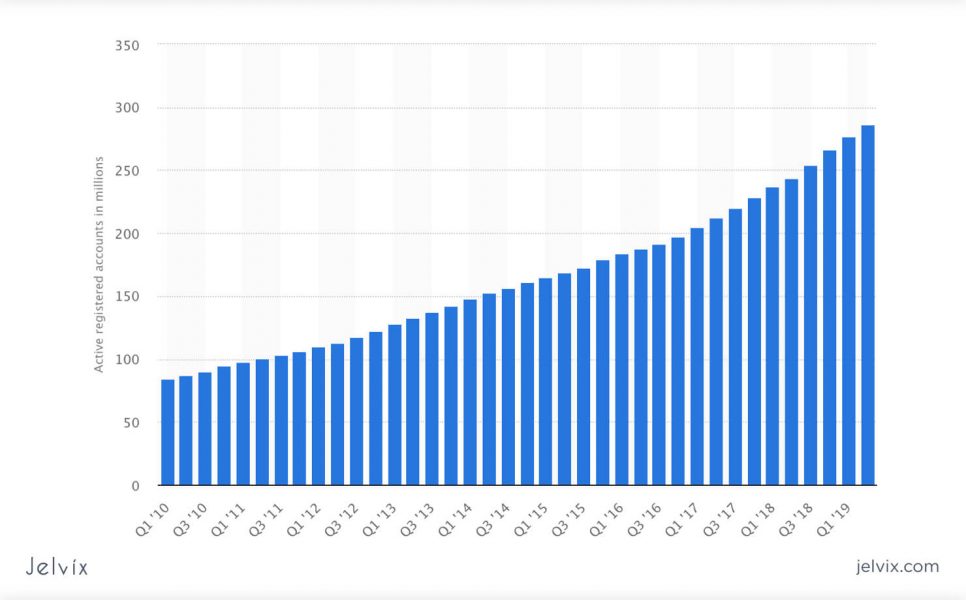

Transaction value in the segment of peer-to-peer money transfers amounts to $79,327 million this year. Also, we expect its annual growth rate to comprise 15.9%. It is a sign of a new development scope — a sign of card-less and bank-less next-generation P2P payment apps.

Let’s discover all aspects of P2P payment app development from the wireframing stage to the very monetization model.

Cashless peer-to-peer payments via apps are getting more and more acceptance among mobile users these days. They can boast a convenient, secure, and no-brainer way to send funds to relatives, friends, and people you know.

What is a P2P payment app?

P2P stands for “peer-to-peer.” Thus, a peer-to-peer payment system is a medium between two persons who want to exchange funds. Such a system became extremely popular among young people who are more eager to use tech to pay for things rather than dealing with cash.

Peer-to-peer payment apps originated in 2009 when Venmo saw the world. It is a pioneer in this industry – a first mobile app that, over the years, became the primary payment tool for Millennials. Just five months after the launch, Braintree, which is a PayPal company, bought Venmo. The price Braintree paid for this P2P money transfer app amounted to $26.2 million.

While Venmo seems to be similar to PayPal at first glance, you can see the differences. Venmo is a combination of a payment app and a social network. It allows customers to make payments easily, keeping all the user’s friends listed. It even offers the opportunity to pay for services and goods listing local businesses, too. A continuous feed, and, of course, a list of all the transactions significantly enhances the user experience.

This peer-to-peer payments app even allows you to set up automatic payments for recurring needs. Venmo offers a lot of useful features, along with an intuitive and appealing interface. That’s why it is one of the best and most used peer-to-peer payment apps.

Why are peer-to-peer apps so popular?

