The dental software market is in an accelerating phase of evolution. According to Fortune Business Insights, the global dental practice management software industry as of 2024 was worth $1.80 billion and is projected to grow more than twice that by 2032 (to $3.90 billion).

North America occupied over half (54%) of this pie, reflecting the region’s mature infrastructural capacity in digital technology and rising demand for interoperable, AI-enhanced administrative tools among dentists’ practices.

Practices are now shifting actively to more nimble and data-informed systems—an outcome influenced by the digital pivot of the post-pandemic era, as well as heightened expectations from both patients and from forward-thinking management for accuracy and transparency.

The sort of modern dental software is no longer simply a scheduling tool. It’s a multilayered platform involving patient record management, billing, diagnostics, and insurance verification, fused into a cohesive whole. The Cloud-based architecture and AI-supported analytics on which such systems are built are no longer differentiators but prerequisites for operating in this market.

Driving this transformation is a broader push across the healthcare software development landscape to embed actionable intelligence into every operational layer. Dental practices, in particular, are under mounting pressure to reconcile manual legacy processes with real-time verification systems, especially as insurance models become increasingly complex and patient volumes rise.

Yet even with increased usage of digital systems such as these, there are barriers to implementation that won’t go away just because you put up more money or pour more into your platform.

This article aims to explore the challenges involved in integrating dental insurance verification systems with network monitoring skills, what makes a system technically demanding, and to put forth some best practices for creating robust assurance workflows securely and efficiently.

What Is the Dental Insurance Verification Process?

At its core, dental insurance verification is the operational step that determines whether a patient’s treatment will be covered and under what conditions. It involves retrieving eligibility data, validating plan-specific benefits, checking coverage limitations, and confirming financial responsibility. While the purpose is administrative, the implications ripple across treatment planning, billing, and patient satisfaction.

Typically, the process begins before the appointment. Staff collect a patient’s insurance details, from which they then verify through payer-specific portals or clearinghouses as well as by direct communication. Depending on the insurance company concerned, this may involve navigating proprietary interfaces to obtain PDF copies of plan breakdowns or even making follow-up calls when automated systems fail to return comprehensive results.

Errors at this stage can lead to denied claims, delayed reimbursements, or unexpected costs, which patients are forced to cover out of pocket, none of which is good for long-term retention.

In digitally mature practices, verification is partially automated through integration with eligibility APIs. These pipelines allow staff on the front lines of operations to pull in real-time data and cut down manual input.

However, even if the APIs are there, they are unlikely to return standardized data formats, and you might have to parse fields like deductible met periods or frequency limitations from unpredictable wordings or buried metadata.

The technical complexity of correctly ingesting and translating this information is a reason dental insurance verification remains a pain point in otherwise well-ordered chains.

Traditional Verification Workflow and Its Challenges

The dental insurance verification process is still heavily reliant on fragmented, manually driven procedures. Front-desk staff often handle both phone queries and slow-to-load verification portals. To make matters worse, every payer has its way of accessing eligibility data, adding delay and uncertainty where neither is welcome.

In clinics equipped with the latest dental software, gaps still exist. Patients’ records and insurance information typically reside in different systems, forcing staff to jump back and forth among them or re-enter the same information multiple times. Such repetition not only exhausts human effort but also amplifies the chance of administrative blunders, especially during busy periods when mistakes are most likely to occur.

Compliance and data privacy requirements (especially those with regard to HIPAA) only further complicate matters on this score. Transmitting Protected Health Information (PHI) via insecure or unencrypted channels exposes practices to potential breaches and legal penalties.

Despite the increasing adoption of cloud-native systems, many traditional workflows persist because they’re fragile during their integration into payer ecosystems. This not only entails a reactive mode of workflow but also an effort-intensive and unsustainable process on a larger scale.

How Dental Insurance Verification Software Can Save Time and Money

The costs of inaccurate insurance data to administration are rarely just a matter of pushing paper. In fact, it actively sabotages financial performance, the patient experience, and operational efficiency.

Yet when a dental practice learns insurance eligibility in real-time, verifies plan limitations, and unmistakably confirms a patient’s coverage prior to treatment, it thereby avoids the future cascades of delayed billing, claimed rejections, and financial disputes after treatment. Such software for dental insurance verification also acts as a kind of shield, preventing predictable revenue losses.

