics

The accounting software market is expected to reach a remarkable $28.61 billion annual growth rate of 11.8% by 2030. Accounting software adoption rates have skyrocketed, especially among small and medium-sized enterprises (SMEs), large corporations, and digital-first companies. Here are a few factors contributing to this growth:

- Adoption by Small and Medium-sized Enterprises (SMEs): SMEs are essential for expanding the accounting software industry. In 2022, there were 32.5 million small firms in the United States alone, making up 99.9% of all businesses. With the growth of cloud-based, affordable choices, this large base of SMEs is increasingly using accounting software to boost accuracy and save time.

- Business Digital Transformation: Several sectors focus on more financially efficient digital options. A Deloitte survey says 75% of CFOs name digital transformation as the most important element within the finance function. The instant requirements of digitization and data demand attention to accounting software that meets businesses’ demands.

- Regulatory Compliance: The intricate financial rules further stress the need for precise and compliant financial reporting systems. SEC enforcement proceedings related to financial reporting rose 7% in 2023, pushing businesses to turn towards software that ensures compliance with financial standards.

These adoption trends also highlight key market drivers shaping the accounting software landscape. As solutions are shifting to the cloud, data security has become crucial. Accounting software providers use high-level cybersecurity measures such as encryption and multi-factor authentication to ensure safe, sensitive financial information, aligning with stringent standards like GDPR and HIPAA.

Cost is another factor that cannot be ignored, particularly when dealing with SMEs. expenses like licenses, subscriptions, and add-ons will accrue despite the efficiencies gained from accounting software. Companies should then measure these costs against the benefits, such as fewer mistakes and saving time.

Another area for improvement is software integration. A smooth accounting software implementation is crucial for efficient operations, as many organizations rely on numerous systems (CRM, payroll, etc.). Poor integration might cause workflow disruptions and make it more difficult for the organization to obtain real-time financial data.

Types of Accounting Software

Not all business accounting software is created equal. With different focuses and functionalities, businesses should carefully consider the types of accounting software that best meet their needs before choosing one.

General accounting software comprises different segments — income and expense tracking, financial reporting, cash management, or inventory tracking — to serve core business needs. Famous examples include QuickBooks and FreshBooks, which provide a broad range of tools for businesses needing a standard solution to handle their finances. General accounting software is flexible, coming in on-premise or cloud-based versions (the latter provides access and functionality across multiple devices).

Industry-specific software best suits businesses with specialized accounting needs. For instance, project accounting software is designed for businesses that work on an ongoing or individual project basis—construction and consulting companies are two examples. These programs help track expenses and revenues at the project level, ensuring accurate budget management and financial oversight. Examples include Deltek for government contractors and Sage Intacct for nonprofits.

Finally, enterprise resource planning (ERP) software offers accounting, which unifies HR, supply chain, and inventory management into one platform. ERP systems cater to large corporations with complex, multifaceted needs, offering a comprehensive view of business operations that aids strategic decision-making.

Cloud-Based vs. On-Premise Accounting Software

Cloud-based accounting software is subscription-based, allowing businesses to access the system from any device with an Internet connection. This flexibility is a huge benefit for businesses that need real-time data access on the go or have remote employees. Scalable storage options allow companies to expand by adding users or licenses. Furthermore, the manufacturer maintains cloud software, so fixes, upgrades, and new features are released automatically without user input. Long-term subscription fees might add up over time, even though the initial expenses are less than those of on-premise alternatives. Cloud-based software is a modern and convenient choice for companies prioritizing easy access, adaptability, and automatic updates.

On-premise accounting solutions are hosted directly on company’s local servers, offering greater control and customization of data. Software of this kind generally relies on a one-time payment with ongoing maintenance and upgrade costs. On-premise solutions often appeal to companies with considerable data privacy concerns or those working in highly regulated industries, as they ensure total control over security and data management. Despite high up-front costs, on-premise software can prove more affordable in the long term due to the absence of ongoing license fees beyond maintenance. However, the enterprise will require internal IT support for update management, troubleshooting, and hardware requirements.

