What often goes unnoticed is how a project’s financial setup can subtly steer its path. Software pricing models shape behavior.

Stability often matters most when uncertainty hits—fixed rates respond by holding boundaries firm. When requirements are clear, knowing the cost upfront supports steady planning.

What matters most is context. When unpredictability grows, approaches based on market principles often work, if supervision, autonomy, and authority adjust accordingly. Misalignment causes problems. What sets outcomes apart is less about choosing a structure than managing exposure through changing conditions.

This article breaks down the most common pricing structures through the lens of execution risk: from the rigid boundaries of Fixed Price to the fluid adaptability of Time & Materials. We’ll also share how Jelvix helps partners navigate these choices to ensure that the financial setup protects the project’s future, rather than endangering it.

Software Pricing Models as a Delivery and Trust Mandate

Commercial models define how everything from risk to responsibilities is distributed between people. At least, if one is being fair, stress over project spending usually does not come from price alone. What breaks confidence most often? When resources flow ahead of measurable results. When enterprise software pricing models are without clear rules on handling change, spending decisions breed suspicion instead of cooperation. Talks about progress, then shifts toward guarding resources rather than fixing issues.

This misalignment gives rise to scope conflict as a direct response. Software development pricing practices repeatedly demonstrate that it is not the change itself sparking disagreements, but rather unclear rules managing how changes are handled.

When commercial frameworks value predictions more than results, confidence erodes through repeated estimation conflicts. In fields such as healthcare software development, where rules tighten and systems interconnect unpredictably, estimates about timelines carry chance-like uncertainty. Unpredictable links between systems magnify tangles—so linear predictions fail easily.

When systems block communication, collaboration slows down. Because payment choices involve strict oversight, employees might put off raising concerns to prevent renegotiation delays. This leads purchasing teams to introduce extra reviews and intermediaries prior to approval. When one party takes on more procedural load, confidence starts to weaken.

Delivery Risks That Software Pricing Models Must Address

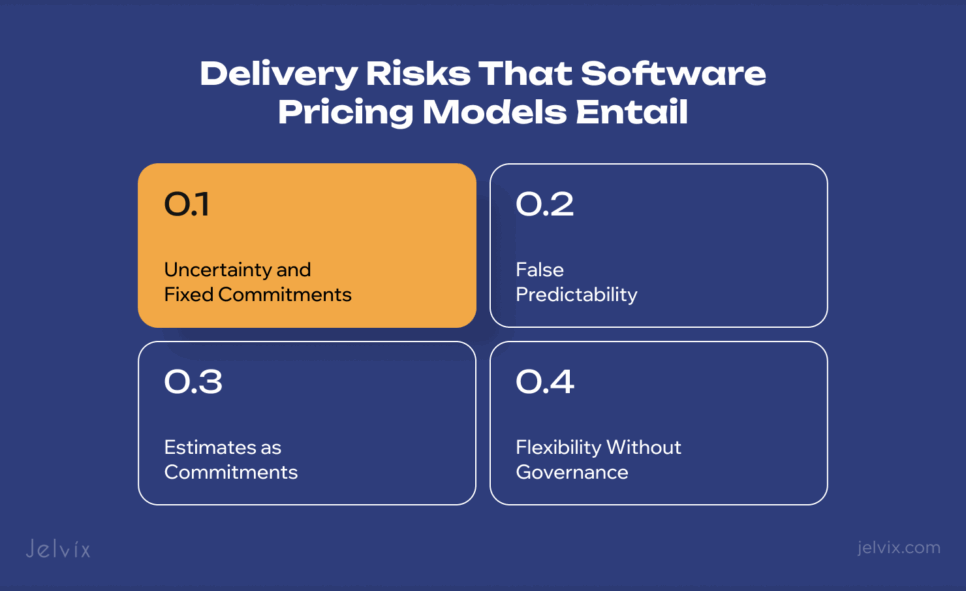

Uncertainty and Fixed Commitments

When requirements shift, uncertainty grows in software work. Dependencies during integration introduce unpredictability, too. Data that arrives late or incomplete adds another layer of doubt. How rules are interpreted can change over time, affecting outcomes. Feedback from stakeholders often reshapes direction mid-effort.

