Determining the value of a company is of paramount importance for any business sector of the finance industry. The awareness of the business worth helps investors to make reasonable decisions and provides a more holistic picture for acquisition assessment.

Therefore, traders, investors, analysts, and journalists of the economics sector often use different financial metrics to measure the value of a company and see if it’s worth the investment or not. Yet, identifying the enterprise value (EV) is arguably one of the best ways to assess a company as a whole.

In this article, we are going to delve into what an EV is, overview its components and discover how to calculate the enterprise value of a company using formulas.

What is an Enterprise Value?

An Enterprise value (EV) is a fundamental economic measure that represents the entire cost of a business. It is classified as one of the central metrics applied in business evaluation, accounting, financial analysis, and risk analysis.

The enterprise value represents a more comprehensive and accurate way to estimate the worth of a company than market capitalization (also referred to as a market cap). Unlike market capitalization, it considers such additional factors as debts, preferred stock, minority interest, cash, and cash equivalents.

To put it simply, the enterprise value calculation is focused on identifying the value of a firm as an enterprise rather than just concentrating on its present market capitalization. The enterprise value can then be used to compare other companies belonging to the same industry or carrying on with the investment analysis.

In the business world, there are two ways to grow your company. The first way is to do it internally by increasing your product lines and attracting new customers. But, unfortunately, it takes a lot of time and money.

The second way relies on expanding by acquisition. Instead of developing new products, the company can just find other companies that already have these products and buy them. This is where calculating enterprise value becomes extremely important.

In the acquisition context, it’s one of the most important metrics used to evaluate the theoretical takeover price that any investor should pay if they want to acquire a certain company or business. A reason for that is the fact that an investor will take over not only the company’s cash and future earnings but also its debts.

During the EV evaluation of a business, it’s essential to pay attention to how the firm operates with its debts and liabilities. In many cases, businesses belonging to the capital-intensive sectors have a great amount of debt used to facilitate their growth.

This fact usually has a huge influence on the enterprise value of such businesses. Therefore, it’s recommended to compare only companies within the same industry, as they are evolving in more or less the same conditions.

How is Enterprise Value Calculated?

There are two formulas typically used to calculate the enterprise value of a business. One of them is simple, while the other one is a bit more complex and extended.

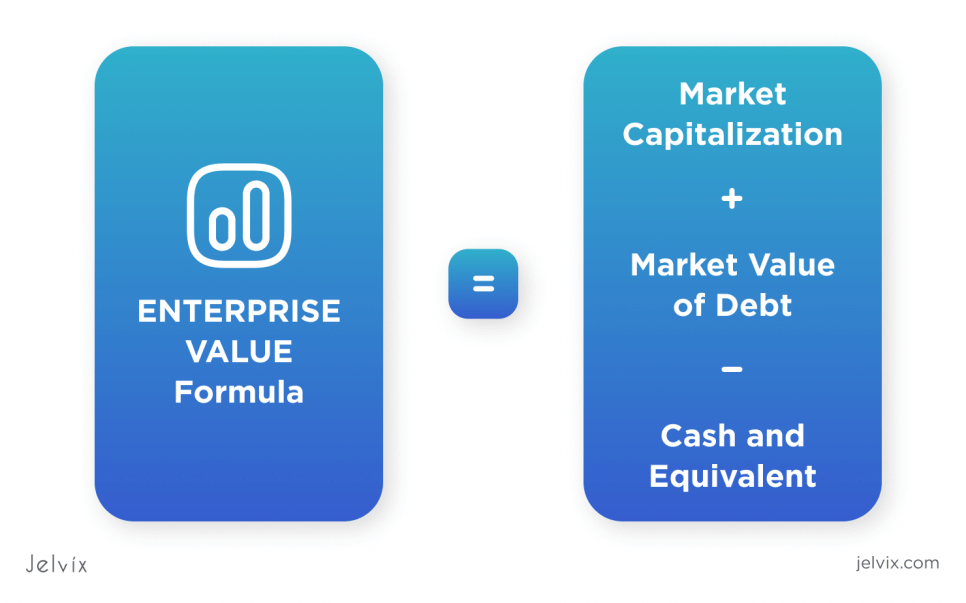

The Simple Formula

The simple formula presupposes that you take the market cap, add all the debts of the company, and subtract the cash. So, the firm’s actions EV formula can be shown with the following equation:

