Global

tech partner for

digital

transformation

and software innovation

Who We Are

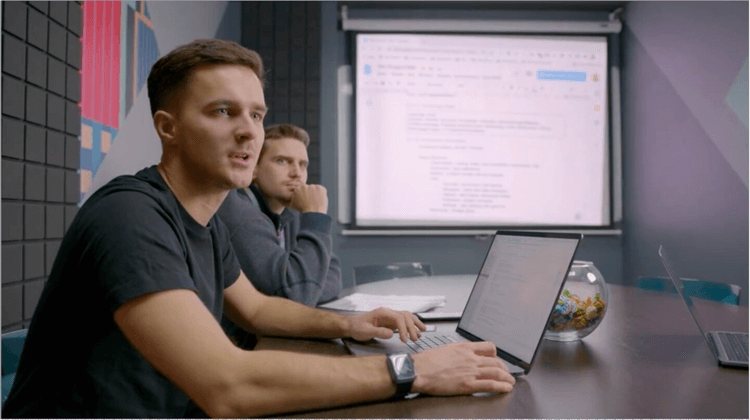

A global leader in software development that helps companies overtake the competition, Jelvix specializes in complex, sophisticated software development to help companies digitally transform their business and their industry. Get world-class enterprise engineering, design and technology consulting services to skyrocket your operations, customer service, and automate business processes.

More About Us More About Us-

200+

satisfied customers

-

98%

customer retention rate

-

14

years in business

-

$3B+

our clients’ overall revenue

-

150+

team members

-

5/5

customer satisfaction rating on Clutch

Jelvix goes well beyond expectations. We provide complex services to meet a variety of challenges global businesses face today. We offer innovative technology solutions to fit every need with our customers' success in mind.

IT Consulting Services

Consulting first with an industry leader before charging ahead means you’ll know your customers truly want your product instead of hoping they will.

Dedicated Development Team

Employ a dedicated development model to enhance your technology capacity, get access to domain expertise, and skyrocket growth. Get a result-driven R&D center tailored to specific business needs.

Enterprise Software Development Services

Build multi-faceted enterprise solutions that can easily withstand the highest loads, scale up in line with your business growth, and provide 99.98% availability.

Software Development Services

Get customized, complex software development whether you’re a startup or an enterprise. Integrate your legacy systems and modernize your system’s functionality with today’s innovative technology.

Mobile App Development

Everyone wants personalized mobile apps that speak directly to their needs. Give your customers what they want with impactful mobile apps that represent your brand and industry.

SaaS Development

SaaS has proven itself to be a critical business technology to create innovative user experiences, maximize the value of data, and differentiate the business.

Our areas of expertise include innovative and cutting-edge technology like AI, Machine Learning, AR/VR, Blockchain, IoT, Data Science, and more.

Digital Transformation

You get new, advanced technology to help you solve your business challenges. We’ll help you apply the latest and greatest innovations to transform your business into a powerful digital machine.

Big Data

Are you using all data available at your fingertips? We’ll help you access extremely large data sets to identify patterns, trends, and associations you can only get from Big Data

Internet Of Things

How can you use IoT devices, platforms, languages, and frameworks to create an innovative business solution? Partner with Jelvix for custom solutions.

AR/VR

AR and VR are on the leading edge of business solutions today. Capture its power and boost your business with AR/VR tools for visualization, collaboration, quality control, and more.

UI/UX Design

Engage and compel your target audience with a beautiful product that goes beyond trendy. Provide a custom user experience with interactive design to bridge the gap between your brand and technology.

Awards & Certifications

The ISO 9001:2015 standard ensures that our services and solutions meet the needs of our clients through an effective quality management system. It also assures that Jеlvix has solid, clearly defined procedures in all the business areas and a strong business continuity process.