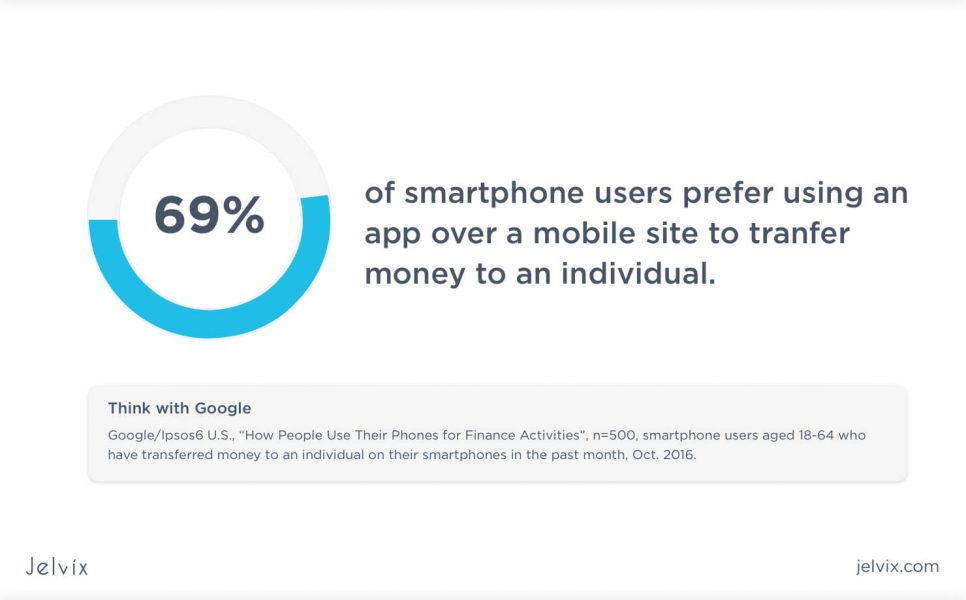

Just over a couple of last years, the demand for such service has grown very significantly. Also, today, 69% of smartphone users prefer an app over a mobile site to send funds to the person.

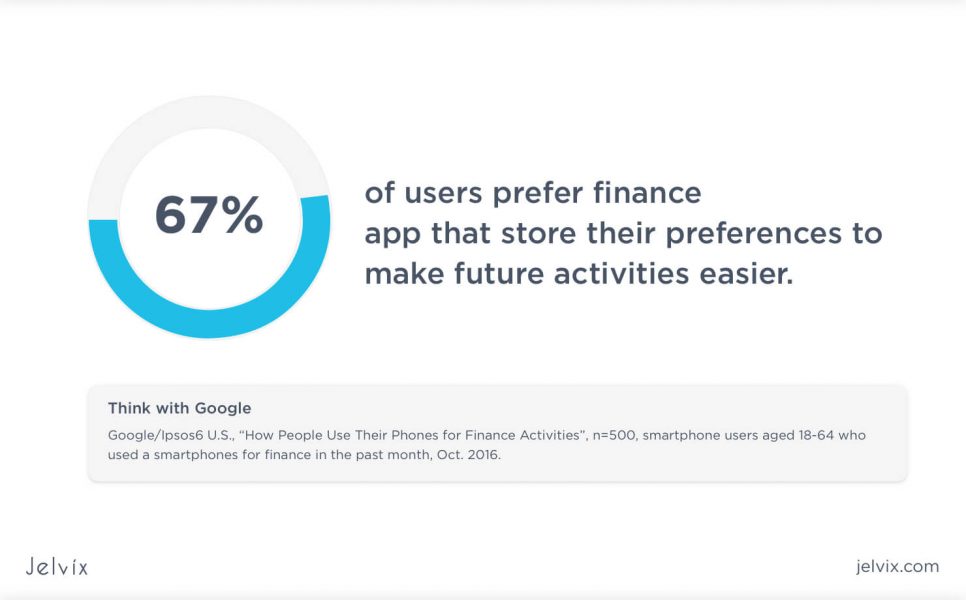

The main reason for this is, of course, the convenience of a P2P payment application. It seems very appealing to be able to send funds with just one tap on the screen. As statistics show, 67% of finance app users prefer the system that saves their preferences to ease future transactions. Moreover, while this tendency is quite apparent, many developers forget about it. So while developing your app, don’t forget to make it remember the user settings and other details.

Types of P2P payment applications

To understand how to make a cash app, you need to know the types of such apps. Only then you can determine what is it exactly that you want.

1. Standalone vendors

Such providers utilize a unique mechanism to process money payments. They offer an electronic wallet where users can keep their funds. Customers can save money in the wallet or make a withdrawal to a bank account. Overall, this e-wallet works just like a credit or debit card. Clients can make and receive payments using it.

In this category, Venmo and PayPal take the leading positions. So if you’re willing to make an app like Venmo, you will need your own payment mechanism. While it might sound complicated, our experience at Jelvix suggests otherwise. Having all the required tools and knowledge, we can create a new system in no time.

2. Bank-based

Such apps involve banks as one of the sides during the transaction. With these services, customers can make payments via the app using a credit or debit card. Bank centric applications simplify the operation both for the seller and the buyer and are usually used in e-commerce.