Enterprise Value = Market Capitalization + Total Debt – Cash & Cash Equivalents

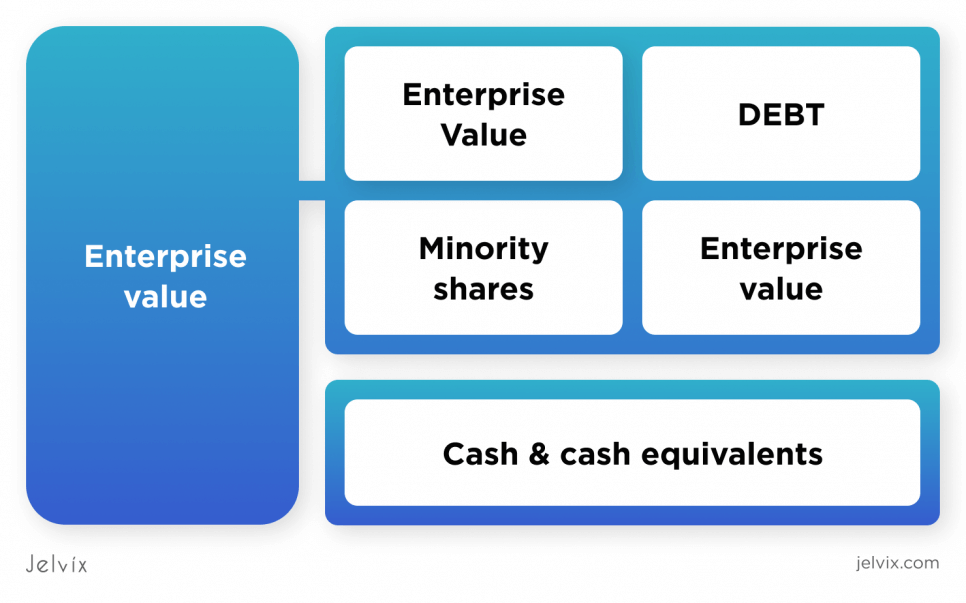

The Complex Formula

Apart from considering the market capitalization, debt, and cash, the complex formula also covers such components as a minority interest and preferred stock. It can be presented through the following equation:

Enterprise Value = Market Cap + Preferred Stock + Total Debt + Minority Interest – Cash & Cash Equivalents.