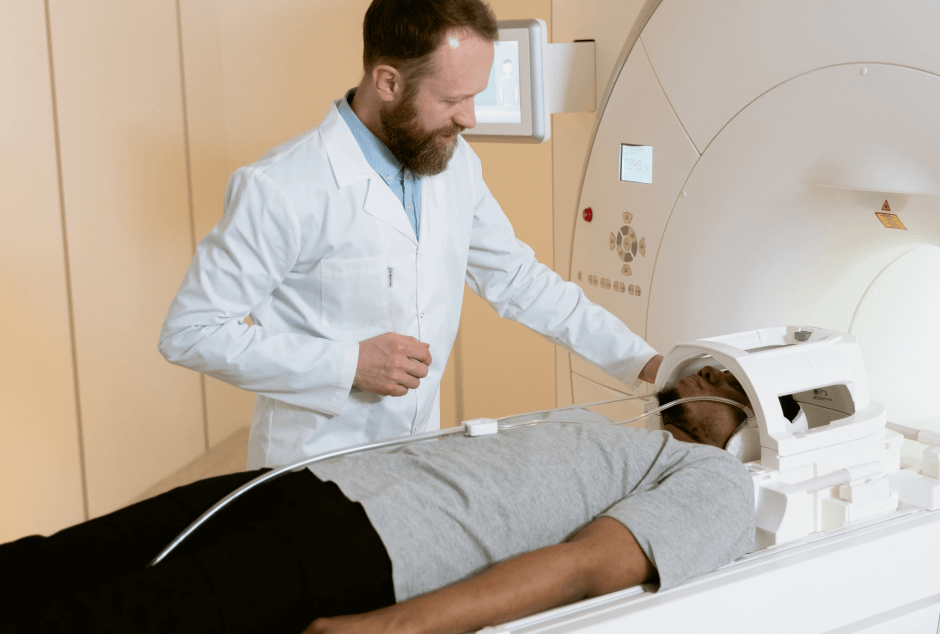

Jelvix has successfully implemented the quality management system ISO 13485:2016 for the production of medical devices. This certification demonstrates our commitment to providing high-quality, consistent products and services to our clients and our ongoing investment in the medical devices segment.

Case Studies

See how our clients accelerated their businesses with software, web and mobile apps tailored specifically to their customers’ needs.

Client Testimonials

Our many satisfied customers have a lot to tell you. Read their success stories to learn how Jelvix helped them transform their businesses with software solutions, apps, and more.

Leonid Nekhymchuk

CTO, VisiQuate IncThe Jelvix team worked collaboratively to produce a higher-quality code and deliver a suitable MVP. Project management is a clear strength, and the desire to achieve customer goals within scheduling and guidelines are evident. Their agile methods were vital for project success.

moreless

David Wenner

Co-Founder, VocalReferencesOur application was finished and able to generate revenue within one year as the Jelvix team adhered to the required timeline efficiently and professionally. They were communicative, responsive, and always available to take on feedback and make tweaks or changes as required.

moreless

Dave Townsend

Founder, SwitchBack Health LLC Santa Rosa, USAThank you, Jelvix, making our vision into a reality. You executed, delivered and were responsive through the whole project. The finished product has an awesome look, feel and user experience that will change the way physical therapists and patients interact between visits.

moreless

Inna Tereshchenko

Brand Director, Auchan Retail Ukraine UkraineI’m pleased to notice that the team not only managed to comply with all our demands but even exceeded expectations. Jelvix engineers were facing a challenge to create a web application, able to process big data and cope with the high load during a peak of buying activity. Jelvix team is highly recommended for long term partnership. We are absolutely happy to continue our cooperation and intend to assign them with a new up-and-coming project.

moreless

Patrice Archer

Founder & MD, Appy Ventures Farnham, Surrey, UKGreat to work with such a professional team. I've worked with many development teams over the past 2 years but Jelvix had by far the most proactive communication style and the quality of output. They met the timeline, delivered code after each weekly sprint and generally impressed us.

moreless

Curtis Lane

Founder, Micswag LLC Annapolis, USAThe most impressive trait about the Jelvix team is that you can't give them a task or idea too large. No matter how grand a vision you may have, they'll always have a solution or means to accomplish it.

moreless

Peter Kelly

CEO, ImployableJelvix delivered digital products that are fit for purpose and, in the case of the mobile apps, award-winning. Led by an engaged project manager, communication with the development team is smooth and purposeful. They contributed conceptually to the solutions and were excited to problem-solve.

moreless

Joanna Conti

CEO, Vista Research Group Annapolis, USAOver the last year, Jelvix has developed a very complex, HIPAA-compatible app for my research company. I have been extremely pleased with our developer and the company, and highly recommend Jelvix. I am continuing to work with them on the next phase of the app.

moreless