The situation in the world is now forcing people to stay at home much more which leads to them making their purchases and processing payments mostly online. Cash is now used for only about 30% of transactions in North America. Therefore, most companies now require a payment processing service in order to ensure they are not losing any of the customers.

Thus, finding the best credit card processing service is crucial for any business to stay afloat and be able to compete in the market in the long run.

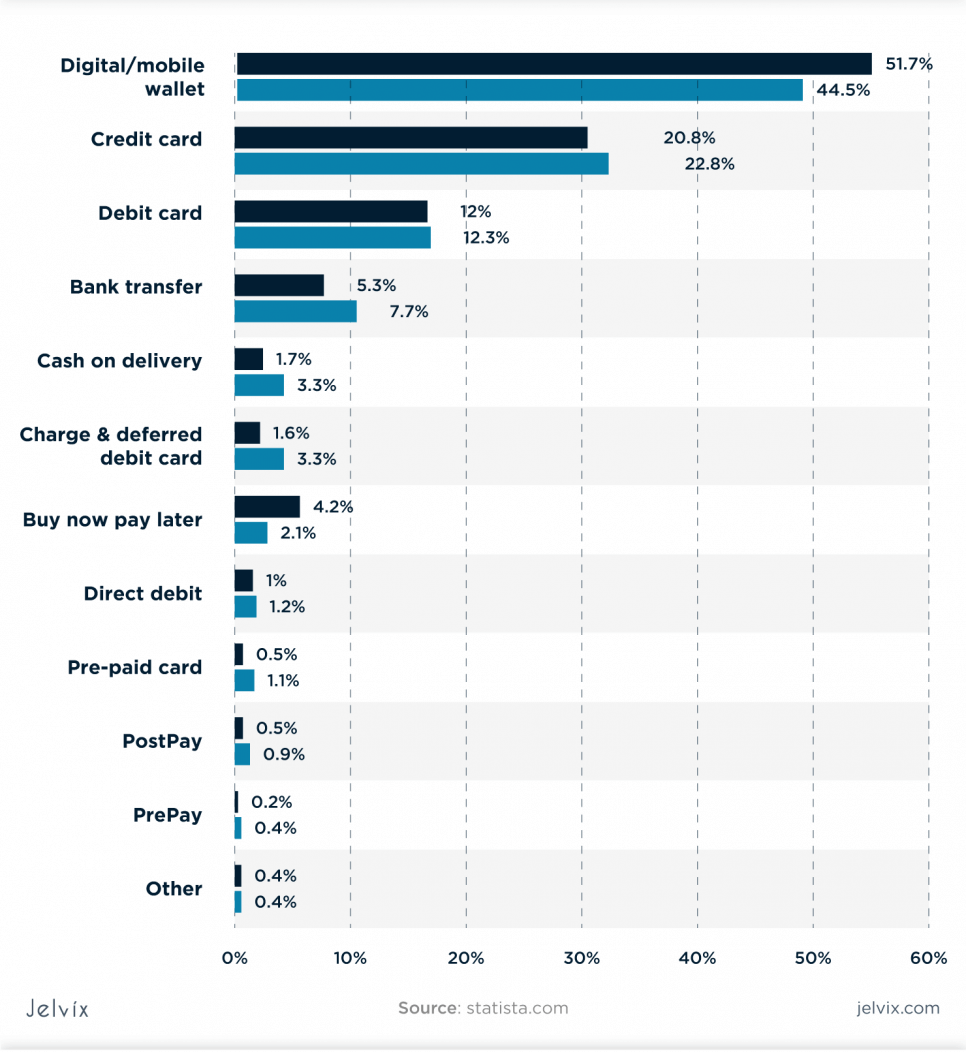

Whether you’re accepting payments in-person or online, with the best credit card processing services, you can lower your payment processing rates and at the same time expand payment options for your customers. You might have already noticed that digital wallets and e-payments are trending now apart from the usual options.

See the following image reflecting the usage of the most popular digital payment methods.

Now there are over 1,000 credit card processing services to choose from, with each company claiming to be the best and the most reliable. So how can you understand which payment processing solution is the best fit for your unique business?