Custom vs. Off-the-Shelf Accounting Software: Pros and Cons

Custom financial software development functions according to the unique workflows of an organization so they coincide perfectly with exact financial processes. Such solutions provide flexibility and customization regarding features, integrations, or reporting tools — perfect for company needs. Here’s an example: businesses operating in highly niche industries, such as construction or healthcare, may need a custom accounting app uniquely designed to monitor costs and income at the project level.

Therefore, the benefits of such a decision include:

- Alignment with unique business requirements;

- Extensive integration capabilities with existing systems and software;

- Flexible design for scalability and future upgrades.

However, it’s also important to cover the drawbacks of building accounting software customized for specific needs from scratch:

- High initial investment in development, testing, and deployment;

- Longer setup time due to design and customization;

- Requires ongoing IT support for maintenance and updates.

Off-the-shelf accounting solutions are ready-made and feature many functionalities for frequent accounting activities. They are best suited to small and medium enterprises with typical needs and constrained budgets, as they are rapid to implement. The vendor maintains off-the-shelf software, with customer support and routine updates included in the subscription or licensing fee. On the other hand, customization is mostly constrained, which might not be sufficient for organizations with specific processes or large-scale integration.

The choice of a custom versus an off-the-shelf solution or a cloud-based versus an on-premise solution depends upon a business’s particular objectives, resources, and IT capabilities. Customized and on-premise solutions permit greater control for firms with unique needs or larger budgets while being aligned more closely with business processes. Cloud-based solutions are accessible and efficient and combined with off-the-shelf options to provide user-friendly alternatives for businesses that prioritize convenience over cost.

Key Benefits and Financial Outcomes of Custom Accounting Software

Businesses can achieve revolutionary results by implementing custom accounting software, which increases productivity, improves financial accuracy, and provides flexibility for expansion.

Enhanced Operational Efficiency and Productivity

Custom accounting software automates the tedious tasks of data entry, reconciliation, and report generation, streamlining the workflow so that the finance team can concentrate on more critical activities. With manual work diminished, businesses witness an increase in productivity along with a decrease in operational costs.

Improved Financial Accuracy and Compliance

Accuracy is the cornerstone of accounting; any mistake could bring a heavy price. Customized software provides exact financial tracking by incorporating error-checking algorithms and automated calculations, significantly minimizing human error chances. With accurate records maintained, businesses can comply with strict compliance requirements since custom software can automatically perform tasks like general ledger reporting, accounts payable/receivable processing, and regulatory reporting.

Scalability and Flexibility to Support Growth

Custom accounting solutions can also grow with the company, scaling to accommodate more data, more users, and new features as business needs change. An example of this would be a growing company’s integration of its custom accounting software with CRM systems, payroll systems, and inventory management systems, allowing for seamless data flow and flexibility in accommodating the expansion of operations. This flexibility ensures that the software remains relevant by adapting to current demands while supporting future growth.

Increased ROI and Long-Term Cost Savings

While custom accounting software requires more investment upfront, it saves a lot of money in the long run by eliminating ongoing license fees and reducing the need for several software subscriptions. Additionally, lower accuracy and higher correction raise costs related to errors and rework. Companies can measure ROI through decreased labor costs, fewer financial mistakes, and better tax filing efficiency.

Real-Time Insights for Better Decision-Making

Custom accounting software arms a business with current financial information to facilitate accurate decision-making. With data analytics and business intelligence features, the software allows companies to track their expenses, monitor their cash flow, and predict their financial outcomes. Access to such real-time information regarding critical metrics enables leaders to make timely, data-driven decisions about anything from budget adjustments to identifying opportunities for cost reduction.

In summary, custom accounting software empowers businesses to streamline operations, boost accuracy, support growth, and make informed financial decisions, offering a valuable competitive edge in today’s fast-paced market.

Key Features of Custom Accounting Software

Custom accounting software is built to match a business’s specific needs. Focused on automation, security, and easy integration, these solutions take accounting tasks to a higher level.

- Tailored Financial Reporting and Analysis: Custom software can help businesses generate specific financial reports that align with their objectives. This is a vital step in planning and helps businesses remain compliant. It also gives analytics related to financial health and trends.

