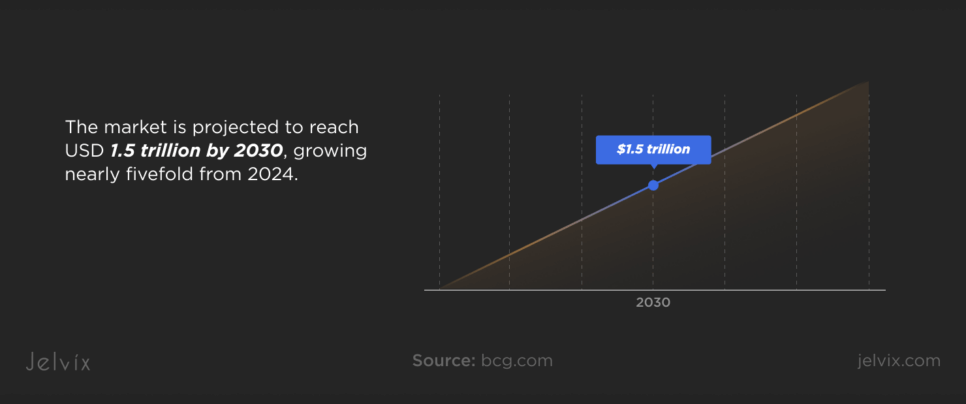

Being a comparatively new technology, FinTech has already taken a strong position in the industry. Its market is expected to reach USD1.5 trillion by 2030, growing almost five times compared to 2024.

With the new technological solutions on the market, fintech and banking are getting the best of it. And businesses need to correspond if they want to survive and expand their services to a broader audience.

If you aim to stay competitive in the market not only now but also in the future, this article is for you. We’ve gathered an ultimate list of the latest FinTech trends to help you stay in the loop and understand how to implement them into your business strategy to increase your profits.

The Top Trends in Fintech That Can Help Your Business Grow

Modern users prefer to do whatever is possible on the go and without too much effort. And, the FinTech industry delivers, following global tech trends and moving away from a legacy banking system they used to depend on.

Embedded Finance

When you integrate financial services into non-financial platforms, it is called embedded finance. This approach allows businesses to offer fast payment processing integrated into their services, freeing up their customers from searching for a separate payment provider to make a transaction. Thanks to embedded finance opportunities, companies can simplify transactions for clients and create new revenue streams within their existing client base.

Open Banking

Open banking is a convenient way to enhance your business services as it allows third-party providers to access your clients’ banking data through APIs. With open banking, you can create personalized financial products and services based on real customer data and adjust them to meet customer needs.

Neobanking

Neobanks are digital-only banks that don’t have physical branches. They make the user experience remarkably convenient by making banking accessible anywhere, often with lower fees. Neobanking can help businesses improve customer satisfaction and attract clients who want convenience at their fingertips.

Regulatory Technology

As we’ve noted earlier, the development of new digital tools is always followed by new regulations. This is when RegTech comes to the rescue to make compliance easier and more cost-effective. As regulations become more complex, businesses can benefit from RegTech solutions that automate compliance processes and help prevent costly errors related to non-compliance.

Green Banking

The more we get into technology, the stronger effect it makes on the environment, That’s why global industries, including FinTech, seek green opportunities to support ecological initiatives. For example, the green banking trend encourages financial companies to support sustainable initiatives like funding renewable energy projects or offering green loans.

Implementing AI and Machine Learning

The AI market in finance has already reached USD44.08 billion in 2024 and is expected to exceed USD50 billion in 2029. One of the reasons for that is that AI-powered chatbots and personal digital assistants have been significantly improving customer experience. They can analyze customer financial data, provide clients with statistics, calculate their spending, and advise on optimizing their spending.

Discover how Machine Learning enhances cybersecurity by enabling faster threat detection and smarter risk prediction for robust digital defense.