To help you decide, let’s discuss some of the best payment processors along with the guidelines on how to choose the relevant one specifically for you.

What are Payment Processors?

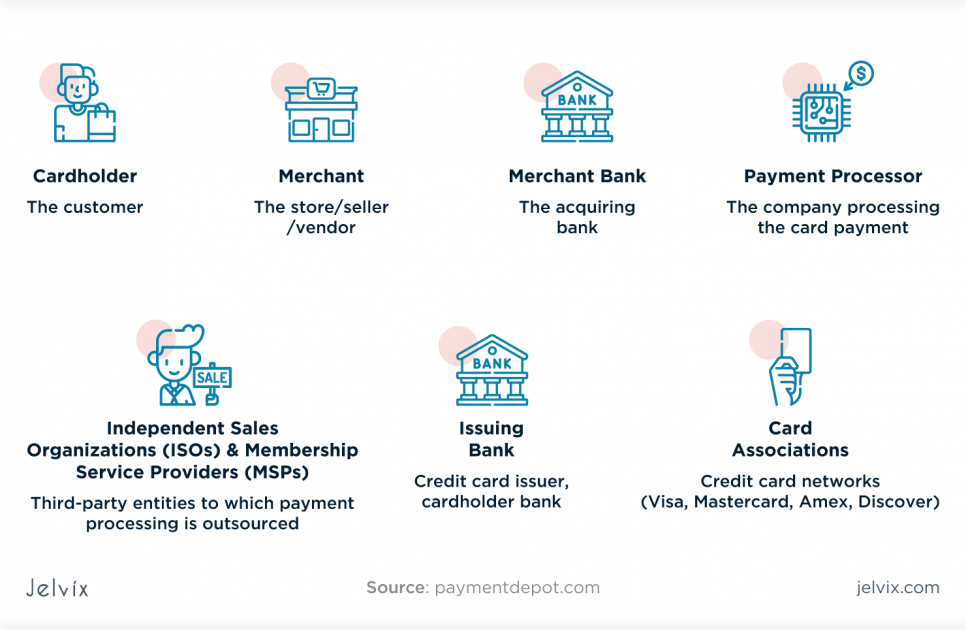

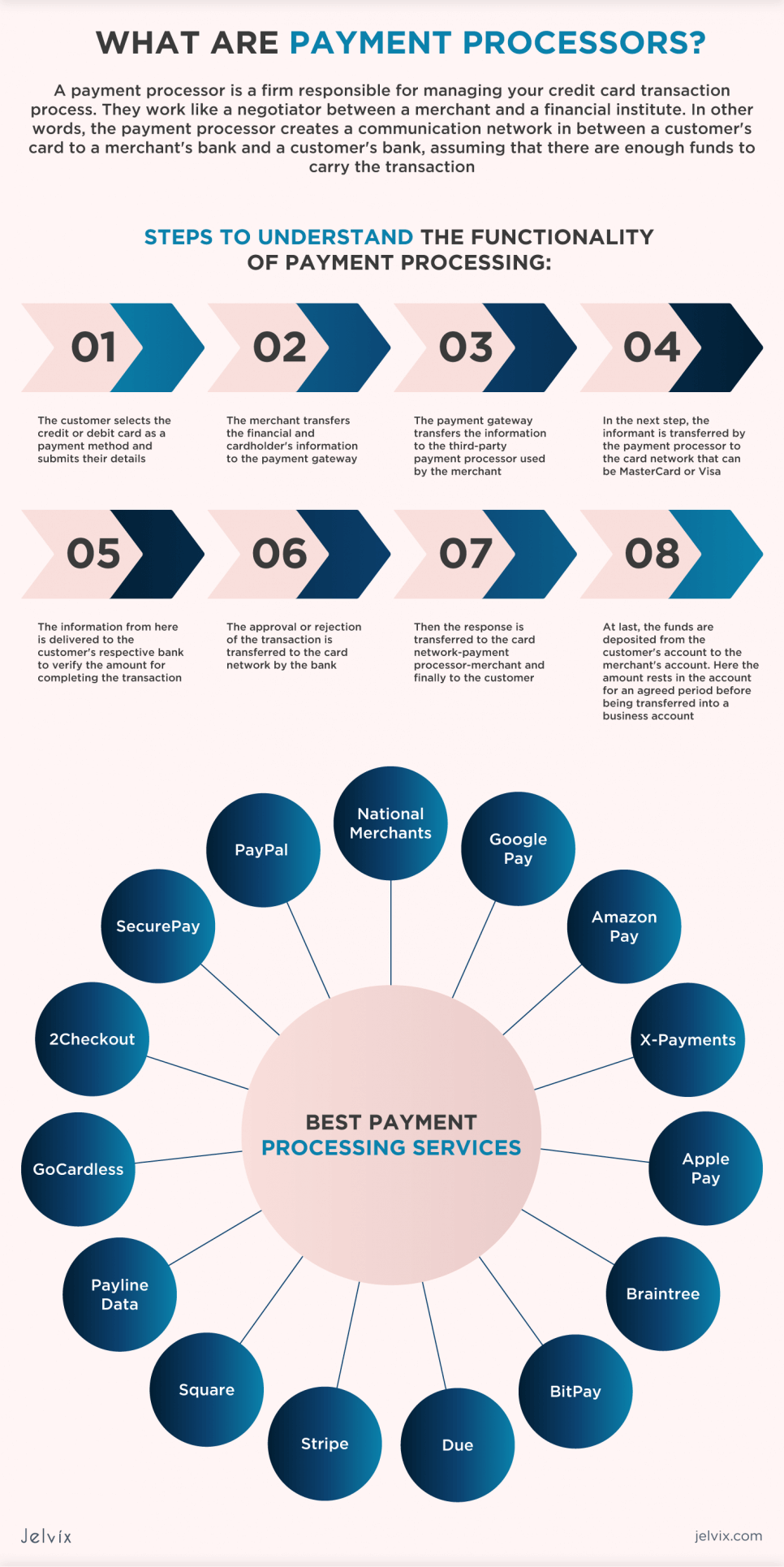

A payment processor is a firm responsible for managing your credit card transaction processes. It works like a negotiator between a merchant and a financial institute. In other words, the payment processor creates a communication