- Automated Bookkeeping and Data Entry: Automation reduces repetitive tasks like data entry, reducing errors and saving time. The software helps maintain accurate and up-to-date financial records by automatically recording customer transactions.

- Enhanced Security and Data Protection: Custom accounting solutions implement strong data protection measures through encryption and access controls to mitigate the risk of unauthorized users accessing sensitive information. They also help prevent cyber threats because they are less likely to be targeted like common systems.

- Customizable Dashboard and User Interface: A personalized dashboard lets users view the financial data they need most. The clear and well-arranged interface, which can be easily accessed, helps to enhance daily workflows by providing relevant information quickly.

- Multi-Currency and Multi-Language Support: For businesses with worldwide reach, custom software can support all currencies and languages so that they can deal with finances of different areas precisely

- Seamless Integration with Other Business Systems: Custom accounting infrastructure can be designed to assimilate with other business-critical environments, for example, CRM & ERP implementation to enable data movement across platforms. This helps reduce time and keeps operations efficient and effective.

Custom accounting solutions are rich in features that directly fit a business-specific need. They provide end-to-end financial management in one seamless solution, with advanced reporting tools to help make sense of the given data, automated data entry to reduce the risk of manual errors, robust security to keep the data safe, a customizable dashboard for tailored analytics about multiple business processes, and support for all currencies globally that can easily be integrated with other systems within the organization.

The Cost of Building Custom Accounting Software

Financial software custom development is a multifaceted, layered process, and its cost varies from one app to another owing to multiple aspects, such as:

- Scope and Features: Basic bookkeeping and reporting are the lowest-cost options, while advanced apps with multi-user access, AI-driven analytics, automation, and more budget are more expensive.

- Third-Party Integrations: Connecting the accounting app with other software (e.g., CRM, ERP) for smooth data flow adds cost. APIs for payment processing, tax calculation, or banking also require more investment, especially if they carry subscription fees.

- Technology Stack: Opting for native development (separate apps for iOS and Android) increases costs compared to cross-platform development. More advanced technology (like AI or blockchain) will increase the development cost again.

- Compliance Requirements: Regulatory standards (e.g., GDPR, PCI DSS) require high levels of security, which implies more testing and encryption, leading to lengthy development and considerable expenses.

Generally, the cost to build a custom accounting app differs also depending on the stage of the process:

- The Discovery Phase involves understanding business needs and defining the project scope. Costs usually range from $5,000 to $10,000, including research, strategy development, and technical specs.

- Design: A user-friendly design is essential for engagement. The design stage typically costs $10,000 to $15,000, including creating wireframes, prototyping, and UI/UX design.

- Development: This is the heaviest part of the process and often ranges from $15,000 to $150,000+, depending on the feature set and complexity. It is the front-end and back-end development phase; generally, costs rise as invoicing, financial reporting, multi-user access, and integration (with other systems) are incorporated.

- Testing: Testing verifies that things work, are secure, and comply with standards. This phase takes around $5,000 to $45,000 and includes bug fixes, performance checks, and security audits.

- Deployment: Deploying the app to servers or stores costs about $3,000 to $5,000, covering setup processes and additional app store fees.

- Maintenance: Regular maintenance is required for optimal functioning and security. Normally, the annual maintenance cost is about 15% to 20% of the initial development cost.

Building customized accounting software is an investment that depends on the complexity, feature set, and integration requirements. Custom software’s scalability, security, and long-term flexibility make it an excellent asset for firms with specialized accounting needs, even while the initial costs are higher than those of off-the-shelf choices.

Discover how Jelvix developed a Compensation Management Platform that transforms collaboration between employers and financial institutions—find out more in our case study.

Challenges in Custom Accounting Software

Building custom-made accounting applications can surely be beneficial and rewarding, but it also comes with risks.

- Customization vs Simplicity: Custom features should not be overadded because the software becomes complex and hard to use. It’s important to keep things simple and easy to navigate while meeting business needs.

- Ensuring Data Security and Compliance: Any accounting software is used to input sensitive financial data, making security critical. Companies using custom software are expected to comply with industry expectations such as GDPR, which involves integrating security features like encryption and access controls.