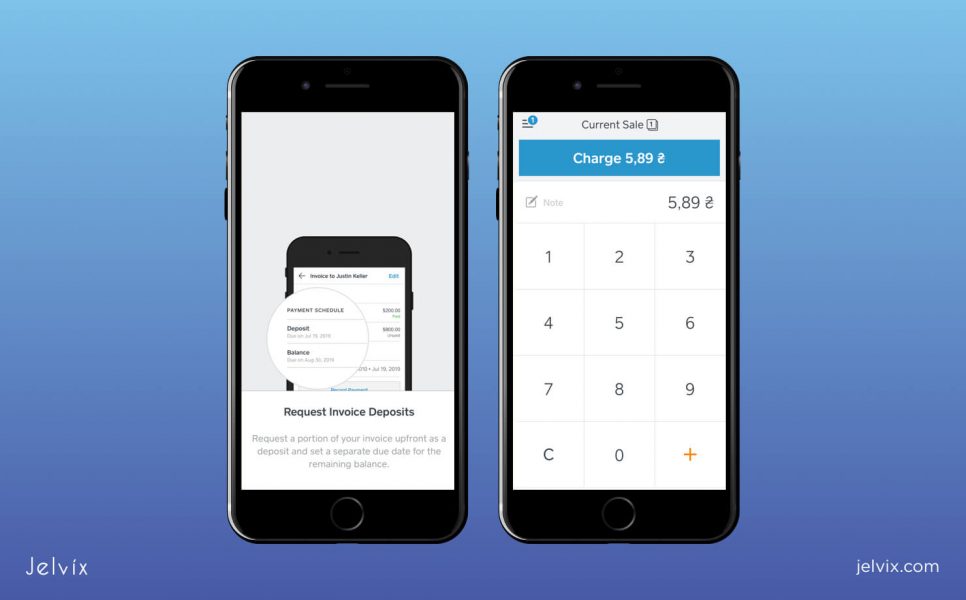

One of such apps is Square. It offers a payment system that sellers can build in their businesses to process transactions. The provider even created a device that can read the credit or debit card and works as a bank POS terminal. If you want to make an app like Square Cash, you need to reach an agreement with some banks.

3. Social media-based

As social media become a powerful selling tool, they launch built-in payment features. For example, Facebook did it back in 2015, allowing users to make payments in messenger, not even leaving the app.

Snapchat launched its P2P payment feature called Snapcash even before Facebook. However, this social platform shut down the function in 2018. Finally, Google went big and acquired Softcard – a mobile wallet system.

How to build a P2P payment app: crucial points to bear in mind

Before we dip into the development process, let’s define some basic requirements for your future application. It comes without saying that publishing some random software product won’t bring you much good.

Quality determines the success of the app. Don’t skimp on the development and designing of your solution. Some one-day application will at best get acquired by some low-budget company for further improvement.

At the same time, an overfunded project is also a bad idea. How to make a P2P payment app that is well-balanced? You should find opportunities to save (not skimp) resources and optimize the process. This way, your product can withstand a fierce market competition.

How to create a mobile payment app: features for a developer to consider

So we took a look at all the general requirements. Now let’s consider some scope-specific features you might want to implement.

Notifications

Take care of the user and notify them when they receive a payment or initiate a transaction. Also, you can offer additional notifications for other activities like bill due dates. Allow the user to choose which notifications do they want to receive.

Currency conversion

Sooner or later, you have to face the need for converting the currency of your user transfers. Many people travel, expand their business, or have customers abroad, and that’s when a currency conversion feature comes in hand.

The issue with this feature is the relevant exchange rate. The point is, current banking conditions make instant transfers, let’s say, overcomplicated. Hence this problem arises.

Your solution may vary depending on the platform and banking system you are using. We recommend you to make a mobile payment app that synchronizes the exchange rate with the bank at the moment of transaction. Just make sure you notify users about it to avoid the misunderstanding.

Your solution may vary depending on the platform and banking system you are using. We recommend you to make a mobile payment app that synchronizes the exchange rate with the bank at the moment of transaction. Just make sure you notify users about it to avoid the misunderstanding.

Modes of payments

To fulfill the requirements of each customer, you should offer as many options as you can. Therefore, make sure that your app necessarily supports the following payment methods:

- Payments within your system

- Online payments for e-commerce

- On-the-spot payments at shops

These methods are necessary and essential. Often, trying to figure out how to make a P2P payment app developers forget to cover all the payment needs of the user. So if you want to get more customers, think about additional modes you can incorporate in your app. For example, here are some other cases when people might need to use a P2P payment application:

- Paying out the installment plan

- Paying for taxi services

- Setting a limit for a friend who borrows money from a user. A friend must be able to withdraw the allowed amount of money for the permitted number of times. It’s a handy feature for parents and kids

- Sending an invoice or a borrowing request

- Transferring money with a comment

Hide user‘s data

Creating the payment layout make sure the receiver of the payment doesn’t see the credit card details of the user. Also, always add security features like fingerprint identification. You must make your P2P payment app as safe for the user as possible. Otherwise, you risk that your customers can get their banking details stolen because of the lack of protection in your app.

The history of transactions

None of us can remember all the transactions we’ve made. So make sure your app shows users their activity, and try to store this data for as long as possible. Also, it will be helpful to allow customers to download the statistics and overall info of their financial activity. Another useful feature will be to show the user their income and spendings. You can present the spendings as a pie chart that will show what for was the money spent.