network between a customer’s card, a merchant’s bank, and a customer’s bank, assuming that there are enough funds to carry the transaction.

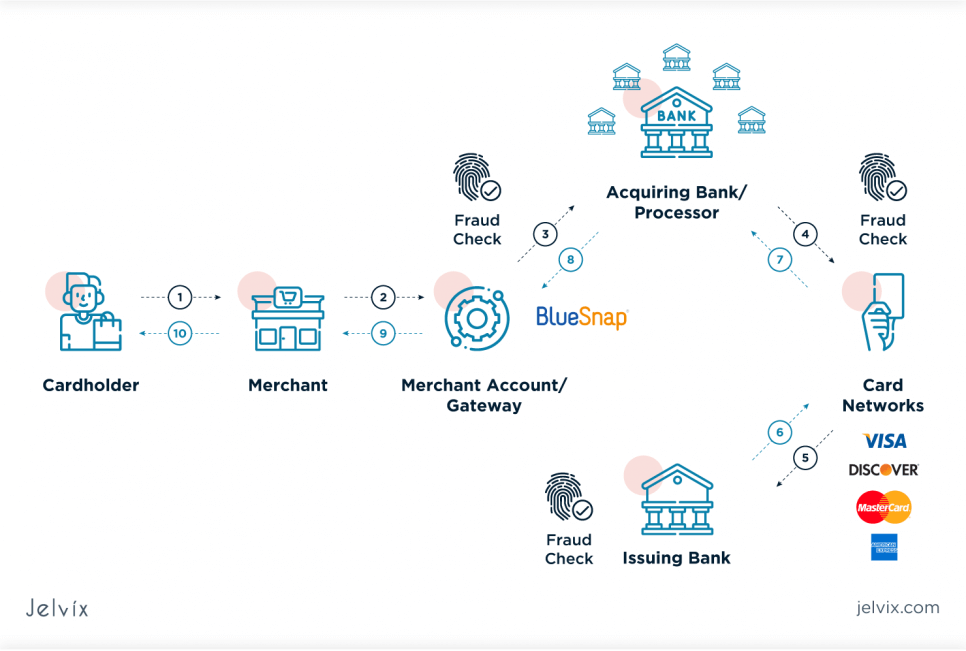

The payment process model earns its revenue from the fees it charges the clients. There is a diverse range of fees charged: transaction fees, start-up fees, termination fees, chargeback fees, and lease charges for operating credit cards. See the following image to acquire the functionality of the payment process.

