The future of money might be a digital version of the cash that’s already in your wallet – potentially shunting aside the traditional means of payment. As the cryptocurrency industry matures, more and more people are planning to create their digital currency.

Suppose you are new to crypto but have been feverishly observing the cryptocurrency market. In that case, this article may help you to increase your knowledge about digital money and learn how to benefit your business from it.

Although there are many advantages to building your cryptocurrency, the process of development can be difficult and time-consuming. Indeed, Bitcoin’s success, the first decentralized digital currency, was huge and striking, but this doesn’t mean that your efforts to create your crypto are to be crowned with success. For instance, 2018 saw a large number of ICO’s failing to raise enough funding or going out of business after their launch.

To avoid such scenarios, we’ve created a step-by-step tutorial on how to build your cryptocurrency and explained potential risks associated with crypto assets. Read further to learn about blockchain, financial technology, and digital money in detail.

FinTech Today

The U.S. dollar has been the world’s dominant currency since the 1920s, but it might finally face real competition with the advent of a digital token. Indeed, when viewed from a technological standpoint, making a new digital currency is much easier than printing traditional fiat money.

From investment to money transfer, everything is going paperless. Central banks and governments are moving towards issuing their own digital money – a solution that would require careful consideration and policy trade-offs. Federal Reserve in essence already issues digital money via the commercial banks that have accounts with them.

Since the central bank is not an investment expert, it cannot invest in long-term projects itself but relies on private financial intermediaries to do so. It uses a central bank digital currency (CBDC) to engage in large-scale intermediation with investment banks.

Hence, a CBDC allows consumers to hold a bank account with a Fed’s bank directly. Eventually, a CBDC could provide means for central banks to secure sources of short-term deposits and start offering loan services like mortgage lending with commercial and investment banks’ help.

Central banks’ digital currency has already proved to be beneficial for economic growth – it can help policymakers monitor the supply of money in the economy, and the supply of the cryptocurrency.

What is more, commercial banks that issue money electronically to businesses and individuals enable them to make and receive payments digitally without exchanging cash. But a central bank digital currency would be a leap beyond that.

It is still debated whether fintech policy regulations will be sufficient to maintain the continuous development of the financial industry. The concerns around fintech include securities of cryptocurrency, systemic risk regulation, money laundering, and taxation.

However, experts suggest that worries around the misuse of financial technology should be weighed against its potential benefits to society. “Above all, we must keep an open mind about crypto assets and financial technology more broadly, not only because of the risks they pose but because of their potential to improve our lives,” – says IMF Managing Director Christine Lagard.

Nevertheless, we will continue to monitor the development of financial technology and share our insights on the topic.

What is Cryptocurrency?

