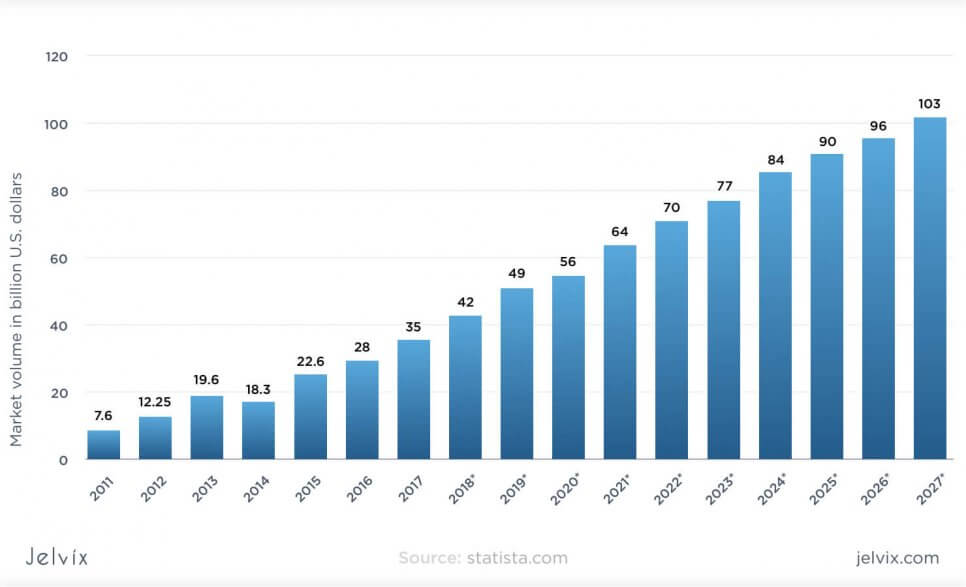

The need for Big Data analytics keeps growing constantly. Today, according to G2, as many as 95% of businesses say they need to manage unstructured data on a frequent basis. As a result, the Big Data market will get more popular among investors, having reached $103 billion by 2027.