All the equipment used by cardholders, including the credit card machines, is provided by the payment processor. Other than this, there is no relevant option to accept digital payment from the clients. The payment process is not a universal term, ‘payment service provider’ and ‘acquirer’ are used interchangeably with it.

The payment processor transfers the customer’s credit card information and passes it to the respective bank. After the bank’s approval that the account holder has enough funds, the transaction takes place, later that amount is deposited in the merchant’s account. This is what the payment processor company does.

How Does Payment Processing Work?

The payment process landscape is a difficult one with lots of entities and elements involved. Take a look at the illustration below elaborating the entities involved in the process:

However, the overall process of the payment is relatively convenient. See the following steps to understand the functionality of payment processing.

- The customer selects a credit or debit card as a payment method and submits their details.

- The merchant transfers the financial and cardholder’s information to the payment gateway.

- The payment gateway transfers the information to the third-party payment processor used by the merchant.

- In the next step, the informant is transferred by the payment processor to the card network that can be MasterCard or Visa.

- The information from here is delivered to the customer’s respective bank to verify the amount for completing the transaction.

- Approval or rejection of the transaction is transferred to the card network by the bank.

- Then a response is transferred to the card network-payment processor-merchant and finally to the customer.

- At last, the funds are deposited from the customer’s account to the merchant’s account. Here the amount rests in the account for an agreed period before being transferred into a business account.

Payment Gateway vs Payment Processor

The payment processor facilitates the transverse of payment among four major entities; merchant, customer, customer’s bank, and merchant’s bank. It may also provide physical equipment required for card-based transactions.

Contrary to the payment processor, the payment gateway is the virtual equivalent of the point of sale terminal. The payment gateway secures the merchant’s or customer’s credit/debit card information. This is why it fortifies a significant position in the payment industry.

The main difference between both processes is that a payment processor will facilitate the whole transaction process. However, a payment gateway is an encrypted application that allows the transaction information to circulate among the payment processing model entities.

Elements to Consider While Choosing Credit Card Processing Company

Among the innovations in the financial sector, the largest number of services is presented in the payment environment. The transition of online trading and the development of e-commerce would be impossible without simplifying payments for the purchased goods.

With the advent and spread of the Internet, payment services began to move away from tangible items towards more convenient infrastructure – providing digital payment methods or credit card acceptance.

Around 58% of small businesses provide credit card facilities to customers. A credit card processing company is required to include different payment methods. See the following aspects to consider prior to selecting a processing company.

Setup Process

A setup process is an initial benchmark that is required to be verified. Before selecting a company, make sure the setup process is convenient and has fewer steps as per your business model. Ask important questions like: how long will the installation take? How long will they facilitate your business? Every delay in the process can cost an additional charge to you; therefore, lengthy processes are not in favor of your business.

Fees and Costs

Pricing transparency is a paramount feature of a processing company to consider. Generally, the processing companies charge 0.5-3% per transaction, dependent on the type of credit card you withhold. The things to consider are the time of billing, the minimum permissible amount of transaction, and subtle charges.

Facilitates Payment Types

The core purpose of hiring a processing company is to facilitate customers. Ensure that your service provider supports multiple payment types to comfort consumers. Make sure that all the major debit and credit cards are included in the list of payment types. If the payment type supports gift and prepaid cards, it is the most beneficial for the business.

Provision of Security

The provision of security and significance of the organization works simultaneously. To secure the payment data of consumers, the presence of a fraud prevention tool is necessary. The tokenization and encryption features are the obligatory elements; if any company lacks these features, it does not compromise.

For online payments, the provider must support SSL certificates and CVV2 verification. Furthermore, they must have a PCI-DSS compliant system.