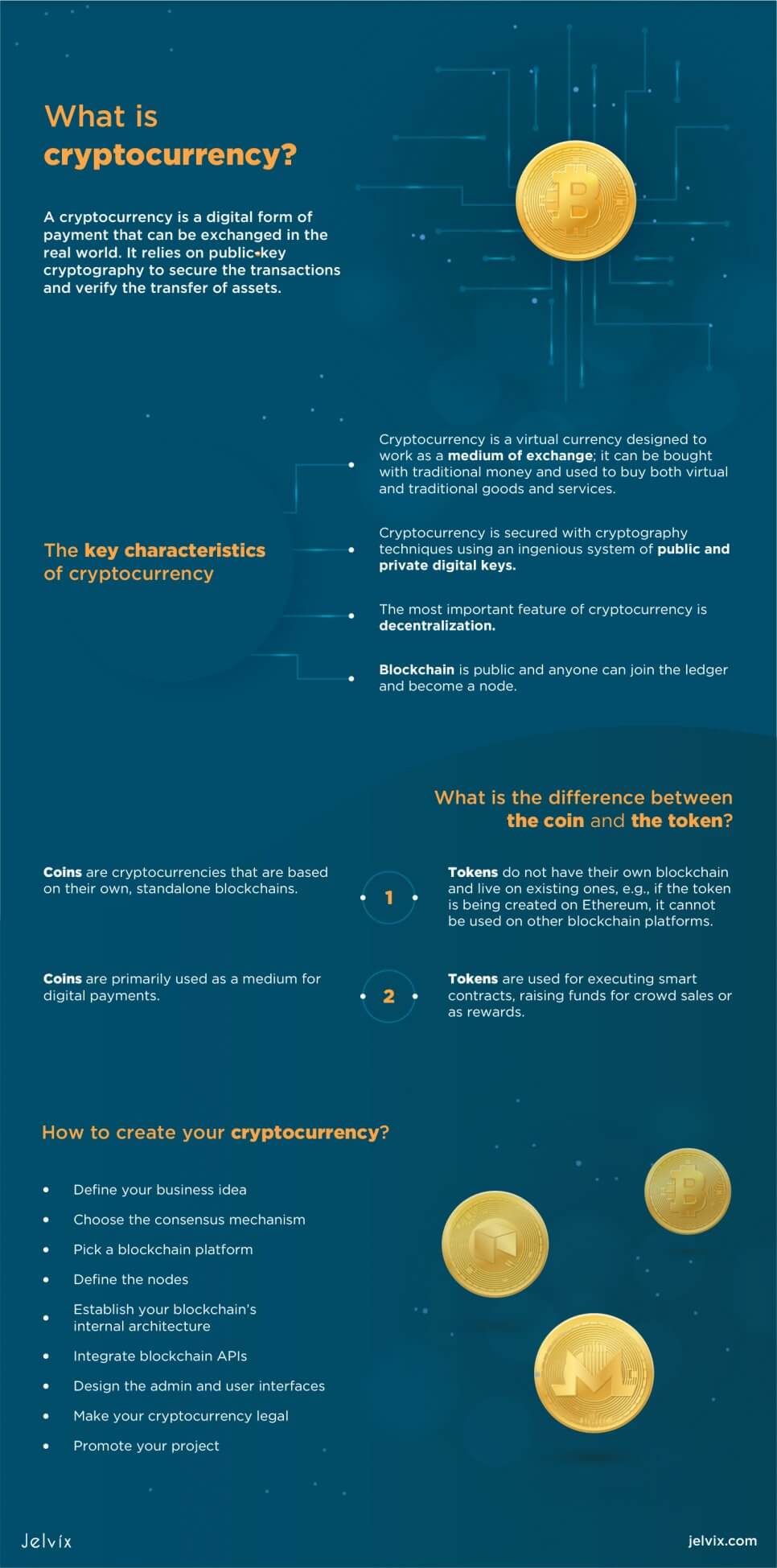

Before jumping right into the development of your crypto, let’s start with defining what cryptocurrency is. A cryptocurrency is a digital form of payment that can be exchanged in the real world. It relies on public-key cryptography to secure the transactions and verify the transfer of assets.

Many cryptocurrencies use decentralized control (are based on a distributed ledger technology or DLT), which allows them to exist outside the control of intermediaries, such as banks or state authority.

There are several hundreds of cryptocurrencies and applications of blockchain technology. As you may have learned from our recent blog, a blockchain is a universal mechanism that found its relevance in a wide array of industries, including the financial sector.

Since the successful evolution of digital currency requires building safety payments, the blockchain’s encryption method, like no other, contributes to the effectiveness of crypto assets. Accordingly, the blockchain uses mathematical algorithms to create and verify a continuously growing chain of “transaction blocks”, which functions as a distributed ledger.

Explore how blockchain can strengthen your business by improving transparency, trust, and efficiency.

How Does Cryptocurrency Work?