Decentralized Finance

Decentralized finance is making a difference by eliminating the need for intermediaries like banks. DeFI allows people to lend, borrow, and trade directly with one another using blockchain. This trend opens up a world of possibilities for businesses, as it enables more efficient and transparent transactions and lower costs.

Smart Contracts

Smart contracts are self-executing contracts where the terms of the agreement are written right into code. They automatically trigger actions when certain conditions are met, which means less room for errors and disputes. For businesses, this means faster transactions and less overhead.

Payment Gateways

Payment gateways are becoming essential as businesses move online. Thanks to these tools, enterprises can make transactions safer and smoother, offering a better experience for consumers. As more people shop online, having a reliable payment gateway can enhance customer satisfaction and boost sales.

Biometric Authentication

Biometric authentication is stepping up security in the fintech space by using unique physical traits, like fingerprints or facial recognition, to verify identity. This trend not only enhances security but also makes accessing accounts more convenient for users. Businesses can benefit from reduced fraud and improved user trust, leading to stronger customer relationships.

Gamification

Gamification means adding a fun twist to financial services by incorporating game-like elements into apps and platforms. This trend engages users and encourages them to interact more with their finances. And also makes them stay longer in your app or website. This enjoyable financial experience has the potential to improve customer engagement and loyalty for your company.

Cross-Border Payments

Cross-border payments allow businesses to process transactions seamlessly across various countries. This trend helps them serve international customers, providing them with multiple currency options and reducing conversion and transaction fees.

Financial Identity Fraud: Key Dangers and Ways To Prevent Them

As more transactions happen online, the risk of personal and financial information being stolen is increasing. For instance, the cost of identity fraud in the US was estimated at USD43 billion in 2023.

One of the biggest challenges is that cybercriminals are using more advanced tactics to trick people and steal their information. Techniques like phishing scams, data breaches, and social engineering are just a few ways thieves can access sensitive information.

To fight back against financial identity fraud, businesses need to implement strong security measures, like multi-factor authentication and encryption technology to protect customer data. Educating customers on how to stay safe online can also help them protect their information. Regularly checking financial accounts and using identity theft protection services can further enhance security.

What’s more, when identity fraud happens, the response can be slow, making it difficult for victims to recover their money or protect their accounts. Establish a quick and efficient process for responding to fraud reports, including having dedicated teams to assist victims and help them recover as fast as possible.

By working together and being proactive, businesses and customers can reduce the risk of financial identity fraud and create a safer online environment for everyone.