Customer Support

Any organization operating the credit card system for the first time can face difficulties. Ask the service provider about their customer support team. Do they have a customer support representative or any helpline to facilitate you? What are the working hours of the team? Is there enough information to solve your queries? Of course, not one size fits all, but every merchant appreciates adequate customer support.

Industrial Relationship

Inquiring about the service provider’s industrial relationship allows you to estimate the additional benefits you can acquire. The better the relationship of the credit card company with the e-commerce business is, the higher potential they can serve you in growing your business. Inquire about their sponsor banks and years of operation in the market to cement their relationships.

Learn more about how to navigate through the nuanced process of building a P2P payment app.

Best Payment Processing Services

Businesses are rapidly moving towards digitalization, which means that soon all business processes will be carried out within a blink. According to the data from 2020, the use of credit cards increased by 63% in the U.S only. With the high demand for payment processing services, there are now a lot of companies offering such services.

To help you not waste your time researching each and every one of them, we’ve selected the best ones to use in 2024 for adequate business growth.

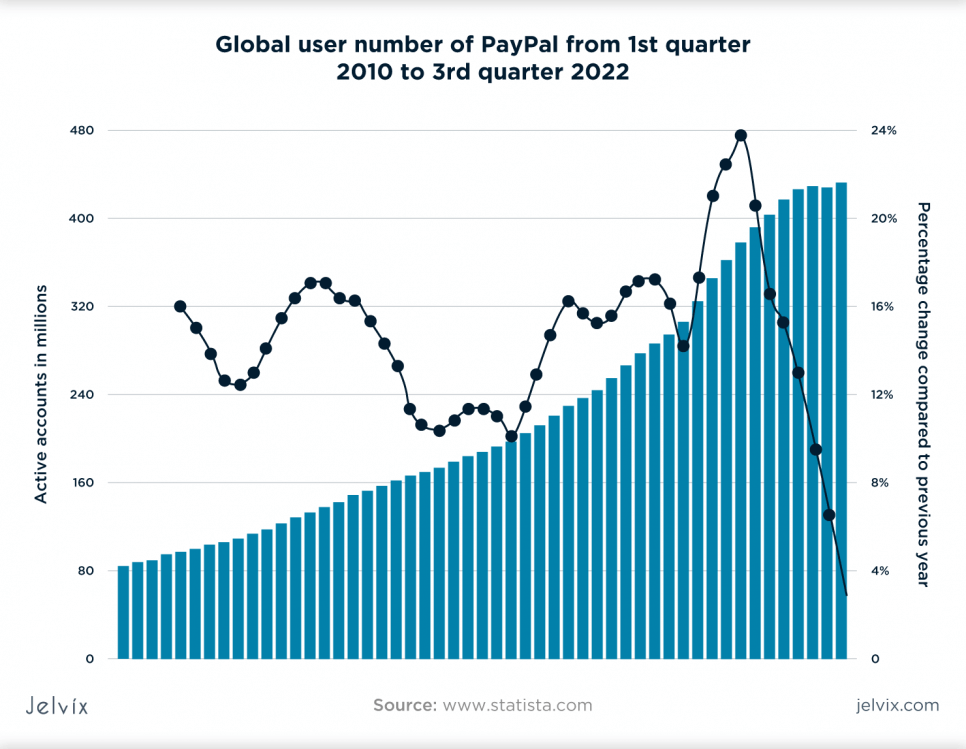

1. PayPal

PayPal is one of the most popular processing companies. There are almost 377 million current users of PayPal. The core reason for its popularity is that the consumer can process transactions only by providing a PayPal number, reducing the proportionality of cybercrime. An easy and fast payment process benefits both – the merchant and the consumers.

The organization has updated its rates and policies. They now will charge a transaction fee even on receiving an amount from someone. They also increased their cross-border transaction charges.

2. National Merchants

If you are looking for an organization that facilitates the simplest payment method, then this one’s for you. The National Merchants are known in the market for charging the lowest charges on transactions, providing round-the-clock customer support and B2B services.

The organization receives fewer complaints than expected regarding their services, but some of them greatly reduce their credibility in the market. They also charge $595 for early termination of the contract.