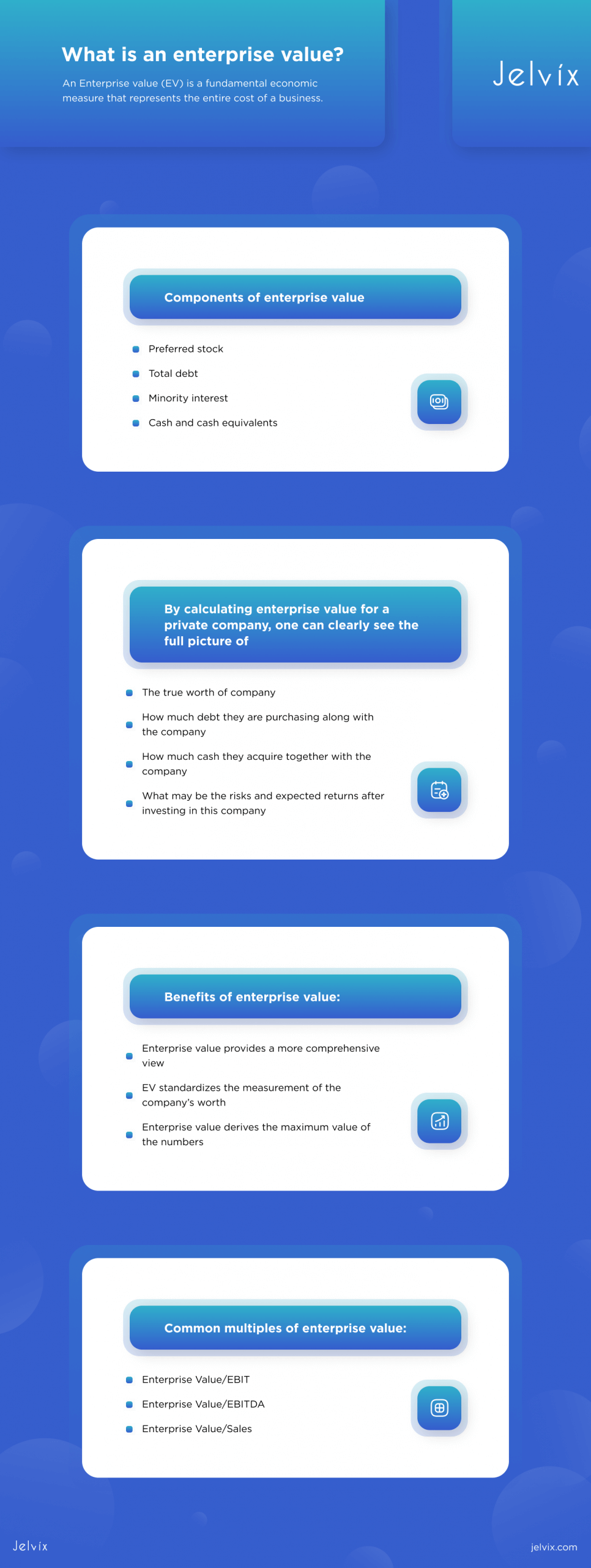

Components of Enterprise Value

In order to better understand the EV formula and make the most of it, you need to take a closer look at each component of the equation.

-

Market Capitalization

Market capitalization is a measure that allows determining the value of the common shares of a business. It can be obtained by multiplying the total number of outstanding shares of the company by the price per share. In this case, the share price is the amount of money someone is ready to pay to own the firm partly.

Market capitalization is an integral part of both formulas, as the value of any company highly depends on the amount of capital available for it. Thus, if anyone is planning to buy a firm, they need to pay at least market capitalization value.

Yet, taking into account only this metric to measure the cost of the entire company will not represent an accurate result. Therefore, the enterprise value formula consists of several other components.

-

Preferred Stock

Even though the preferred stock is typically included in the equity section of the balance sheet, it is still more of hybrid security containing both features of the equity and debt.

Technically, it can act either as one or another, depending on the nature of the case. The market value of the preferred stock is derived by multiplying the number of preferred shares by the worth of the stock.

However, when enterprise value is calculated, the preferred stocks are treated as debts as they have a predefined amount of dividends. Moreover, the preferred stock issue has a higher priority over the common stockholders for claiming the business assets in case of bankruptcy.

-

Total Debt

The total debt represents all the liabilities of the company. It usually incorporates the short-term and long-term borrowings and loans owed to banks and creditors. The debt is an essential component of the formula for the enterprise value calculation. It always increases the true price of a firm, as the acquirer of the business assumes its debts as well.

-

Minority Interest

The minority interest (also known as non-controlling interest) is the part of subsidiaries owned by the minority stakeholders and, therefore, not controlled by the parent company. Although the minority stakeholders cannot govern the actions of the firm, they often have some impact on its management.

As a rule, the minority interest is included in the calculation of the enterprise value since the financial statements of these subsidiaries are combined with the parent company’s financial statements.

-

Cash and Cash Equivalents

Cash and cash equivalents are the most liquid assets of any business. Cash usually includes all currency the company owns either on hand or in its bank accounts. Cash equivalents, on the other hand, incorporate short-term investments, commercial papers, marketable securities, etc., that can be easily converted into monetary funds if needed.

When calculating the business’s enterprise value, it’s essential to pay attention to the debt and cash components. If the company has a significant number of debts or, on the contrary, a huge amount of cash, then the EV is the most precise way to calculate its real price.

If the company has more debts than cash, its real price is higher than the enterprise value. Since buyers acquire not only the cash of the company but also its loans and liabilities, they are going to spend even more money to pay down the debts.

On the other hand, if the company holds more cash than debts, its real worth is lower than the EV. It is sometimes called negative enterprise value. In this case, the buyer pays for the company itself and receives even more money that is owned by it.