Wrong details about coverage are still the biggest single reason for rejections, whether caused by incorrect subscriber information, changes in employer-sponsored health plan on a patient’s part, or doubts about what sorts of services networks cover. And these mistakes that are avoidable and shouldn’t endure on become routine because the practice still relies on fragmented or manual methods.

Dental insurance software in a front desk schedule makes checking eligibility automatic, no longer requiring recourse to unpredictable third-party websites or risky data entry. This not only lessens the inconvenience of having to make repeated submissions, but it also condenses the length of time that claims are outstanding.

Testing the waters through early verification beyond claim validation enables dental practices to forecast how much patients will end up paying out of pocket with precision. This kind of financial transparency upfront gives a clearer sense of what is reasonable and allows some of the emotional friction people might feel when they get a surprise bill to disappear.

It also makes it less likely for staff to have to make those awkward follow-up calls or go chasing after unpaid bills, tasks that take time and often cause strain on relationships. If they know going in what their financial responsibilities shall amount to, patients are much more likely to accept a health plan as advised and make on-time payments. It improves both patient retention rate and cash flow.

The practical results are equally important. Rather than spending hours on the phone with insurance companies, front office staff can put in that time for more patient-oriented duties. This changes the nature of their work, helps build up confidence, and makes the overall dental service experience smoother.

Practices equipped with smart dental insurance verification software have no need to risk booking treatments that are not covered or scheduling double-booked appointments that require additional approval. In an environment where every hour of chair time has value, this means that the difference accumulates fast.

Most important of all, real-time verification underpins a broader demand for transparent healthcare pricing. Patients now more than ever expect to understand what they’re paying for before committing to care and why.

Dental offices that take pains to clarify benefits and the coverage limits they set on treatments are in a better position to earn trust, cut billing friction, and hold onto patients over time. By making verification an integral part of care delivery, pricing obscurity clears up, and professional credibility deepens.

What to Look for in Dental Insurance Eligibility Verification Software

Key Features and Functional Requirements

The functionality of any dental insurance eligibility verification software must extend far beyond basic eligibility checks. To be viable in a modern dental environment, the software should be capable of the following:

- Handle multi-level benefit verification;

- Surface plan-specific limits;

- Provide real-time feedback on deductibles, waiting periods, and annual maximums.

All that without requiring staff to consult fragmented payer portals. Intelligent form autofill, audit logging, and secure document storage are foundational to risk mitigation and compliance.

A good system will have a verification tickbox built into the interface to minimise cognitive effort and ensure consistency. Automating these inputs, such as the policy validation, pre-authorization notifications, and coverage inclusions, reduces time-consuming manual entry and lessens the risk of error.

A practice needs a tool, not just software, that emulates how seasoned staff function at their peak. This is where the more sophisticated insurtech players stand out, as they bring adaptive workflows, exception management, and predictive nudges into the mix based on payer behavior.

The systems that integrate closely with dental insurance billing software also support the continuation of data across patient eligibility and the revenue cycle. This avoids duplicative work and ensures claim submissions are based on validated data, thus reducing denials.

As reimbursement becomes more convoluted, granular eligibility information needs to map seamlessly into precise billing behavior without requiring manual staff intervention at each step of the way.

User Experience and Staff Adoption Considerations

A solution’s UX must be friendly to a non-technical person but not dumb down its capabilities. Clear prompts, inline guidance, and customizable workflows ensure even new staff can perform comprehensive checks without skipping critical steps. And because benefits verification often takes place with a patient on the line, or in the waiting room, speed and responsiveness are not a luxury; they are your minimum standard.

Adoption hinges on whether the software minimizes context switching. If users must alternate between verification, scheduling, and billing interfaces, cognitive fatigue sets in.

High-performing solutions surface relevant data contextually: while scheduling, you see network status; while billing, you see deductible progression. Embedding verification as a background process instead of a foreground interruption is what separates usable systems from exceptional ones.

Learn how API-powered GUI modernization helped transform a legacy dental system.