Even if fixed-price contracts attempt to minimize uncertainties, actual experienced outcomes contradict these efforts. A longitudinal analysis proves rigid techniques cause more failures. When rigid requirements remain, waste spending increases dramatically. Flexibility, not rigidity, ends up determining better results.

Facing shifts without adapting reveals a gap—when companies stick to static models, unpredictability grows quietly beneath the surface. Over time, that tension spills into daily work and long-term goals alike.

False Predictability

Executives frequently want predictability early to drive budgeting and portfolio planning. But such predictability that is not based on empirical discovery is synthetic. And one of the studies, for example, highlights that projects with detailed scope and fixed price software development without enough discovery are much more likely to encounter late-stage rework and slippage in schedules, even if early milestones look “on track.”

Discovery exists to prevent this outcome. It is the phase where specialists test assumptions: experts validate requirements with real users, devs explore technical constraints, and integration risks are identified, thereby reducing unknowns to manageable variables. Instead of guessing how the system should behave, teams gather evidence about how it can and should work. When discovery is skipped or compressed, fixed commitments are made on incomplete information, and risk simply reappears later at a much higher cost.

Uncertainty doesn’t vanish under fixed-price models. It tends to surface later instead. Clarity grows more from experience than from early assumptions. With discovery at the start, decisions gain sharper edges when real information appears. As understanding guides progress, unknowns begin to weigh less. Facts reshape emotion, making the path feel lighter.

Worried about data breaches and misconfigurations in your cloud environment? Learn the most common cloud security risks and how to protect your business.

Flexibility Without Governance

In complex enterprise settings, flexible commercial models are often used to handle change. Still, being flexible rarely means staying in charge. Because financial boundaries blur, projects creep past original estimates, despite intentions. Stakeholders then question value long after momentum takes over. Results like these show up most where oversight fades slowly:

- unmanaged backlog growth;

- unclear responsibilities for prioritization;

- increased scrutiny by procurement or finance teams.

When rules are unclear, the Time and Materials approaches struggle, though the method isn’t at fault. Governance makes the difference: where it exists, adaptability functions without hiccups. In its absence, spending pressures grow while choices take longer. Outcomes depend less on structure and more on oversight.

Estimates as Commitments

Estimates exist as planning tools, but they become liabilities when treated as contractual promises. Teams that are under estimate-driven contracts are forced to spend a disproportionate amount of effort explaining differences. That may be especially true for fintech app development services. Tight estimation commitments frequently result in release delays and higher total cost of ownership.

Long meetings, delayed choices, and sluggish progress often stem from this issue. Teams can shift focus toward delivering value when pricing moves away from fixed forecasts; sprint-by-sprint payment models allow that separation. Promises tied to uncertain predictions weaken collaboration. Value creation gains ground only if incentives stop rewarding guesswork.