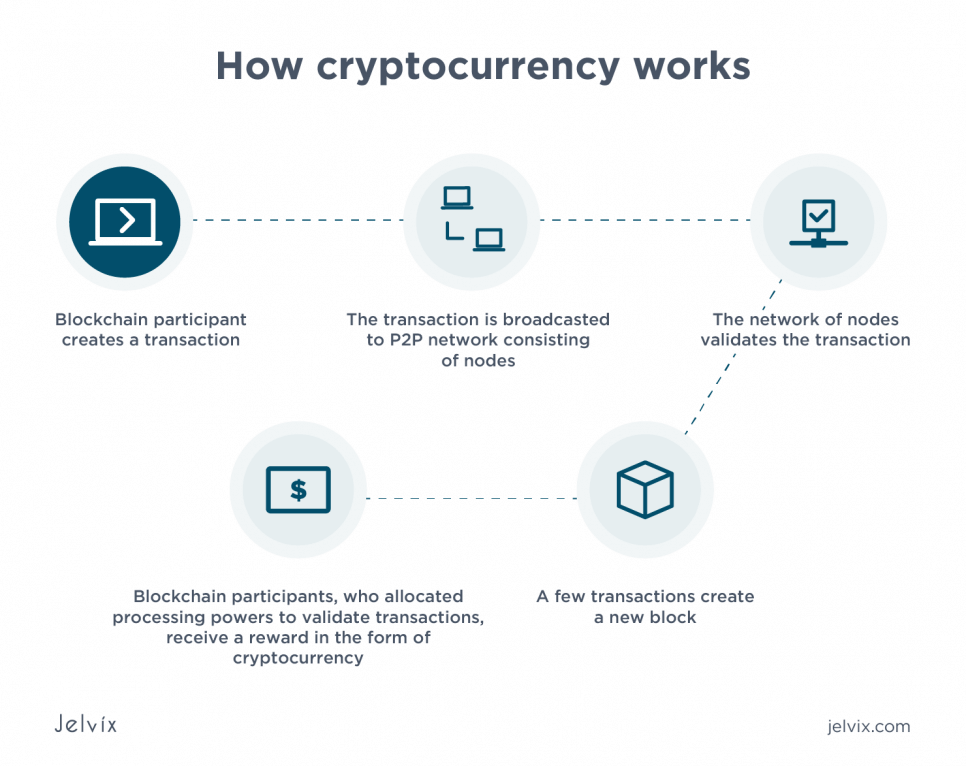

As we mentioned above, cryptocurrency is an integral part of DLT, built on the consensus algorithms regulating the creation of new blocks.

- Blocks store information about transactions like date, time, and amount of money.

- Node is a computer that is responsible for creating blocks and adding them to the blockchain.

For the distributed ledger to function, every new block must be verified by each node before it can be added to the end of the blockchain. Cryptocurrency is issued every time a new block is created and is used as an incentive for network participants taking part in the consensus mechanisms and closing blocks.

The main idea behind incentives is to reward users participating in blockchain transactions with a certain amount of credit. This encourages intermediate nodes and communities to cooperate and enable value creation for the blockchain platform.

Below is the breakdown of the key characteristics of cryptocurrency.

- Cryptocurrency is a virtual currency designed to work as a medium of exchange; it can be bought with traditional money and used to buy virtual and traditional goods and services.

- Cryptocurrency is secured with cryptography techniques using an ingenious system of public and private digital keys.

- The most important feature of cryptocurrency is decentralization. A distributed ledger eliminates the need for intermediaries to certify asset ownership, which eliminates fraud and increases the transparency of the transactions.

- Blockchain is public, and anyone can join the ledger and become a node.

What is the Difference Between the Coin and the Token?