A practical Example of Enterprise Value Calculation

Now, let’s see how all this plays out in practice. In order to demonstrate the calculation of the enterprise value, we’ll assume that there are two companies – ABC Corporation and XYZ Enterprise. Both companies are equally interesting for the acquirer; therefore, we’ll calculate the enterprise value for both and see which is a better buying option.

Suppose that ABC Corporation has the following financial details:

- Market capitalization = $15,000,000;

- Preferred stock = $25,000;

- Total debt = $5,000,000;

- Minority interest = $0;

- Cash and cash equivalents = $3,000,000.

Based on the complex formula mentioned above, the enterprise value calculation of ABC Corporation is as follows:

- Enterprise Value = Market Cap + Preferred Stock + Total Debt + Minority Interest – Cash & Cash Equivalents.

- EV = $15,000,000 + $25,000 + $5,000,000 + $0 – $3,000,000

- EV = $17,025,000

Now, let’s move on to XYZ Enterprise. Its financial information is as follows:

- Market capitalization = $15,000,000;

- Preferred stock = $5,000;

- Total debt = $2,000,000;

- Minority interest = $0;

- Cash and cash equivalents = $6,000,000.

Again, using the complex formula, the enterprise value calculation for XYZ Enterprise is:

- Enterprise Value = Market Cap + Preferred Stock + Total Debt + Minority Interest – Cash & Cash Equivalents.

- EV = $15,000,000 + $5,000 + $2,000,000 + $0 – $6,000,000

- EV = $11,005,000

Thus, as you may have noticed, even if the companies have the same market cap, their enterprise value may be different. In the mentioned example, XYZ Enterprise is evidently a better investment. The higher amount of cash and less debt reduce its enterprise value.

The Importance of Enterprise Value Calculations

The significance of enterprise value is based on the fact that it allows assessing the true price of the firm. It’s a crucial economic measure for investors and business owners that helps make the right decisions and compare companies.

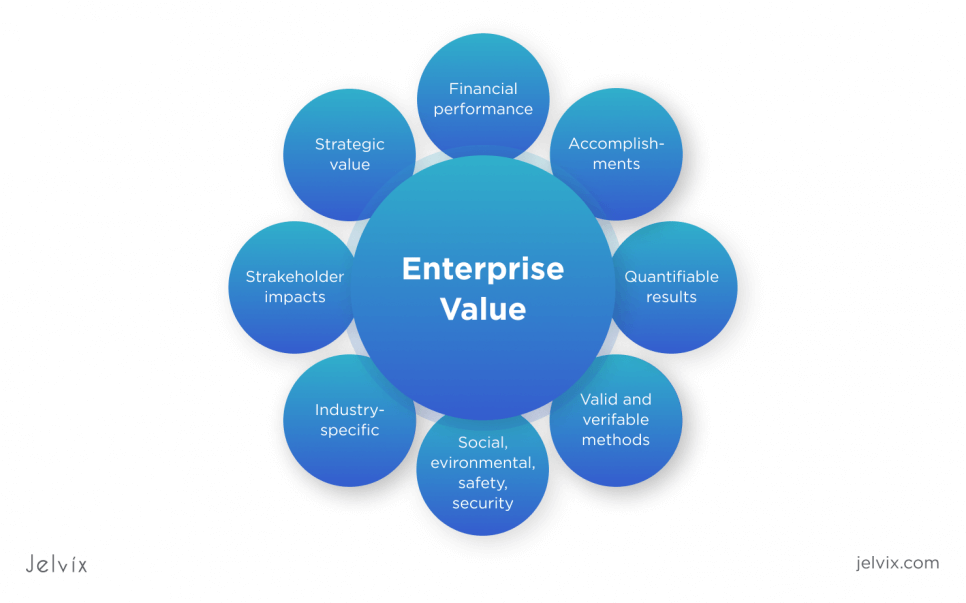

By calculating enterprise value for a private company, one can clearly see the full picture of:

- the true worth of the company;

- how much debt comes along with the company;

- how much cash will be acquired together with the company;

- how this company compares to the other companies with different capital structures;

- what risks and expected returns after investing in this company may be.