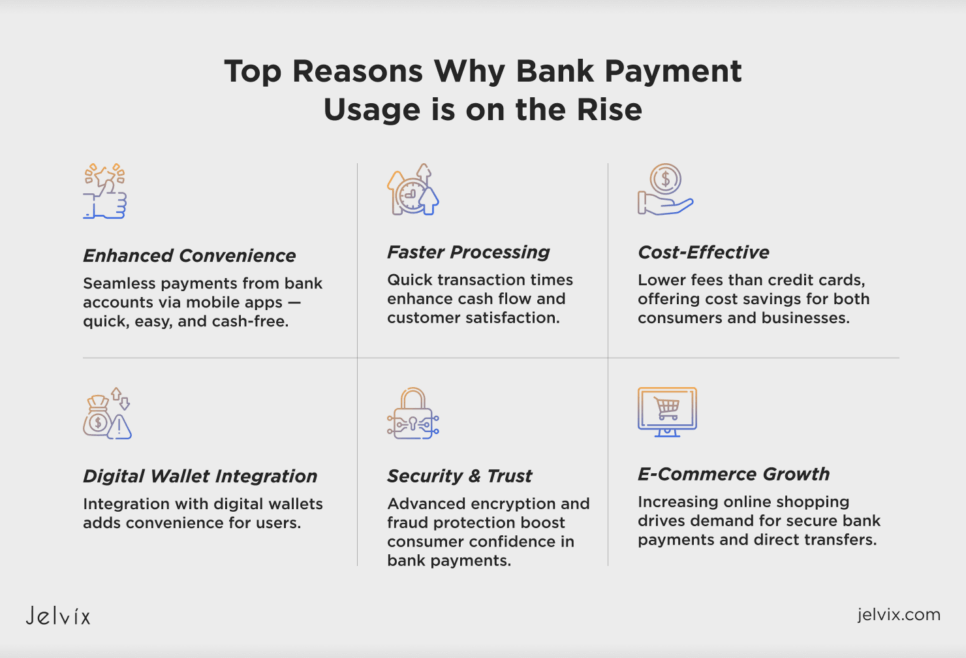

Continued Growth in Bank Payment Usage

As financials expand their infrastructure scalability and digital banking becomes more popular, many consumers choose bank payments. Several key factors, including greater convenience, and the cost-efficiency of mobile banking apps drive this growth.

Enhanced Convenience

Bank payments offer a streamlined way to conduct transactions directly from bank accounts, eliminating the need for cash or credit cards. With just a few taps on a mobile app, users can quickly make payments anytime and anywhere.

Cost-Effective Transactions

Bank payments often come with lower fees compared to traditional credit card processing. Businesses benefit from reduced transaction costs, which can lead to higher profit margins and a more competitive edge in the market.

Faster Processing Times

Transactions made through bank payment systems are typically processed more quickly than those involving checks or cash. This speed not only enhances customer satisfaction but also improves cash flow for businesses.

Integration with Digital Wallets

Many bank payment systems now integrate with popular digital wallets, making it easier for users to manage their finances in one place. This integration enhances the overall user experience and encourages the use of bank payments.

E-Commerce Expansion

As online shopping grows, so does the use of bank payments. People prefer to use their bank cards or make direct transfers to ensure their transactions are secure and their purchases are tracked.

Security and Consumer Trust

Modern bank payment systems use strong encryption, multi-factor authentication, and real-time fraud alerts to keep users’ data and transactions safe. These protection methods help build confidence in bank payments, reassuring users that their money is in safe hands.

The Normalization of the Emerging Technologies in FinTech

As people become more accustomed to using digital solutions for their financial needs, these technologies are no longer seen as niche options; they are becoming standard practices in how we buy, sell, and manage money.

For instance, mobile wallets, contactless payments, and cryptocurrencies are now widely used, and many consumers expect businesses to offer these options. In other words, businesses must adapt to meet customer demands for speed, convenience, and security in their payment processes.

Moreover, as security features improve and rules around these technologies become clearer, trust in them is growing. This creates a positive cycle where increased usage leads to more innovations, resulting in easier payment solutions. Moving forward, the normalization of these emerging payment technologies will likely continue to transform how we handle money, making transactions simpler and more accessible for everyone.

Learn how Jelvix modernized an SDK for a Data Aggregation API, boosting performance, scalability, and integration to streamline data processing for enterprise clients.