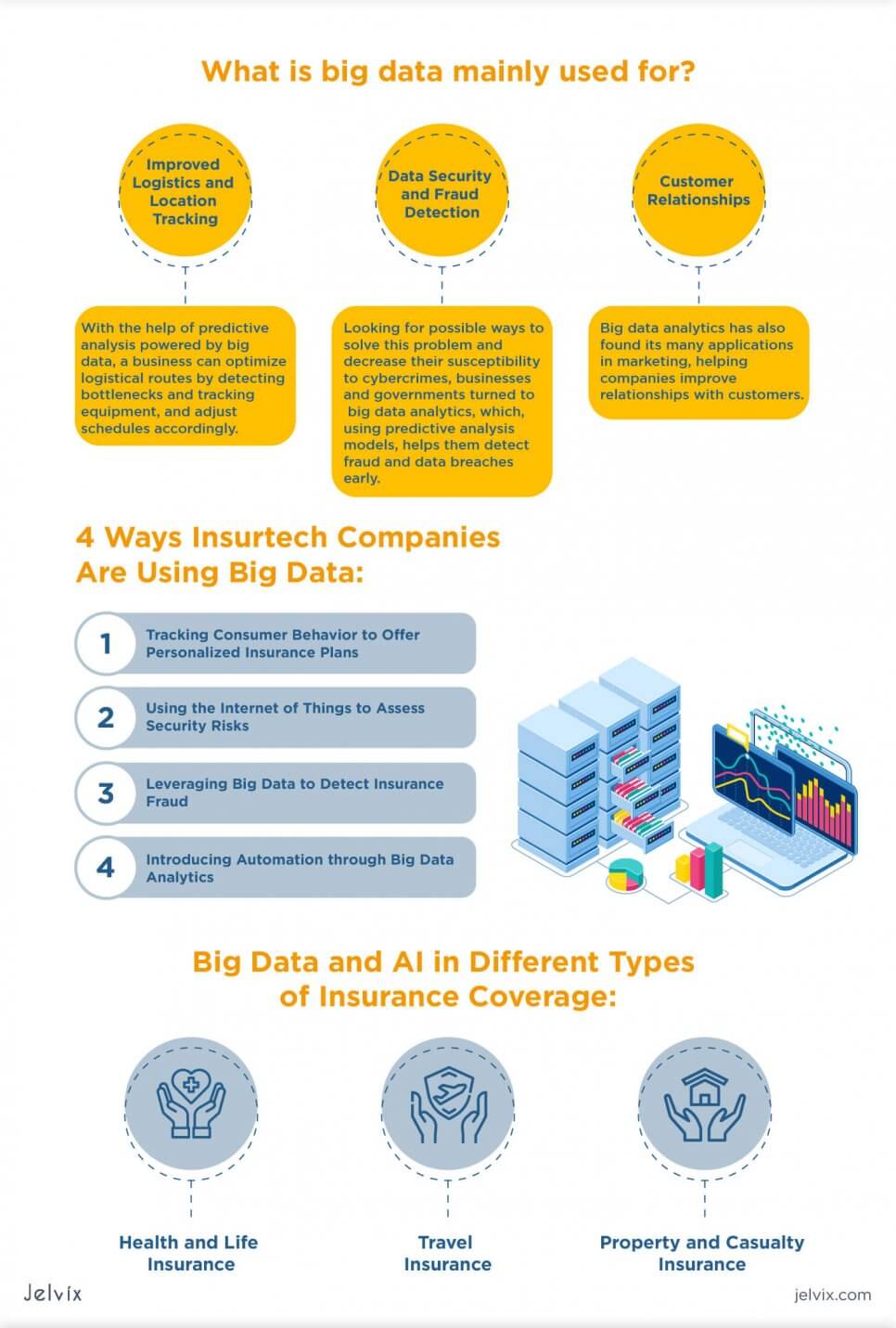

Different businesses find different applications for Big Data analytics according to their needs and goals. But what is Big Data mainly used for?

General Applications of Big Data

Big Data analytics brings out the insights that were previously unknown. As a result, with such analytics, companies are able to find solutions to many issues that they couldn’t handle before. Below are a few practical uses of Big Data that your business can take advantage of.

Improved Logistics and Location Tracking

This application of Big Data analytics is relevant for many industries that depend on logistics and supply chain.

With the help of predictive analysis powered by Big Data, a business can optimize logistical routes by detecting bottlenecks and tracking equipment, and adjust schedules accordingly.

One of the latest applications of Big Data analytics is the data-driven shipment process.

In an interview with Wall Street Journal, Matthias Winkenbach, the director of Megacity Logistics Lab at MIT, says that Big Data improves the shipment and delivery processes with the help of the ‘last mile’ analytics.

Using GPS and the Internet of Things to collect data, the shippers can now see the delivery process from start to finish. As a result, Big Data is what makes it possible to ensure the security of every delivered package.

Data Security and Fraud Detection

Cybersecurity and fraud detection have always been major concerns not only for businesses but also for banks and governmental institutions.

Looking for possible ways to solve this problem and decrease their susceptibility to cybercrimes, businesses and governments turned to Big Data analytics, which, using predictive analysis models, helps them detect fraud and data breaches early.

The Securities Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) introduced Big Data analytics to monitor the financial market for illegal activity some time ago.

FINRA’s data surveillance includes data-driven analysis of trading across the U.S., helping the institution detect illegal financial speculations. Such activities get flagged immediately, and FINRA adds them to its database to prevent them from happening again in the future.

Customer Relationships

Big Data analytics has also found its many applications in marketing, helping companies improve relationships with customers.

Among the many practical uses of Big Data in marketing, the following three stand out significantly:

- keeping track of users’ behavior;

- analyzing social data to form the demographics;

- targeting consumers with the right content at the right time.

Netflix reached success thanks to all these three Big Data applications. The company collects and draws insights from Big Data to make personalized content offers.

Besides, its smart data-based algorithms steer users away from popular blockbusters to not so famous movies based on consumer behavior and preferences. This is what helped Netflix promote their original series over the years, and made it one of the media moguls of today.