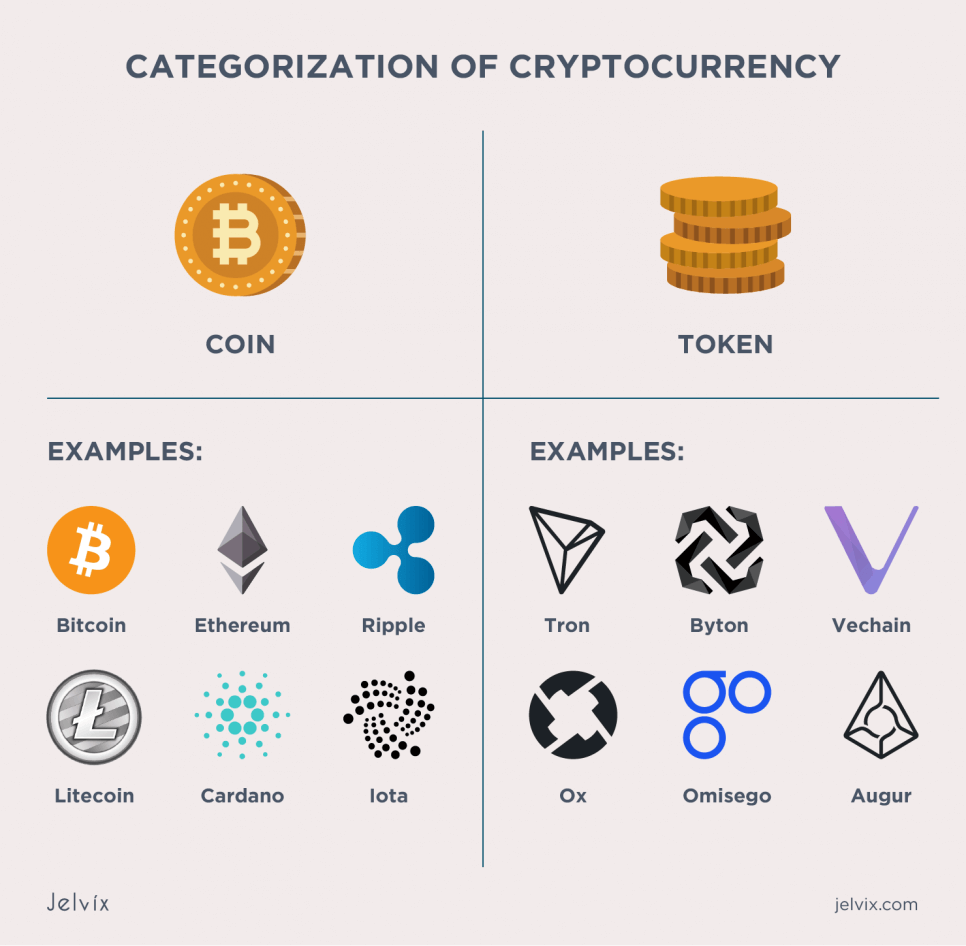

Now that we have learned the basics about cryptocurrency and how it works through distributed ledger technology, it is time we consider the difference between a token and a coin in crypto.

So, what is the difference between them?

- Coins are cryptocurrencies that are based on their own, standalone blockchains; tokens do not have their blockchain and live on existing ones, e.g., if the token is being created on Ethereum, it cannot be used on other blockchain platforms;

- Сoins are primarily used as a medium for digital payments, while most tokens are used to execute smart contracts, raise funds for crowd sales, or as rewards.

To make this clear, let’s take a look at a real-life example. Let’s imagine you go into Starbucks regularly and collect Starbucks Stars each time you buy coffee.

Once you accumulate enough Stars, you redeem them for a free drink. These stars are tokens, and the money you spend on Starbucks products is the coin (in this case a real-life banknote). You can buy Starbucks Stars using banknotes, but you cannot get real money using such stars. Following the same analogy, a crypto coin can be used to buy a business’s token, but not the other way around.

Check out successful business tips that help pave a way to the top of the qualitative services and good revenue.

How to Create Your Cryptocurrency?

If you want to develop your cryptocurrency from scratch, you need to define your business objectives first. Once you think the whole process through, you can proceed with creating your crypto. All of the following are steps in the cryptocurrency development process.

1. Define Your Business Idea

For your startup to succeed, people should have an actual reason to use your crypto. If you are going to make your coin, there must be a strong idea behind it.

- Strong product purpose creates loyalty and connects with people on a personal level. For example, CoinAvatar leverages blockchain technology to allow users to mint unique digital coins backed by their cryptocurrency holdings. This approach not only enhances the visual appeal of assets but also enables investors to achieve additional yields, demonstrating how a compelling business idea can add tangible value for users. Nano is one of the best examples of cryptocurrency with a powerful mission statement – fast and feeless digital payments.

You need to decide what you want to achieve as well as find your target audience. Maybe you want to provide practical and effective means for voters or create an empowering healthcare solution.

There are many guidelines for creating a working marketing strategy and making people interested in your digital currency. Once you have a value proposition, make sure to document it on a white paper, along with the methodology and the technology you’ve used.

2. Choose a Consensus Algorithm

The primary goal of consensus mechanisms is to ensure that all nodes on the network are synchronized, and all transactions are legitimate. According to the Merriam-Webster Online Dictionary, the word consensus is defined as a general agreement or group solidarity of belief or sentiment.