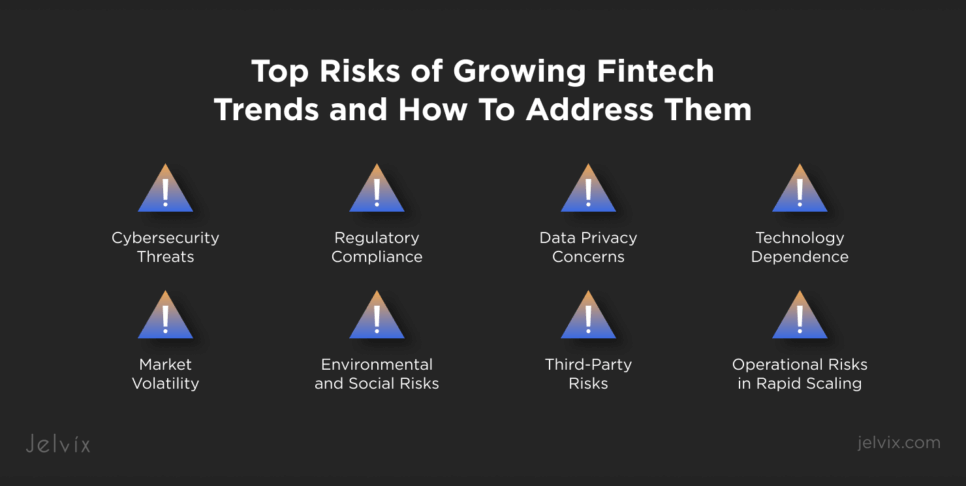

Top Risks of Growing Fintech Trends and How To Address Them

As fintech continues to grow and change, it brings along some risks that businesses need to be aware of. They need to understand these challenges to ensure safe and trustworthy financial services.

Cybersecurity Threats

With more people relying on digital platforms for their financial needs, the threat of cyberattacks is increasing. Hackers are always looking for ways to exploit weaknesses in financial systems.

The average cost of a cyber attack is said to be about USD5 million. It’s an astonishing amount of money for a small company in the financial sector. However, the reasons for such an approximation include the value of the information, reputation loss, and the cost of the staff mitigating the effects.

To protect against these threats, businesses should use strong cybersecurity measures, like encryption and multi-factor authentication. Regularly updating software and conducting security checks can help find and fix problems before they are exploited.

Regulatory Compliance

The fast-paced world of fintech often comes with changing rules and regulations. Keeping up with these requirements can be challenging for many companies. Businesses should stay informed about new regulations and invest in tools that help manage compliance. Working with legal experts can also help navigate the complexities of rules and avoid costly mistakes.

Data Privacy Concerns

Fintech companies collect and store a lot of personal information, which raises concerns about privacy and security. Many users are becoming more cautious about how their data is used. Being transparent about data collection practices and implementing strong data protection measures can build trust. Educating customers about their rights and how their data is handled is also important.

Technology Dependence

Fintech relies heavily on technology, which can lead to risks if systems fail or experience outages. Technological issues can disrupt services and frustrate customers. Investing in reliable technology and having backup plans in place for potential outages can help. Regular maintenance and testing can ensure that systems run smoothly.

Market Volatility

Fintech trends, particularly in cryptocurrencies, can be very unpredictable. This volatility can pose risks for both businesses and consumers. Providing users with educational resources about market risks can help them make informed decisions. Implementing good risk management strategies can also protect against potential losses.

Third-Party Risks

Relying on third-party services in fintech can introduce security and reliability risks. To minimize these, businesses should carefully vet and regularly review external vendors to ensure they meet the company’s security and performance standards.

Environmental and Social Risks

Fintech companies face increasing scrutiny over environmental impact and social responsibility. Addressing these issues with sustainable practices, transparent operations, and community involvement can strengthen customer trust and boost reputation.

Operational Risks in Rapid Scaling

Rapid expansion can lead to operational issues where demand exceeds resources. Businesses should scale gradually and invest in scalable systems and solid processes to support growth without sacrificing service quality.

How Jelvix Supports Key FinTech Market Trends To Help Businesses Grow

The incredible connection of the financial field with powerful technological solutions is improving the state of businesses. All the changes are aimed at providing more security and usability to products.

At Jelvix, we know that the ever-changing world of fintech offers both exciting opportunities and challenges for businesses. By aligning our fintech software development services with important banking industry trends like embedded finance, open banking, and neobanking, we help our clients develop and seamlessly integrate financial solutions into their platforms. We also help companies handle the complex rules and regulations in the financial industry, ensuring they stay compliant while managing risks.

If you need to develop an innovative FinTech solution from scratch or want to integrate the ready-made tool into your existing infrastructure, an experienced tech partner can help. At Jelvix, we have vast expertise in developing and integrating FinTech solutions into set workflows. Reach out and our experts will provide you with tailored advice.

Need a qualified team?

Reach new business objectives with the dedicated team of professionals.