Unique one-time passwords or IDs

It is a handy feature in terms of security. All the mobile financial apps should send unique OTP or ID upon the transaction for the user to verify it additionally. It can protect the customer from thieves and make sure that money wasn’t sent by a mistake. To reinforce security even further, you can make the app send an OTP each time the user logs into the system.

Remember about the chain reaction

While processing a transaction, a P2P payment system causes a whole chain of events. The payment prompts an app to track and recalculate all the amounts and changes caused by the transaction. Also, if this system has numerous users, it can translate to thousands of recalculation, resulting in the shutdown of the system.

So if you try to make your app chase every payment, you can get a system overloaded very quickly. Thus, it would be more logical to create a capability that can adjust all the impacts across the system at the time intervals you set.

A chatbot

Implementing a chatbot that can answer user questions might help your customers feel safer and served. It is a straightforward feature to add, but it can make your payment app look more humane and attentive to the user.

Asynchronous data update

If you are planning to scale your app, it must be able to handle countless transfer queries in no time. This is why there is always a place for performance improvement.

One of the ways to reduce the server load is to save data in the temporary storage. The system can update the main database with the specified interval, let’s say 1 minute. It reduces the server load substantially and brings minimum user experience losses.

Choose a development technology wisely

Remember that if you’re creating a system that allows users to pay for things outside the app, it must be very swift. Even the smallest delay can cause a very high abandonment rate and unreceived revenue. In general, the native application usually loads e-commerce sites 10-20% quicker than other kinds of apps. So remember this detail when you choose the development technology.

Develop a peer-to-peer payment app rationally – use APIs

Programming interfaces are a robust way to win financially and cut the development time. You just use the ready-made solutions for banking integration instead of building them from the ground up.

Without any doubt, some APIs constrain your possibilities significantly. Fortunately, several software suppliers can prove this wrong. They offer genuinely flexible products removing all the limits. Here are the ones worth mentioning:

Without any doubt, some APIs constrain your possibilities significantly. Fortunately, several software suppliers can prove this wrong. They offer genuinely flexible products removing all the limits. Here are the ones worth mentioning:

- Dwolla. It’s a scalable easy-to-integrate platform. Also, it is secure and fast. Dwolla allows for multiple transfer options. Also, a convenient interface allows you to manage and monitor your activity;

- SynapseFI. This company allows you to choose from a wide variety of financial products: payment, deposit, card issuance, loan, and many others;

- Kleynbank. It’s a blockchain solution for banking integration. The decentralized and secure system ensures transparent operations. To date, Kleynbank is at the ICO stage. It’s an excellent opportunity to jump right into this project. With this tool, you can become an early adopter and create a payment app with significant privileges.

As you see, there are some decent APIs you can confidently opt for to save budget and time.

Monetization model: which one suits you the most?

It’s not easy to create a cost-effective mobile payment app development. You need to implement the right monetization model into your application. Let’s find out which options you can use and how to make the right choice.

All in all, here are the most applicable models for you to select from:

- Transaction fee. You take a percentage from every transfer made in your system. Relevantly simple to build and integrate, this option is not user-favorite;

- Ads. You place an ad holder in your UI and charge advertisers for each ad show or click. Although this model is more user-friendly, you need to check all the ads manually if you want to exclude indecent content;

- Paid subscription plans. You offer better conditions for premium users, charging them for it. All the main functionality is accessible for everyone, but some exclusive features are only in the paid plans. This model fits in well with the two mentioned above.

You can choose any model out of these three and keep a decent user experience level. It’s only a matter of correct integration.

Check out successful business tips that help pave a way to the top of the qualitative services and good revenue.

What else to keep in mind when developing your app

How to make a P2P payment app flawless? The answer is to apply a comprehensive development approach. You need to cover as many potential pitfalls as possible.

Although it may seem like a no-brainer, you have to provide a robust and safe system. We mean not only security breach prevention. For instance, you should hide the credit card number. If you forget about it and make this information exposed – even in your first app version – it creates a severe danger of personal data leak.

Another thing is the performance of the application. Users don’t favor runtime issues in our modern competition-driven world. It means the faster and more reliable app is – the better. We highly don’t recommend using questionable tools. Don’t choose to develop faster instead of employing a natural development cycle. It won’t pay off upon the launch.

Another thing is the performance of the application. Users don’t favor runtime issues in our modern competition-driven world. It means the faster and more reliable app is – the better. We highly don’t recommend using questionable tools. Don’t choose to develop faster instead of employing a natural development cycle. It won’t pay off upon the launch.

Conclusion

The integral part of any app development is considering the project user-oriented. Make a mobile payment app for customers, not for profit, and success can be a matter of time.

Do you need professional assistance, or you have a revolutionary application idea to discuss? Reach out to us to get an expert evaluation and analysis of your app concept today! Let’s bring your app idea to life.

Need a qualified team of developers?

Reach new business objectives with the dedicated team of professionals.