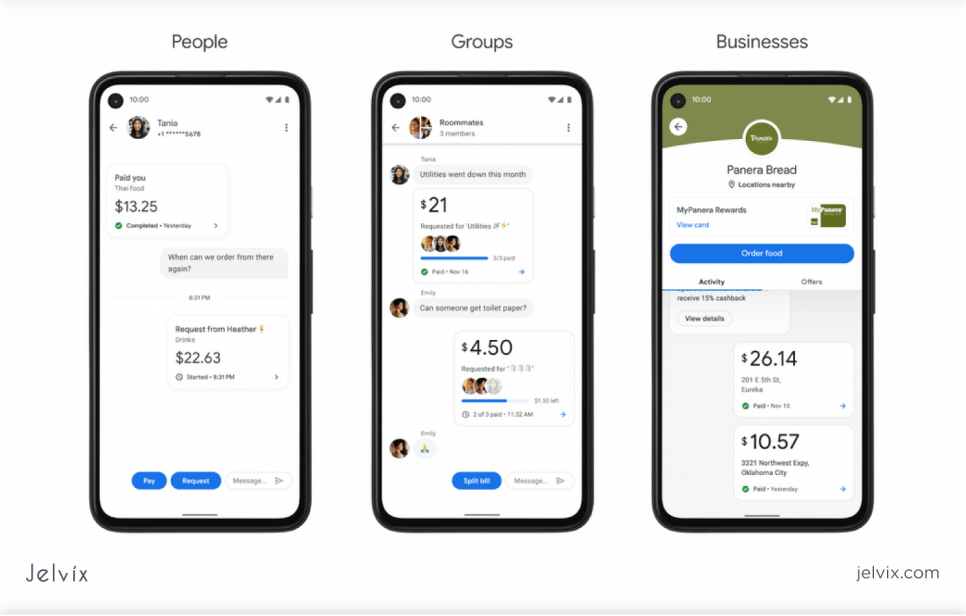

3. Google Pay

Google Pay is the most convenient payment processing service provider. It allows users to conduct contactless transactions and pay their bills. The organization also facilitates users by connecting their debit or credit card details by the application of AI in android phones. It is considered to be more secure than card payments.

However, the software is not supported on the iPhone. Many financial institutes also do not cooperate with Google Pay restricting its usage. Despite these cons, the number of downloads on Google Play increased from 39 million to 100 million.

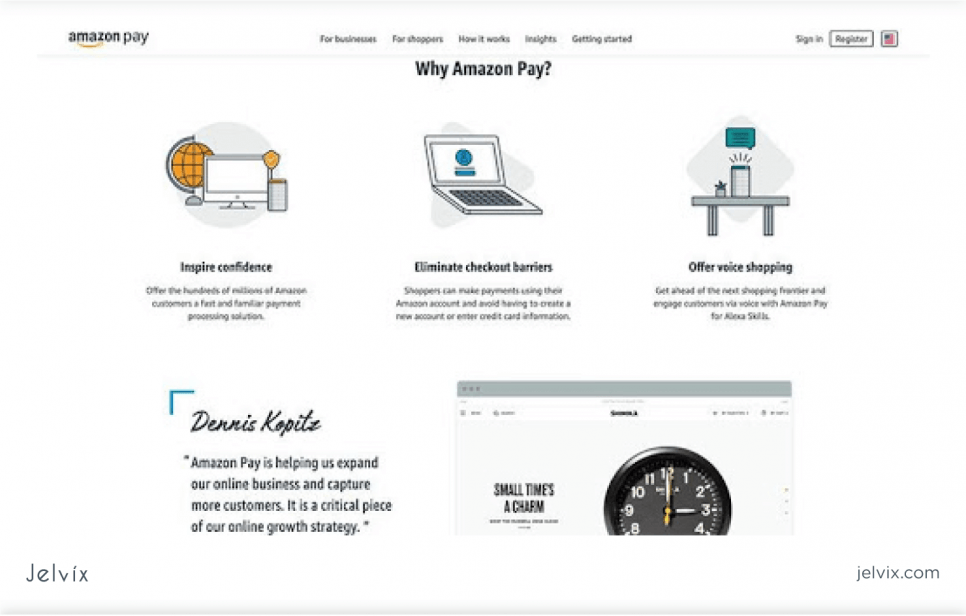

4. Amazon Pay

Amazon Pay got instant popularity when the majority of e-commerce users started switching to the modern money processing system. The primary reason for this was the level of facilitation it provides. You can pay bills, do top-ups and online transactions, all from this single service. The service is equipped with Amazon fraud protection, making it the safest. Moreover, no early termination fee is charged by the company.