In cryptocurrency terms, blockchain consensus algorithms enable the network participants to agree on which transactions should be added to the block.

The most common algorithms used in blockchain projects are Proof of Work (PoW), Proof of Stake (PoS), or Delegated Proof of Stake (DPoS). The Proof of Work (PoW) scheme is considered the best method of reaching a consensus agreement between participating nodes.

PoW requires miners (blockchain volunteers who add new blocks of transaction data to the system) to use their resources to solve mathematical problems and pass the block’s data through a ‘hashing data’ to generate a “block hash”. This is done to confirm that the hash is correct and matches the conditions.

If you want to get a clearer idea of what the consensus algorithm is about and choose the one that best corresponds to your product, watch this video.

3. Pick a Blockchain Platform

Your decision of the consensus method determines which blockchain you’ll use to build your crypto. We have selected the top blockchain platforms available today to help you determine which one will best serve your business’ needs.

4. Design the Nodes

- A full node is a program that validates transactions for efficiency and security.

Once you have selected your blockchain platform, you can proceed with designing the nodes according to their functionality and workings. As you have learned from the above paragraphs, nodes represent the infrastructure of a blockchain and are responsible for creating, storing, and spreading the blocks.

There are many features you can design your nodes with:

- you can set the nodes’ permissions to be either private or public;

- choose between on-premise or cloud hosting;

- select the required hardware details, such as the processors, memory, and disk size;

- you also need to pick a base operating system (usually Ubuntu, Windows, Red Hat, Debian, or Fedora)

5. Establish Your Blockchain’s Internal Architecture

Make sure you make the best of your blockchain’s internal architecture because once the platform is launched, you won’t be able to change the parameters.

- Define who can access, create, and validate new blocks;

- think about what your blockchain address will look like;

- choose the format of the keys;

- provide the rules for asset issuance;

- create a management system for private key protection and storage;

- decide on the number of digital signatures your blockchain will require to verify the transactions;

- plan for atomic swaps that will allow users to exchange different cryptocurrencies without an intermediary;

- estimate the block reward, block size, transaction limits, etc.;

- create block signatures.

6. Integrate Blockchain APIs

Some blockchain platforms don’t provide APIs, so it’s important to make sure that yours does. In case the blockchain of your choice doesn’t have pre-built APIs, you can still use third-party providers to integrate them. The following are the most popular blockchain API providers the development companies use:

- ChromaWay

- Bitcore

- Neuroware

- Tierion

- Gem

- Colu

- BlockCypher

- Coinbase’s API

- Colored Coin APIs

- Blockchain APIs

7. Design the Admin and User Interfaces

A good intuitive interface enables users to build accurate communication and adds value to your startup. At this stage of your cryptocurrency development, you need to make sure that FTP servers are both secure and compliant, while external databases are of the most recent version (e.g. MySQL, MongoDB).

The back-end side of your project has to be built with security and future updates in mind. Usually, when developing back-end, coders rely on languages such as Java, Javascript, CSS, C#, Python, or Ruby. As for the front-end, you can use Node JS or Angular JS.

8. Make your Cryptocurrency Legal

Cryptocurrency regulations help to monitor the emerging digital currencies and provide clearly defined rules for those willing to legalize their new crypto coin. Legalizing your cryptocurrency is necessary for preserving your project and avoiding legal problems.

9. Promote Your Project

Once you get your startup off the ground, you need to think about ways of how to successfully market your crypto. To maintain and promote the coin, search for popular channels that help marketing enthusiasts present their product to the crypto community. Such channels include Telegram, Reddit, Discord, Twitter, BitcoinTalk, etc. You can also post press releases and use media to attract audiences and boost your ranking.

Summing Up

We hope you enjoy our blog and find lots of interesting and necessary information here. Now that we have come to the end of this guide, you can start building your cryptocurrency business.

The approach we have introduced in this guide requires programming knowledge and a fundamental understanding of blockchain technology; if you are not certain of your grasp on power or feel disoriented, you can choose Jelvix to guide you through this journey.

We offer cryptocurrency development expertise and cutting edge integration from our full line of blockchain services. Go to our services page to learn more about our ultimate blockchain solutions.

Need a qualified team?

Access the talent pool to scale your team capacity.