- Integration With Existing Systems: Custom software typically must integrate with other business systems, such as CRM or ERP platforms. While ensuring it integrates smoothly with these systems can be challenging, it is key to seamless workflows.

- Managing Budget and Timeline: Custom-built software can be expensive and take a long time to build. Budgeting carefully and managing time effectively is important to avoid going over budget or delaying the project.

- Changes in User Requirements: As business needs change over time, so do user needs. The software must be easy to change and update to continue to be relevant and applicable.

- Increased Testing Requirements: Working with financial data means errors can have serious consequences. Custom accounting software requires rigorous testing to prevent bugs, with added scrutiny on areas that handle transactions, calculations, and sensitive data. By conducting thorough testing, businesses can reduce the risk of costly errors.

In conclusion, meticulous planning is necessary while creating accounting software to maintain its usability, security, and flexibility. By tackling these issues, businesses can develop software that genuinely serves their financial needs.

Success Factors for Custom Accounting Software

Effective customized accounting software must be carefully planned for and developed using particular techniques. To build custom financial software, businesses should follow these recommendations:

- Define Business Needs: Clearly outline the software’s key functions to align with business goals.

- Choose Skilled Developers: Experienced developers ensure quality, security, and smooth integration.

- Prioritize Usability: Design a user-friendly interface to make tasks easy and intuitive.

- Provide Ongoing Support: Regular updates keep the software secure and adaptable over time.

- Ensure Compliance: Meet industry standards for data protection and regulatory requirements.

Building successful custom accounting software involves understanding business needs, partnering with skilled developers, focusing on usability, maintaining regular updates, and ensuring compliance. With these factors in place, businesses can develop effective and sustainable software.

Go-to Integrations for Custom Accounting Software

It is crucial for optimizing financial workflows, automating data syncing, and facilitating informed decision-making. Custom accounting software integration with essential business tools helps achieve more functionality, speed, and accuracy:

- ERP Integration for Unified Management: By integrating with ERP systems, accounting is synchronized with inventory, human resources, and other departments. This unified picture supports thorough tracking and planning throughout the company.

- CRM Integration: One sure-shot way to sync customer financial data is integration with CRM tools like Salesforce. This enables the seamless flow of financial data, automatically generating invoices and tracking payments as deals close. This speeds up the billing process and increases accuracy significantly.

- Payment Processing Integration: Integrating accounting software with payment processors such as PayPal or Stripe helps automate data entry for incoming transactions while making it easy to track payments. This will minimize errors and enable instant cash flow visibility.

- Tax Compliance & Audit Software: To ensure that all transactions comply with regulations, it should integrate with tax compliance tools. It simplifies tax calculation reporting and builds audit trails that save one from costly mistakes.

- Document Management and E-Signature Solutions: Integrating with DocuSign helps companies handle contracts, approvals, and financial documentation better. It reduces time-consuming processes such as invoicing while ensuring all documents are secure and easily accessible.

These integrations make financial management more efficient and reliable for businesses of all sizes by automating workflows and providing a centralized platform.

Latest Trends in Accounting Software

Accounting software is evolving rapidly to meet modern business needs. Here’s a look at the top trends shaping the industry:

- AI and Machine Learning for Predictive Analytics: AI-driven insights enable businesses to forecast trends, analyze spending patterns, and make data-informed decisions. Machine learning drives anomaly detection and cash flow prediction, enabling better financial planning and analysis.

- Leveraging Blockchain for Increased Security and Transparency: Using blockchain for its decentralized and secured ledger provides tamper-proof data storage and transaction transparency. This minimizes risk from fraud and builds trust with stakeholders by ensuring all records are traceable.

- Automation of Regular Work: Most tasks, including invoice processing, expense tracking, and reconciliations, are automated. Automation minimizes manual labor, greatly reducing errors and time, thereby freeing finance teams up for strategic activities.

- Cloud-First Solutions for Accounting: Cloud-based accounting software has become the new normal today, providing secure, scalable, and accessible solutions to handle financial data. Cloud solutions allow real-time collaboration, remote access, and automatic updates, making it easier for teams to work efficiently from anywhere.