Using Enterprise Software Pricing Models to Manage Delivery Risk

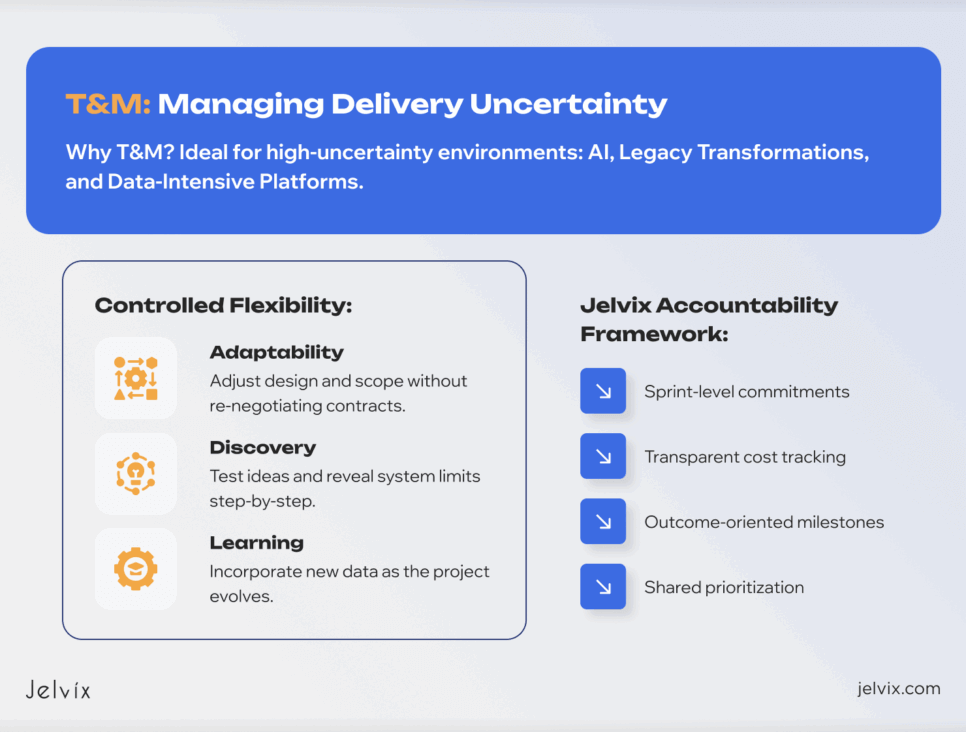

Time & Materials for Managing Delivery Uncertainty

When early projects face unknowns, T&M proves useful. Such conditions often appear during initial platform development, large-scale system updates, handling extensive data workflows, or building AI-driven tools. As teams learn what works, expectations shift gradually. Unclear starting points lead to evolving requirements over time.

Outdated infrastructure often underpins operations in banks or insurance providers. Fixed-time payment models reveal constraints over time, as ideas undergo incremental validation amid evolving strategies. Adjustments occur seamlessly, even when unforeseen issues surface. Much like predictive modeling exercises, outcomes depend on data integrity, integration complexity, and accuracy potential—factors that remain uncertain until far into development.

The T&M meaning in this sense does not imply “open-ended spending” but rather controlled flexibility. Why is it so often misunderstood?

The comparison of time and materials vs fixed price is frequently framed as flexibility versus cost control. Still, this view misses part of the picture. Over time, issues often surface in time and materials agreements if oversight fades. Without a clear structure, individuals may mistake independence for the absence of direction. In unclear situations, evidence shows flexible methods outperform strict rules. In the end, understanding weighs more than authority.

Jelvix applies Time & Materials as a managed delivery approach. Accountability is maintained through clear sprint commitments, continuous cost visibility, outcome-focused checkpoints, and shared ownership of prioritization. Open handling of uncertainties fits within a framework where spending remains foreseeable when it counts most.

Working with Time & Materials allows ongoing contact between the customer and the team. As results appear, priorities adjust smoothly; changes happen freely because rules do not block them. Choices rely on actual responses instead of guesses made at the start. With fixed pricing, key judgments must occur long before any product exists. When conditions change, as they almost always do, adaptation becomes slow and costly, often leading to changes that take time, cost more, sometimes cause people to pay extra for fixes that come too late or receive products built on outdated ideas.

Seen this way, the choice is less about flexibility versus predictability and more about when predictability is earned. Time & Materials accepts that learning precedes certainty and structures delivery accordingly.

Key takeaways:

- T&M is effective when uncertainty cannot be removed upfront.

- Cost risk under T&M emerges from weak governance.

- Accountability must be enforced operationally.