However, the service does not support PayPal transactions, and you are required to have an Amazon account for using Amazon Pay. Furthermore, users are obligated to follow several rules, and in case of any breach, their account can be sealed permanently.

5. X-Payments

The X-Payments is a processing solution for online stores secured by PSD2/SCA-ready. The organization provides a significant amount of facilitation to the merchants by using the outsourcing model and storing their information on the e-commerce platform. It also takes complete responsibility for online transactions by securing them through PCI Level 1 certification.

The primary advantage of using this platform is reducing the redirect risk proportionality and complete control over the checkout process.

6. Apple Pay

Apple Pay is much bigger than NFC because it is based on existing NFC technology. Apple Pay works anywhere NFC-based contactless payments are accepted. To keep transactions secure, Apple uses a method known as “tokenization,” preventing actual credit card numbers from being sent over the air.

Additional security is created by dynamic codes that are transmitted instead of personalized data from the card. The codes keep all information about the user in secret. Apple also secures payments using Touch ID or Face ID on compatible iPhones and continual skin contact on the Apple Watch.

Apple Pay offers one of the most superficial transaction experiences of all smartphone mobile wallets currently on the market. Many positive Apple Pay reviews mention its ease-of-use, robust security features, and all-around convenience.

7. Braintree

Today Braintree is one of the most prominent payment solutions globally, offering business owners an excellent choice of tools. The service provides transaction facilities in 130 currencies and is available in more than 40 countries.

Braintree offers flat-free pricing on its services without unexpected fees to use extra perks of the platform or analytics tools. The platform also comes without minimum fees or recurring monthly fees, which makes it interesting for small businesses.

One other important thing is the way how the company handles its clients’ transactions. Braintree assigns each of its merchants their own merchant account, which means that their actions on the system are independently handled. In this way, Braintree offers a stable environment for clients since there’s less risk that an unrelated merchant issue could prevent conducting transactions.

Braintree also excels in customer support. The company often gets high marks for how well it handles customer concerns, with short wait times between an issue arising and having it addressed by someone. That is extremely important for small businesses, where every sale is crucial and technical glitches can significantly impact the bottom line.

8. BitPay

BitPay accepts digital currency and processes almost $1 million daily. The primary reason for its popularity is the full payment protocol. The security protocol embeds additional security to the merchant’s account. Moreover, the feature of the BitPay bitcoin gateway facilitates merchants in receiving payment from clients from any location in the world. The transaction fee on the international and local transactions is only 1%.

It is currently only available for U.S. citizens, and for registration, users must have a residential address. The account won’t register with a P.O box number.

9. Due

The Due processing service provides economic transaction facilities to the consumers. This billing and payment service is widely used by freelancers, medium-sized corporations, and entrepreneurs due to the competitive market price. It provides services in more than 100 languages. Medium and small-sized merchants utilize this service to manage and control their tax payments, currency management, and invoicing.

10. Stripe

Stripe is widely used by merchants, as it accepts all kinds of debit and credit cards and provides services on desktops and mobiles. They provide a conversion-optimized layout known as checkout that facilitates product development. It is a pre-built system that can be used to maintain data and invoices. Credit details are secured on the website, supporting the transaction process.

It has a consistent service, convenient reporting features, and secure transactions. However, it does not provide automatic tax support, and processing rates are higher than those in the market.