4 Ways Insurtech Companies Are Using Big Data

Almost all the above-mentioned practical uses of Big Data have also found their application in the activity of insurance companies. But improving customer experience has so far been the most important benefit of Big Data for this industry.

Insurance companies use Big Data analytics to collect data about customer behavior in real-time and improve their marketing efforts by catering precisely to their customers’ needs.

So, let’s take a closer look at how insurance companies leverage Big Data analytics to improve customer experience, illustrating our points with a few interesting use cases.

1. Tracking Consumer Behavior to Offer Personalized Insurance Plans

You already know that Big Data analytics has great potential to improve your relationships with customers by tracking their behavior.

To track and analyze consumer behavior, the data is collected from three main sources:

- transactional data – usually involves purchase or shipment details, as well as insurance transactions and other expenses;

- machine data – data generated by processes initiated on a computer or other device;

- social data – information usually obtained from social networks, which includes information about user demographics and other details.

Big Data analysis can help you collect insights that, according to the research from the American Journal of Industrial and Business Management, can help businesses:

- recognize the needs of their customers;

- find out content preferences to tailor personalized content offers;

- determine product or content alternatives;

- determine how to influence customer purchase decisions;

- find out how to nurture leads during the post-purchase period.

For insurance companies, these benefits of Big Data analytics mean a great deal. They offer insurance companies a solution to tailor insurance plans to the needs of every customer.

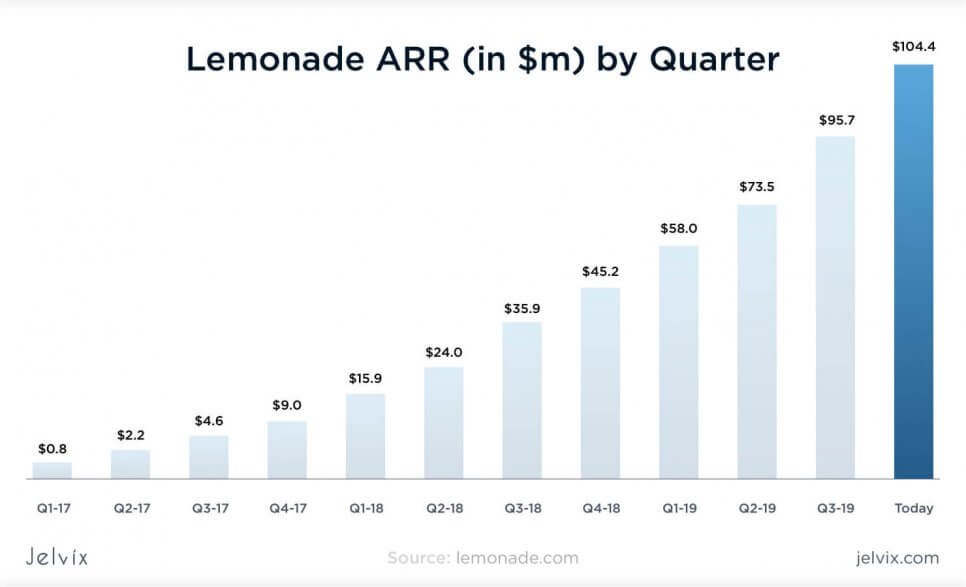

Use Case: Lemonade and Personalized Policy Offers

Lemonade, the NYC based company that offers insurance to renters and homeowners, built its success on Big Data analytics.

Big Data analytics was Lemonade’s primary growth strategy from the beginning, ultimately helping them outcompete other renter’s insurance giants, like Allstate and Liberty, and get the accounting rate of return of over $100 million:

The company uses its chatbot called Maya to interact with a client and gather essential information about them. Maya can have hundreds of simultaneous conversations at once with potential customers. During these conversations, the chatbot collects and organizes their queries and finds personalized insurance plans that fit their needs.

As a result, with Maya, it only takes 90 seconds to get a potential customer insured and about 3 minutes for them to receive insurance funds. Customers also get to switch to a different insurance plan if their living situation changes.