Importance of API Flexibility and Standards Compliance

HL7, FHIR, and X12 EDI compatibility is important as well, particularly for multi-location practices seeking to sync with clearinghouses, PMS side platforms, and revenue cycle management tools. Without adherence to these standards, each new payer integration is a custom job you pay for, and scaling verification across geographies is a fairytale land.

In addition, strict version control and sandboxes are needed so the teams can safely test updates without taking production data hostage.

Security and compliance infrastructure baked into the data exchange layer is also a critical integration component. Insurance and patient data are too sensitive not to have token-based auth, payload encryption, and auditable logs. If a vendor’s API stack isn’t capable of handling flexibility and compliance together, the integration will be functional for the time being, but under real-world regulatory pressure, it won’t stand up.

Integration Challenges in Dental Insurance Verification Software

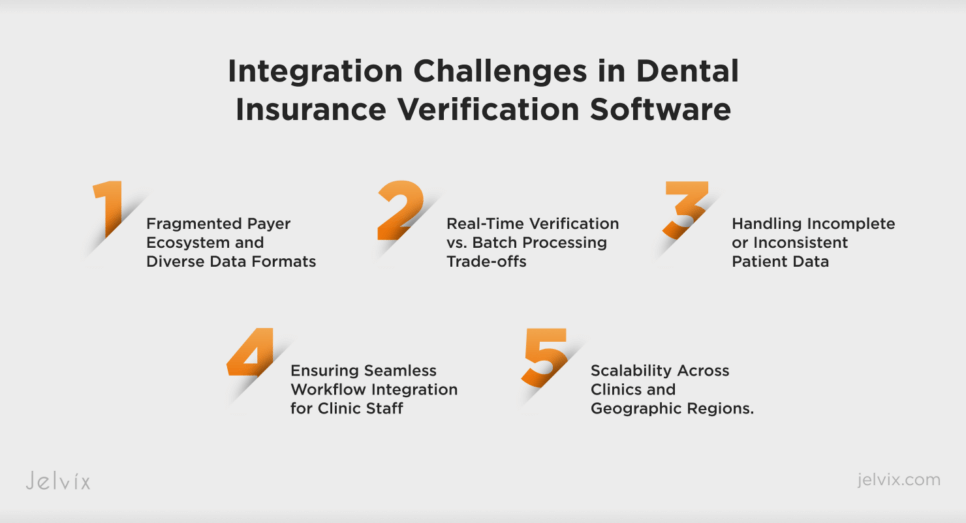

Fragmented Payer Ecosystem and Diverse Data Formats

The dental medical insurance segment consists of numerous fragmented ecosystems where each insurer has different data architecture and there are no fixed API standards, but there is such a thing as eligibility logic; thus, dental software providers may have to deal with hundreds of versions on any number different fields, like deductible remaining or pre-authorization flags.

And even when response fields in basic service boxes are not standardized or do not return consistent content, providing live coverage checks proves both cumbersome and true.

Solution: Normalization across fragmented data sources requires middleware. Today’s advanced medical insurance verification software incorporates adaptive parsers and transformation layers that convert inconsistent payer payloads into unified data models.

As a result, not only is this overhead of little or no concern to integration work, as there is little or no integration work left now, but downstream systems, such as billing clerks, receptionists, and report generators, receive dependable, reconciled information regardless of which payor provides it.

Real-Time Verification vs. Batch Processing Trade-offs

Many clinics struggle to choose between real-time API-based lookups and batched overnight verification. While real-time checks provide up-to-the-minute data, they can be expensive in terms of API throttling and unreliable when payer systems experience latency or downtime. Conversely, batch processing is cost-effective but introduces timing gaps, potentially leading to stale or inaccurate insurance data by the time of the appointment.

Solution: The middle ground maintains the best of both kinds of systems. Intelligent dental insurance billing software platforms now allow users to pre-set threshold levels for verification—routine cleanings, say, are pre-verified at batch time, while high-cost treatments trigger real-time checks.

Depending on cover uncertainty or payer behavior, batch processing software can fluidly shift to API-based queries while preserving both cost-effectiveness and medical accuracy.