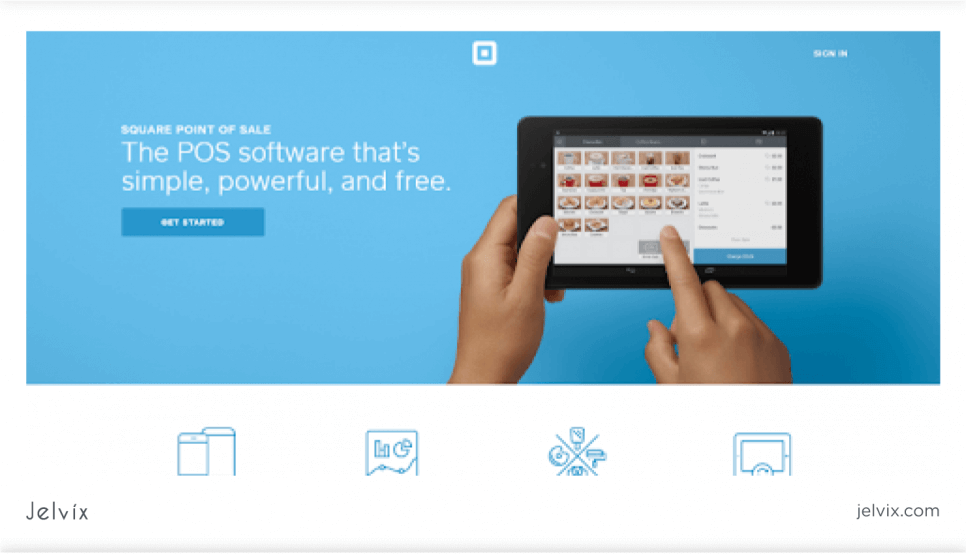

11. Square

Square provides online payment acceptance from any corner of the world. It uses innovative products like magstripe readers, contactless chip readers, and stands. These innovative technologies can convert a smartphone into a unique payment processor.

The service provider has inventory tools, a point of sale system, cloud services, and built-in payment processing to deposit payment on the next business day. Despite these advanced features and a small learning curve, the options for customizability are reduced.

12. SecurePay

SecurePay is a completely online platform that provides merchants with a complete package. It provides a number of solutions, including; Secure IVR, Guard, and Secure Frame. The merchants can leverage fast online payments, and a detailed report of each payment is also provided. The shopping cart integration help facilities provided by SecurePay increase its significance among other competitors.

13. Payline Data

The Payline data supports a number of payment methods and facilitates merchants and customers. It is simple to use and secure to operate, along with convenient integration options and fraud solutions. It has an end-to-end secured transaction process to diminish any proportionality of fraud. Moreover, it has a user-friendly interface and deposits funds within two business days.

However, it charges additional monthly fees and requires a minimum of $25 processing per month. Customer support is also time-bounded.

14. GoCardless

The GoCardless, as evident from the name, exempts the need to carry a debit or credit card. It facilitates small and medium-sized merchants to carry transactions without a card. Along with this, it also automates the tracking process of payments. It charges competitive market fees and has an attractive interface.

The signup is also single-folded, which provides merchants’ frequent access to the account. But it has a slow activation process and does not have any accounting software for proper integration.

15. 2Checkout

The 2Checkout provides mobile and desktop-based processing services in more than 196 countries. You can process credit, debit, and PayPal payments from this PCI-complaint platform. It has a lower fee and charges only 2.9%+ 30¢/transaction. Moreover, there are no monthly or registration charges.

Wrapping it up

The world is moving towards digitalization. Since the beginning of the COVID-19 pandemic, cashless transactions have gained significant attention. The majority of consumers now prefer touchless or cardless payments. However, the increased usage of online mediums of payment also increases the chances of fraud.

There are numerous payment processors in the market. These organizations provide payment channel facilities for credit/debit card usage by serving as a bridge between merchants, customers, and financial institutes.

Such processors include a payment processor gateway to encrypt and secure the information transfer, which ensures the protection of client’s and merchant’s monetary transactions information.

Every processor in the market provides distinct services; you can select them as per your organizational needs. We hope the payment service providers we have mentioned above will support you in selecting an appropriate platform for the payment process.

Claudia Jeffrey currently works as a Sr. Research Analyst & Digital Evangelist at Dissertation Assistance. This is where higher education students can acquire professional assistance from experts specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments around the globe.

Need a qualified team of developers?

Reach new business objectives with the dedicated team of professionals.