- Mobile and Remote Accounting Solutions: As remote work becomes more common, organizations need accounting software that has mobile capabilities. Mobile accounting apps allow users to manage finances, approve transactions, and access reports on the go, resulting in improved responsiveness and convenience.

With artificial intelligence taking the upper hand in foretelling trends and blockchain paving the way for secure transactions, accounting is innovating to become faster, more flexible, and a larger catalyst for business success. Companies that embrace them are preparing for a streamlined, more trustable, and more impactful future in finance as these trends develop.

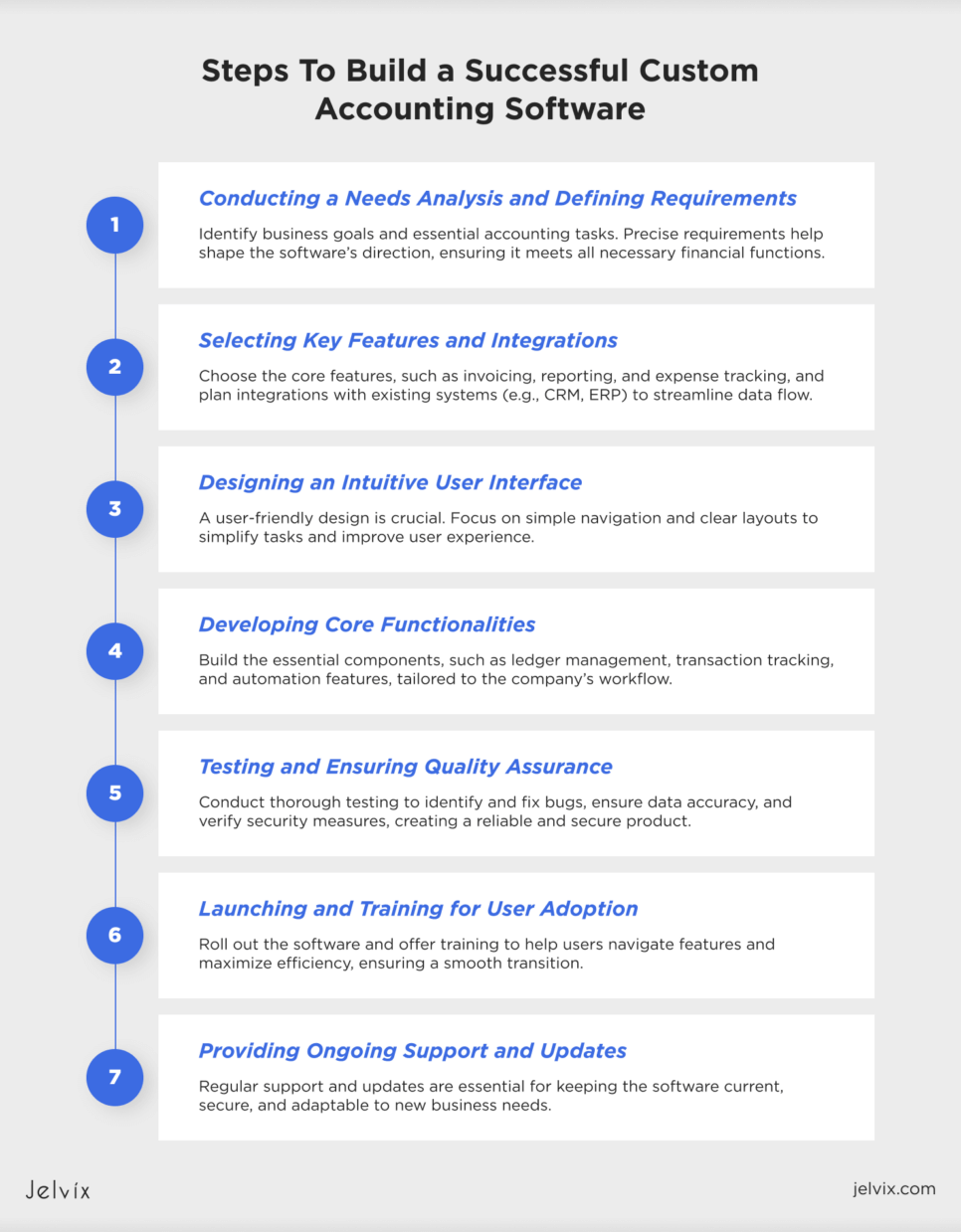

Steps To Build a Successful Custom Accounting Software

Accounting software development requires a structured approach. Here’s a breakdown of the essential steps:

Step 1 – Conducting a Needs Analysis and Defining Requirements

Identify business goals and essential accounting tasks. Precise requirements help shape the software’s direction, ensuring it meets all necessary financial functions.