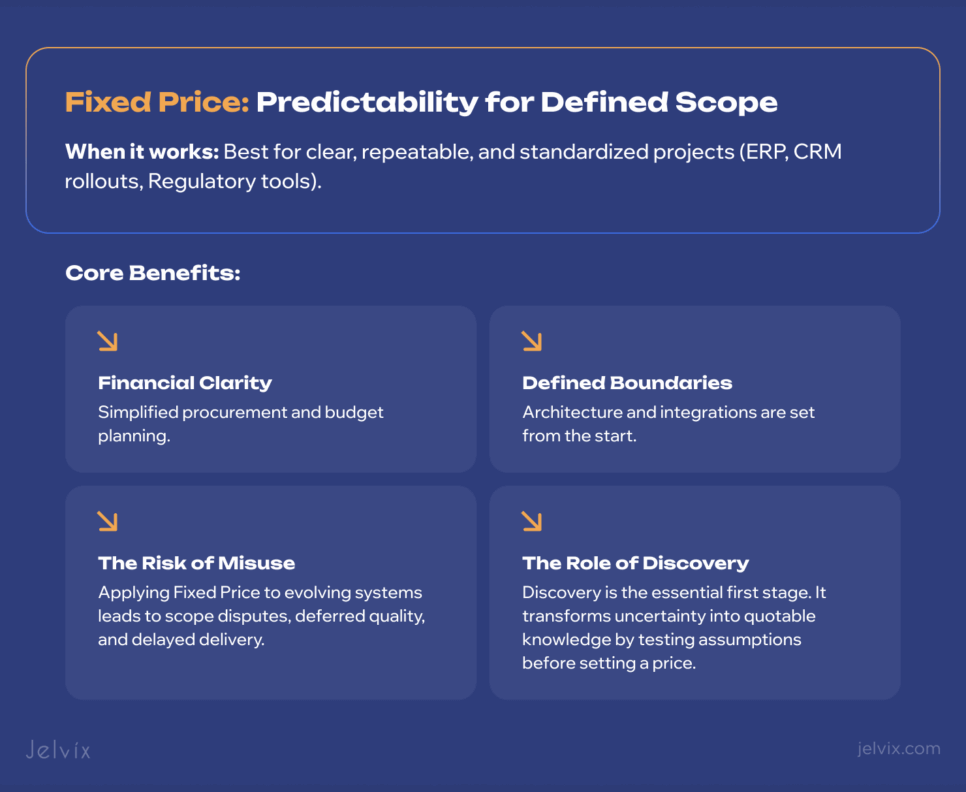

Fixed Price for Predictable and Well-Defined Scope

Fixed price software development is effective when the core problem and solution pattern are already understood, and expected changes are incremental rather than structural. It is most common if you need to create repeating configurations, roll out standardized systems, or expand your more mature solutions.

A solid structure supports deployment of ERP components, modifications to CRM platforms, or integration of features such as regulatory reporting. Where companies adopt uniform configurations, like standard SAP or Salesforce setups, a clearer line forms between planning and execution, improving their chances under flat-rate contracts. When expenses stay steady, forecasting becomes more straightforward, provided implementation routes do not shift unexpectedly. Approval processes gain too: smoother procurement flows emerge when disruptions are rare.

Difficulties appear when fixed plans are applied to initiatives that continue to evolve. Projects like online health systems or updated company software often reveal unknown needs after launch, once live usage begins. With set pricing models, each significant adjustment demands reassessment and sign-off. Over time, teams become reluctant to adapt because it introduces contractual friction. The result is often slower delivery and growing disagreement over what “done” actually means.

One less visible downside of fixed pricing lies in the risk premium built into the contract. To guard against unforeseen changes, suppliers include safety margins early on for risks that might never occur. Even so, clients tend to disengage over time, given that the framework favors sticking to initial plans instead of evolving through feedback. As expectations or environments change (which happens regularly), adjustments demand high effort and delay, leaving outcomes out of step when finally completed.

Why does clarity emerge only after discovery begins? Because turning vague ideas into solid understanding relies on structured inquiry. For Jelvix, this phase isn’t optional—it precedes pricing decisions in smart planning. Assumptions gain reliability when examined, rather than left to chance.

Key takeaways:

- Once clarity replaces doubt, fixed pricing becomes possible.

- A rigid fee set ahead of time turns adaptation into tension.

- What we find opens the door to what we can foresee.

Fixed Price per Sprint for Controlled Flexibility in Long-Running Programs

Fixed price per Sprint is rooted in the framework of large-scale companies’ long-running projects, where a constant budget was required without “freezing” system design. This approach appears across expanded Agile setups, particularly where regulations shape development pace.