All these features are possible thanks to Big Data analytics, using which Lemonade crawls the social, transactional, and machine data provided by their customers to offer personalized insurance plans.

2. Using the Internet of Things to Assess Security Risks

Insurance companies strive to improve customer experience and better predict and prevent the risks associated with the type of insurance policy.

This is where IoT devices often come into play, helping insurers collect and analyze consumer data to predict possible risks.

IoT devices, such as sensors, wearables, and telematics, rely on different types of data analytics:

- status data – when the appliance turns on and off, when it connects to and disconnects from the internet, and so on;

- location data – data coming from sensors that detect movement and change of location;

- actionable data – data used from forecasting and prediction analysis, which benefits decision making in the long term;

- automation data – the type of data that usually runs IoT systems, such as smart homes and vehicles, and ensures their security based on automatically performed tasks.

Insurance companies can employ the IoT devices to determine how suitable the choice of an insurance policy is for a particular customer, as well as determine and prevent risks.

Use Case: Safeco and Risk Assessment

A Boston-based company Safeco uses Big Data analytics to evaluate risks and adjust insurance policy plans using the Internet of Things.

In case of a road accident, the costs for insurance usually go up. Safeco’s Rewind program offers typically responsible drivers to put the Rewind IoT device in their car after they’ve had a single-time accident.

This IoT device tracks the data about the driver’s activity on the road and evaluates its safety for four months. If the data that the Rewind device has collected shows that a person drives safely, the insurance price drops to its previous level.

Safeco goes further and uses Big Data analytics to encourage safe driving by offering discounts based on the driver’s performance.

Safeco’s mobile app uses location tracking to evaluate whether a person is driving safely, based on four criteria – breaking, acceleration, nighttime driving, and total miles driven. If the driver’s performance is excellent, they get a significant insurance discount.

This is a great use case, how an insurance company can use Big Data to assess and prevent risks and even reward the customers for safely using their property.

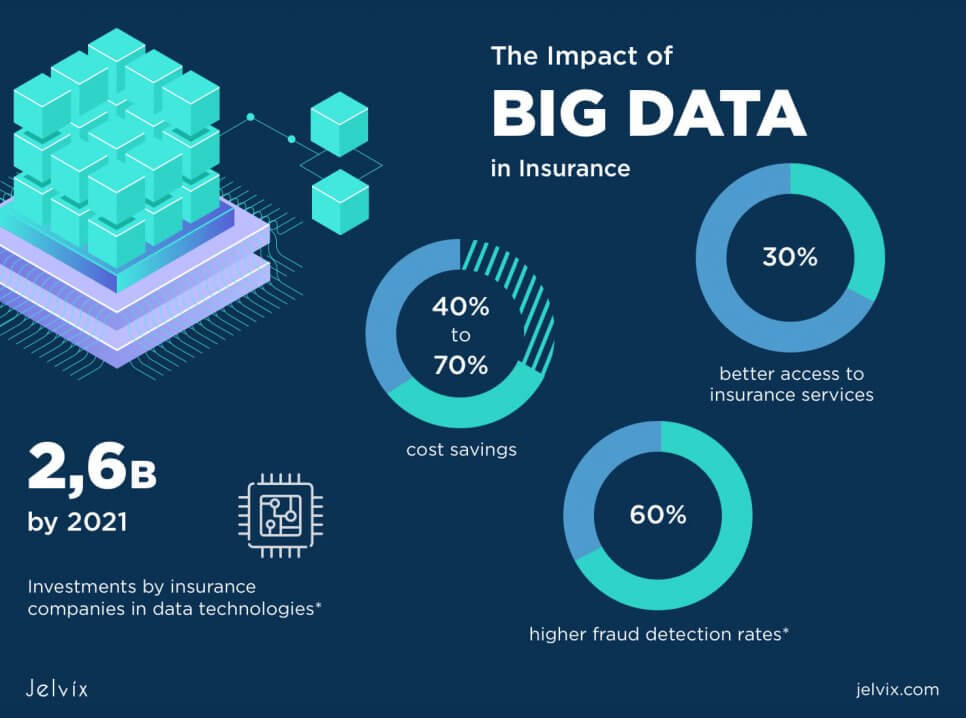

3. Leveraging Big Data to Detect Insurance Fraud

Insurance fraud is one of the biggest concerns for companies in this industry. Just as it helps detect fraudulent schemes in the cyber world, Big Data can also help insurers detect fraudulent activity.