Handling Incomplete or Inconsistent Patient Data

Due to poor inputs, insurance verification processes often fail. Misspelled names, outdated policy numbers, and missing subscriber IDs lead to failed lookups or mismatched results. Worse yet, these mistakes usually find their origins at intake, then move downstream to compromise claims, patient estimates, and scheduling.

Solution: Intelligent verification tools validate and enrich patient records before querying payers. Some insurtech platforms incorporate third-party data validation, auto-correction routines, and UI checks that detect anomalies in real time. By addressing input hygiene at the point of capture, software reduces failure rates later in the pipeline and ensures that verification results align with real patient coverage.

Ensuring Seamless Workflow Integration for Clinic Staff

Despite the advanced verification techniques now in general use, a clinic’s performance can suffer if it doesn’t smoothly integrate with existing systems. If front desk staff have to switch between different software programs to confirm a patient’s eligibility, update charts, or prepare treatment estimates, then missed steps become more likely, and otherwise simple processes can become chaotic.

Solution: Good dental insurance billing software takes the approach that verification is something that occurs in the background. Instead of forcing staff to initiate eligibility checks themselves, systems like this one automatically initiate verification at predefined workflow junctures: when an appointment is scheduled, checked in for, or prior to billing.

Where verification results are embedded in context (such as eligibility flags during the appointment-scheduling phase), this mode of operation reduces human error and becomes adopted by staff without undue additional complexity.

Scalability Across Clinics and Geographic Regions

Multi-site dental organizations face unique scaling issues. Each clinic may deal with different payers, local regulations, or operational procedures. A software integration that works seamlessly in one location might break entirely in another due to region-specific rules or unsupported insurers.

Solution: Scalable platforms use modular design and direct each payor’s medical logic. They provide a single place for settings, which can be overridden on a case-by-case basis locally, so rules for covering tests, writing up treatment documents, and reading claims are in step with each site.

An API-first strategy, backed by logic layers sensitive to compliance needs, enables physicians to scale check-out processes across territories without repeating every step for all these locations and without increasing business risk.

Best Practices for Successful Integration and Adoption

Integrating dental insurance verification software into a clinic’s digital infrastructure isn’t a plug-and-play operation. A technically sound rollout without operational alignment creates peripheral equipment, while a well-meaning adoption effort lacking backend flexibility tops out in bottlenecks. Reconciling these two needs requires not only architectural foresight but operational discipline.

Data Validation and Quality Control. Any automation is only as accurate as the data on which it is built. Minimize downstream verification failures by verifying patient information at the door, right down to policy numbers, correct spelling, and IDs for subscribers. Establish validation gates at critical capture points to flag incomplete or inconsistent records using pre-verification rules.

Modular and Scalable Architecture. One-size-fits-all systems inevitably crumble under the weight of multi-site operations. Modular architecture helps each clinic or system group configure its own workflow, payer logic, and data models while remaining consistent at a system level.

Message queuing enables asynchronous processes; API-first infrastructure; loose coupling between verification, billing, and scheduling modules allows your system to expand without rigid dependencies

Staff Training and Change Management. Software that staff neither trust nor understand stands unused and delivers no ROI. Effective transition management means providing training that goes beyond how-to interface walkthroughs.

Clinics should build case scenarios into their boardings that are based on real-life scenarios; offer microlearning sessions as part of a few weeks’ refresher training on a periodic basis, with real-time feedback during roll-out. Training should be ongoing, not a single event, especially when payer actions, insurance plans, and platform capabilities shift rapidly.

Measuring KPIs and Continuous Improvement. Eligibility verification is a dynamic process influenced by external systems, internal workflows, and regulatory changes. Active tracking of KPIs such as success rate for verifications, claim denial rates due to eligibility issues, and average verification turnaround times should also be conducted.

By benchmarking these metrics and performing root cause analyses of failures, as well as prioritizing feature improvements in consultation with its dental insurance software vendors, an organization can fine-tune its operation.

The Smart Way to Choose – Download Your Guide to Selecting the Right Healthcare Tech Partner!

The Role of AI in Dental Insurance Verification

Manual insurance verification often involves interpretation. AI mitigates human error by parsing and standardizing this information in real time.