Some tech firms using SAFe may rely on sprint-based costing when handling remote teams. Rather than fixed budgets, telecom providers building customer platforms might allocate funds per cycle. Healthcare organizations adding data-sharing features sometimes adjust spending after each phase. Outcome-focused planning helps them respond to integration challenges or meet regulatory demands.

This format is effective as the delivery rhythm is constant, while the solution points are fluid. The finance teams experience predictability, while the product and engineering teams are able to adapt to new information. The custom enterprise solution is especially useful as learning happens without disrupting the budget.

Jelvix uses the sprint pricing approach once the delivery pace and the maturity of the governance structure enable efficient management of the backlog. If not properly managed in the planning stage, the method becomes a disorganized fixed price approach.

Key takeaways:

- With sprint-style pricing, staying flexible fits neatly within budget limits.

- Achieving predictability happens step by step.

- When sprint rules are followed closely, the model performs most effectively.

Outcome-Based Elements for Rewarding Measurable Results

When software runs in real conditions, system behavior reveals the true result of delivery. Outcomes emerge straight from deploying solutions, not from vague goals set earlier. What appears in daily operations makes success visible, far more than counting built functions or time spent. Measuring actual effect shifts focus away from endless production toward creating things users notice. Clarity grows when effort links to what really shows up after launch.

A business without defined structures often falters when trying outcome-driven methods. In complex settings, focus turns to what users do and how teams behave internally, while external regulations also play a role, shaping not only how programs operate but also their reliability and whether intended patterns emerge over time.

The outcome-based elements are suitable in the context of the following settings:

- when the delivery impact can be isolated;

- measured consistently;

- governed jointly by all parties involved.

Jelvix is using outcome-based factors prudently in the project as reinforcement elements within commercial systems, rather than as standalone contracts. This keeps the value of the incentives in a consistent manner without being influenced by factors that are beyond their control.

Key takeaways:

- Outcome-based elements work only with clear, verifiable metrics.

- Misdefined outcomes introduce risk.

- Selective use preserves alignment without distorting accountability.

Jelvix in Practice: Choosing the Right Model Based on Risk

Jelvix chooses outsourcing pricing models by analyzing delivery risk as it is most likely to occur and how it should be managed under software development contracts. Execution behavior, not contractual preference, is the focus.

How Jelvix evaluates delivery risk:

- Scope clarity. Clarity in scope matters most when decision control shifts often. Where ownership lacks consistency, even thorough records carry elevated exposure. Stability in authority forms the base—without it, documentation alone cannot reduce uncertainty. Risk rises if choices are poorly anchored, regardless of how much is written down.

- Innovation level. Measured by technical novelty and uncertainty about validation. When putting artificial intelligence projects into real settings, outcomes often stray from expectations. Moving beyond simple analytics, sophisticated data instruments carry matching degrees of doubt. Systems based on standardized connections—such as those following FHIR interoperability standard—also face unavoidable risks during rollout.

- Dependency risk. Evaluation considers how tightly operations bind to third-party platforms, alignment demands across suppliers, and interaction with oversight bodies. As linkages increase, interruptions tend to emerge, shaped by factors beyond internal control. Complexity here links directly to timing uncertainty.

- Regulatory pressure. Considered an evolving execution. In regulated environments, especially healthcare, interpretation and enforcement often change during delivery.

- Stakeholder maturity. Governance behavior dictates backlog ownership, financial oversight, escalation discipline, and decision cadence. Commercial flexibility is scaled to the observed maturity and not role seniority.

Occasionally, Jelvix combines different pricing approaches to improve outcomes. Starting off, separate project phases carry distinct risks even under one initiative. Because of this, activities like exploration, core dev, integration, and compliance validation are unlikely to benefit from the same commercial structures. That difference allows Jelvix to match rewards more closely with actual effort.

Struggling to share healthcare data seamlessly? Explore how FHIR standards simplify interoperability and unlock better patient outcomes.

The objective is delivery stability. Predictable progress emerges when commercial structures reflect how risk actually behaves over time, rather than how it is assumed during procurement. In complex enterprise initiatives, the lowest price is often achieved only after delivery risk has been appropriately managed. Not before.