Step 2 – Selecting Key Features and Integrations

Choose the core features, such as invoicing, reporting, and expense tracking, and plan integrations with existing systems (e.g., CRM, ERP) to streamline data flow.

Step 3 – Designing an Intuitive User Interface

A user-friendly design is crucial. Focus on simple navigation and clear layouts to simplify tasks and improve user experience.

Step 4 – Developing Core Functionalities

Build the essential components, such as ledger management, transaction tracking, and automation features, tailored to the company’s workflow.

Step 5 – Testing and Ensuring Quality Assurance

Conduct thorough testing to identify and fix bugs, ensure data accuracy, and verify security measures, creating a reliable and secure product.

Step 6 – Launching and Training for User Adoption

Roll out the software and offer training to help users navigate features and maximize efficiency, ensuring a smooth transition.

Step 7 – Providing Ongoing Support and Updates

Regular support and updates are essential for keeping the software current, secure, and adaptable to new business needs.

However, outsourcing this task or co-developing a tailored solution with a finance software development company would be better than doing it from scratch. We at Jelvix, as specialized experts in custom software development service for over 14 years, will help you build an efficient and secure accounting solution with reliability.

Our team has a wealth of experience in finance technology, so we will be there to guide you on every step, from conception and design to launch, as well as ongoing support and beyond. Discover and unleash the potential of custom accounting software and Jelvix to streamline your business financial management.

Conclusion

Custom accounting software investment is a great solution for businesses with specific financial needs. This type of software increases accuracy, improves work efficiency, tightens data security, and maintains compatibility with other systems.

Custom software, by automating mundane tasks and providing real-time insights, liberates time that can be used for strategic decision-making, enhances productivity, and supports scalable growth. So, it might be high time you boosted your financial operations today. Contact Jelvix experts for a free consultation!

FAQ

What is Custom Accounting Software, and how does it differ from standard accounting solutions?

Custom accounting software caters to a business’s unique financial needs. This allows the inclusion of features and integrations unavailable in off-the-shelf solutions. While standard accounting software provides a generic set of features, custom solutions offer much more by supporting specific workflows, regulatory requirements, and business goals. Therefore, they are most useful for organizations with complex or highly specialized accounting needs.

How long does it take to develop custom accounting software?

The timeframe for developing tailor-made accounting software varies based on the project’s complexity, features needed, and integration requirements. Typically, it takes anywhere from a few months up to a year. All the phases of requirement gathering, design, coding, testing, and deployment contribute to the final timeline. An experienced development team will make this process more efficient.

Is custom accounting software scalable as my business grows?

The scalability of custom accounting software is one of its main benefits. Custom software can be modified to meet the needs of an expanding business, in contrast to conventional solutions that might restrict growth because of set characteristics. As your business expands, developers can create software with a scalable architecture that simplifies adding new features, modules, or users.

How secure is custom accounting software compared to off-the-shelf options?

Custom accounting software can be much more secure than any ready-made solution. A developer can introduce advanced security features such as data encryption, multi-factor authentication, and even secure user access controls specifically tailored to your business’s needs. All these make sensitive financial information safer from breaches because they are regularly updated and audited.

Can custom accounting software support international financial regulations?

Indeed, custom accounting software can be programmed with the provisions for international financial regulations and is therefore suited for multi-regional businesses. You can customize it to meet the compliance requirements of different countries, such as GAAP, IFRS, or even various tax rules, making sure that your financial activities are compliant across all regions where you conduct business.

Need a qualified team of developers?

Unlock new business opportunities with the first-rate dedicated development team.