Among the benefits of enterprise value, the experts single out the following points:

- Enterprise value provides a more comprehensive view

When choosing a firm for investments, such indicators as earnings per share, return on investment, or profit are never enough. As a rule, they reflect more on what has already happened to the business.

However, enterprise value takes into consideration the cash and debt of a business. These two components allow investors to evaluate the future potential of the firm in a more precise way.

- EV standardizes the measurement of the company’s worth

Regardless of the industry and capital structure, calculating the enterprise value provides the ability to standardize the process of assessing the takeover price of different companies. It also makes comparing various businesses more transparent due to using the same measurement formula for this purpose.

- Enterprise value derives the maximum value of the numbers

To determine the true takeover price of a company, it is crucial to take into account the cash flows, preferred stock, and minority interests of the company. These components allow investors to make a more accurate judgment about the takeover price of a business and neutralize different risks.

Yet, it’s important to understand that relying solely on the enterprise value alone is insufficient for making sound investment decisions as one of the major weak points of the EV formula is that it doesn’t take into account the nature and industry of the business.

Along with the enterprise value, it is essential to take into account the following factors:

- Does the company belong to the capital-intensive industry?

- If the company has debts, what are they used for?

- Is the company at the stage of growth, or is it stagnating?

Overlooking these factors will lead to one-sided judgments and result in making poor decisions due to distorted information. A company’s debts with any other financial metric, paying attention to the numerical values alone limits your perspective on the state of affairs in the company as a whole.

For this reason, it is crucial to have a deep understanding of the components of the formula for enterprise value coupled with other external factors and analyze how they all relate to each other.

Let's find out what is Enterprise Asset Management, and why is it so important?

Common Multiples of Enterprise Value

The valuation multiples with enterprise value allow investors to delve deeper into comparing companies of different types and sizes. Among the most commonly used EV multiples are the following:

- Enterprise Value/EBIT (earnings before interest and taxes) is used to decide whether the share is cheap or expensive in comparison to similar shares or the market as a whole.

- Enterprise Value/EBITDA (earnings before interest, taxes, depreciation, and amortization) is a measure applied to compare the value of the business to its cash earnings, excluding non-cash expenses.

- Enterprise Value/Sales is used to compare the EV to the company’s sales. In simple words, it gives the idea of how much the company’s sales cost.

Difference Between Enterprise Value vs Equity Value

Both enterprise value and equity value represent the financial metrics used to calculate the worth of the business during a merger or acquisition. Even though each metric is used for assessing the worth of a business, they view it from slightly different angles.

The enterprise value reflects how much it would cost to buy a company as a whole. Whereas equity value (also known as market capitalization) shows only the total worth of the outstanding common stock of the business. In simple terms, the equity value represents the market value of the owner’s shares of a business.

For the most part, the enterprise value is used as a fast and easy way to estimate the company’s worth for those interested in purchasing the controlling interest of this company. Aside from that, this metric is often applied by portfolio managers in the process of stock selection.

At the same time, calculating the equity value is widely utilized by business shareholders and owners to take balanced decisions for strategic investing. This measure provides deep insights into the stage of the business, its stability, potential growth, focus, position within the industry, and possible risks.

Conclusion

When it comes to investing money in a firm, the detailed analysis of all the metrics related to that business is crucial for shaping the right decision. The total enterprise value is one of the fundamental ways to evaluate the market value of the company. In fact, it is the real price an acquirer will have to pay for the target company.

Unlike market capitalization, enterprise value accounts not only for the stock shares but also for the debt and cash reserves of a company. The latter two are the key components of the EV formula that help identify the business’s takeover price.

By all means, enterprise value is not a common term that one would encounter frequently. Yet, we hope that if you’re considering investing in some company, now you’ll know how to calculate the enterprise value of the company you’re interested in.

In case you’re looking for smart fintech solutions, our experts can boast expertise in developing efficient software for companies in the financial sector. Our innovative solutions for investment management will help your organization automate routine financial calculations, data analysis, and risk prediction.

With Jelvix, making informed and reliable investment decisions, optimizing investment strategies, and monitoring investment performance will become an uncomplicated and painless task.

Need a qualified team?

Leverage the top skills and resources to scale your team capacity.