This is why Jelvix does not use commercial models in a rigid, templated fashion. In every engagement, our execution framework is designed in accordance with the delivery conditions, limitations, and requirements set by the client. In this manner, we ensure that while adapting our commercial strategy according to how risk arises, emphasis is placed on making steady progress.

Software Pricing Models Across Common Delivery Scenarios

Startups with an Evolving Product Vision

Dominant risks:

- Requirements volatility driven by market feedback and user discovery.

- Architecture decisions that cannot be validated upfront.

- Limited historical data to support accurate estimation.

Recommended commercial approach:

Though time and materials models guide the approach, caps on expenditure tend to emerge periodically. Financial thresholds often coincide with stage assessments. Funding constraints might also take the form of sprint-driven appraisals

Looking past earlier remarks, unclear responsibility for pending tasks frequently leads to uncontrolled expenses. When financial clarity is absent, trust gradually erodes. Start basic monitoring early, set short-term goals, reveal spending openly, make consistent choices, and transform flexibility into visible progress.

Scale-Ups Extending an Existing Platform

Dominant risks:

- Hidden complexity within legacy components.

- Integration limits appear at later stages.

- A situation where understanding is limited arises when objectives shift over time. As expectations change, full alignment becomes harder to maintain.

Step by step, sprints make cost planning more manageable, giving teams room to adjust work as needed. Rather than fix everything at the start, development moves forward in consistent loops. Because deliveries happen on a regular rhythm, budget talks stay realistic. Slow growth of systems helps maintain confidence among decision makers. Even when goals shift, space for change is preserved.

H3. Enterprises Operating Under RFP-driven Procurement

Dominant risks:

- Over-specification driven by procurement requirements.

- Assumptions made too soon often weaken once work begins.

- Frozen terms block change.

Enterprise RFPs often demand predictability before sufficient information exists. Separating discovery from execution allows uncertainty to be reduced before commercial commitment. Fixed-price execution becomes viable only after assumptions have been validated.

AI and R&D-heavy initiatives

Dominant risks:

- Results from trials shape how likelihoods behave under uncertainty.

- Across various sources, precision tends to differ noticeably. Data handling stages show repeated irregularities.

- Model validation and iteration cycles.

AI software development grows through trial, observation, and later adjustments. Goals set too early can block insight, urging focus on small improvements without sufficient understanding. With effort measured by duration and resources used, exploring concepts drives advancement instead of aiming strictly at fixed outcomes.

Outcome-focused setups require careful attention to how success is defined, since unclear terms might lead purchasers to overlook issues like data quality or workflow limits outside the team’s influence. When there are no clear baselines or dependable methods to measure advancement, linking payments to results tends to create conflict rather than mutual gain. Only where effects can genuinely be followed, or gains independently verified, do such measurement systems operate as intended.

Compliance-Driven Delivery

Dominant risks:

- Regulatory interpretation evolving during implementation.

- Dependence on standards conformance and external certification.

- Integration with heterogeneous clinical systems.

A suggested method for business involves mixing time-and-materials with set sprints and defined checkpoints. Consider the healthcare sector as an instance.

Uncertainty emerges not only through technology choices but also regulatory expectations within clinical interoperability initiatives. Progress unfolds gradually when hybrid approaches support compliance checks alongside integration trials, enabling certification tasks to advance even as official directions change over time.

Summary: Buyer-Side Decision Signals

- Choose commercial models based on where uncertainty resides, not on procurement preference.

- When assumptions lack proof, split exploration from implementation.

- By combining different frameworks, risks can be separated more effectively.

- Focus shifts toward steady advancement, where choices are clear, even if initial expenses remain uncertain.

Conclusion

A commercial model built on clear business terms helps manage risks tied to delivery. At Jelvix, we help our partners balance their financial constraints with their technical ambitions, ensuring that the project setup incentivizes quality and speed rather than endless negotiations over scope. By aligning business objectives with the right delivery framework, we turn complex initiatives into reliable, market-ready products.

Ready to turn your vision into a scalable software solution? Let’s discuss your project’s goals and find the most efficient execution path together.

Making pricing decisions before uncertainty is resolved?

Let’s map your delivery risks and select a model that protects long-term outcomes.