The Digital Insurer magazine names thee main fraud prevention methods involving Big Data analytics that insurance companies can use to track and detect suspicious activity:

- Social Network Analysis – a hybrid approach that uses text mining, sentiment analysis, and data categorization to identify or predict a fraud.

- Big Data Predictive Analysis – a method using sentiment and text analysis to scale insurance claims and detect possible fraudulent activity.

- Customer Relationship Management – this approach integrates social data into customer relationship management and uses social listening to extract information that goes to the case management system. This system investigates the compliance of this information with the insurance company’s rules. If this data does not comply with the company’s terms of use, it may be considered fraudulent.

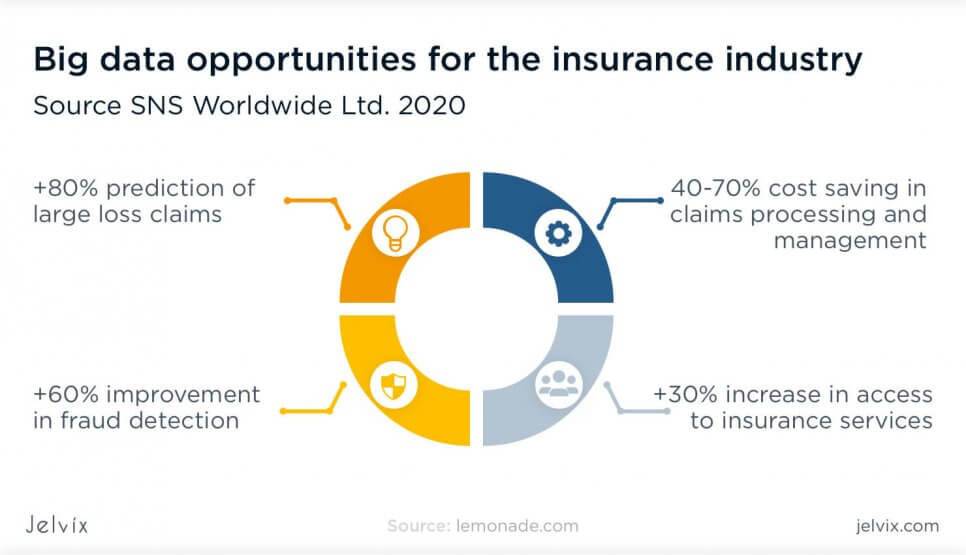

As a result, using one of these methods can help an insurance company improve fraud detection by 30% and decrease expenses connected to it.

Use Case: State Farm and Fraud Detection

State Farm is one of the biggest insurance companies in the U.S. that successfully leverages Big Data to detect fraud.

The company uses predictive analysis to detect suspicious activity, including:

- using a false residence address to get a cheaper insurance plan;

- staging or inflating an accident;

- inflating medical bills and other medical records;

- misrepresenting identity and payment information.

The company also tracks a person driving activity through the Drive Safe & Save program, which is similar to Safeco’s Rewind program. However, with this program, State Farm also identifies the gaps between the real driving records and the information provided by the customer.

4. Introducing Automation Through Big Data Analytics

With the help of Big Data, it became possible for insurers to introduce automation to improve the flow of routine tasks.

Today, Big Data makes it possible for insurance companies to automate:

- compliance checks

- data entry

- loan underwriting

- verification of claims

- property assessment

- collecting customer insights

- dealing with customer interactions (through chatbots)

The use of Big Data analytics for automation has also become the key factor in the competition between insurance companies, who realize that customers want fast service and would choose the insurer that provides it.

Use Case: Metromile and Insurance Automation

Metromile, a San Francisco-based insurance company, offers its clients exclusive insurance coverage plans for their vehicles based on how many miles they drive.