For example, intelligent models can instantly flag inconsistencies between submitted patient data and payer records, reducing eligibility mismatches before they affect claim submission. In this way, AI dental insurance verification doesn’t just replicate human actions—it enhances them, identifying edge cases that manual workflows miss and surfacing insights early in the revenue cycle.

Response time is another area of measurable impact. Traditional verification steps, especially those requiring interaction with outdated portals or multiple third-party databases, can stretch beyond acceptable operational windows. AI shrinks this latency by automating decision trees and enabling asynchronous checks. In multi-location practices, this translates into lower administrative overhead and fewer verification bottlenecks at scale.

Key AI Technologies Driving Insurance Verification

The strength of AI lies not in one algorithm, but in the orchestration of several core technologies. Optical Character Recognition (OCR) plays a foundational role, converting scanned EOBs, PDFs, and patient documents into structured datasets ready for ingestion.

Natural Language Processing (NLP) next derives meaning from benefit descriptions, authorizing requirements, and policies, many of which are written free-form and would demand a human review otherwise. These tools are already standard in mature AI in medical billing platforms and are being tailored for dental-specific use cases with increasing precision.

At the same time, predictive analytics empower a more proactive posture toward insurance verification. By analyzing historical claim data propounded under payer behavior, AI models can predict whether a claim will be approved, identify claims in need of special treatment, and effect therapy plans according to reimbursement probabilities.

Integrated into advanced dental AI software products, these functions enhance verification and also provide an important input before treatment begins for making intelligent clinical and financial judgments.

The true worth of AI dental insurance verification lies in making complex benefit data instantly actionable. It reduces risk, speeds up workflows, and instills confidence into every decision affecting a patient’s fiscal coverage. Acknowledging that payer systems and insurance models continue to evolve, AI is increasingly playing a vital role in transforming dental clinics into modern, efficient revenue operations.

Conclusion

Dental practices can’t afford to treat insurance verification as a task that stays in the back. Verification is now a critical factor in the self-perpetuating financial performance and operational resilience that dominates an environment of thinner margins, higher patient expectations, and complex payer systems.

The right solution doesn’t just prevent denials—it streamlines workflows, supports transparent pricing, and builds long-term trust with patients. Clinics that have built intelligent verification into the very fabric of their operating procedures can achieve more than administrative efficiency: they are poised to compete on speed, accuracy, and clarity.

Today, whether you’re optimizing a multi-site operation or refreshing a solo practice’s operation, there is only one path to follow: make your robust insurance verification software detail-oriented, with smart architecture and AI augmentation.

And as AI dental insurance verification matures alongside broader trends in dental AI software and AI in medical billing, forward-thinking clinics will treat eligibility verification not as a compliance necessity, but as an enabler of strategic growth.

Jelvix’s team of experts can tailor a solution best suited to your practice that will stand the test of time. For custom integrations, scalable architecture, and the deep technical knowledge that it takes today to make your verification process into a competitive edge, contact us.

FAQ

What are the biggest technical challenges when integrating dental insurance verification into existing software platforms?

Key challenges include managing fragmented insurance payer systems, varied and inconsistent data formats, enabling real-time verification without disrupting workflows, and ensuring scalability across multiple clinics and regions.

How can a smooth user experience be ensured for dental clinic staff during insurance verification?

Seamless integration into existing workflows like appointment scheduling and patient check-in, along with intuitive interfaces and reduced manual data entry, improves adoption and minimizes errors.

What technologies are most effective for automating dental insurance verification?

Effective technologies cover AI-powered Optical Character Recognition (OCR) for document parsing, Natural Language Processing (NLP) data extraction, and predictive analytics, which anticipate eligibility and the outcome of a claim.

How is data security and compliance addressed in insurance verification software?

Conforming to HIPAA specifications, using data encryption both in transit and at rest, and deploying role-based access controls all serve to protect patient information and comply with regulatory standards.

What is the typical implementation timeframe for dental insurance verification in an existing SaaS platform?

Implementation time varies depending on the complexity of the interface, the coverage of the payer network, and the implementation of different features; typically, a phased approach and test iterations make it ready only 3 to 6 months before production can occur.

Need a qualified team of developers?

Extend your development capacity with the dedicated team of professionals.