To calculate the number of miles, Metromile users install a device that transmits data to the insurer and allows them to determine how much the insurance coverage will cost:

Moreover, Metromile’s solution allows people to insure not only their cars but any other type of vehicle they own, as they only pay per mile.

As a result, this is not only an excellent money-saving solution for low-mileage drivers but also a great example, how Big Data can empower insurance automation.

Big Data and AI in Different Types of Insurance Coverage

Now, after we have covered the four basic ways how insurtech companies leverage Big Data analytics, let’s take a look at three types of insurance coverage – health insurance, travel insurance, and P&C insurance, to see how Big Data is changing them.

Learn more about 10 Best Big Data Tools to decide which one should you choose for your project.

1) Health and Life Insurance

All the Big Data application cases mentioned above can also be used in health and life insurance. These applications of Big Data are transferable and can also help health insurers assess risks, prevent fraud, improve customer satisfaction, and implement automation.

But, in health insurance, transparency has always been one of the burning issues that need a solution.

According to the Health IT Analytics journal, healthcare is one of the biggest monthly expenses for U.S. citizens, but the healthcare system is not forthcoming when it comes to pricing structures.

As a result, many insurers offer their customers healthcare plans that are beyond their means. It creates the problem of transparency, as all pricing negotiations are held behind closed doors.

Vitality, a London-based insurtech company, is determined to solve this problem. Initially, the goal of the company was to measure illness and death risk based on biometric markers and the lifestyle of its customers.

The company moved forward from it, and now it offers its clients personalized healthcare plans based on the above-mentioned criteria. The price for these plans is formed based on each customer’s needs, so they understand when and how much they should pay.

2) Travel Insurance

Travel insurance is one of the most important types of insurance coverage. It covers a variety of services and incidents, including:

- emergency medical care

- lost or stolen luggage

- rental car coverage

- trip cancellation

- flight cancellation or delay

With so many benefits that travel insurance can offer, still, only 38% of Americans purchase this type of insurance coverage, and the majority of them only purchase it because of the possibility of trip cancellation.

There are quite a few reasons why people opt out of purchasing travel insurance, from the lack of personalization to high prices. However, one of the main reasons is that many insurance companies deliberately slow down insurance payments when it comes to trip cancellation.

Allianz is one of those insurers who decided to leave behind the statistics-based approach to travel insurance plans and handling claims. The company has an algorithm that uses Big Data analytics not only to personalize travel insurance offers but also to detect and respond to customer inquiries about trip cancellation within a few minutes.

3) Property and Casualty Insurance

Property and casualty insurance (P&C), also called general insurance, includes vehicle and homeowner’s policies and provides coverage based on the loss that the customer experienced from a particular event.

We’ve already talked about this type of insurance a bit earlier when we mentioned Safeco and their Rewind program that adjusts the insurance coverage policy based on the person’s driving records.

This is a perfect example of how Big Data is already changing the future of P&C insurance.

Other insurers use Big Data analytics to expand the number of services they offer to their customers. For example, Liberty Mutual, a Boston-based insurance company, apart from offering different policy programs, shares property ranking based on location, noise levels, and traffic patterns, and rates roads based on the frequency of accidents.

The insurer has also found implementation for blockchain as a measure to securely manage customers’ physical assets and better protect their private data.

Conclusion

Big Data has already found plenty of applications in insurance. From fraud detection to better personalization, insurtech companies are heading towards the future and proving that Big Data will soon change this industry forever.

The concept of Big Data implies that there is an endless, infinite stream of data that is accessed to get useful information using limited resources. This means that a significant part of useful information is not used at all, but simply lost.

However, the growing interest of insurance companies towards further implementation of Big Data shows that the demand for it will only grow in the upcoming future.

Helene Cue is a professional editor and blogger. She is also one of professional college essay writers who provide students with academic writing assistance. An insurance agent in the past, she still follows her passion by educating companies about the technological innovations in the insurance industry.

Need a qualified team?

Unlock new business opportunities with the first-rate dedicated development team.